Table of Contents |

Whenever you hear or see news about the economy in the media, such as “the Fed cut interest rates for the third time this year” or “the unemployment rate fell to 7.9% this quarter,” it generally falls under the category of macroeconomics, because these issues are related to how the economy is functioning overall.

When we truly understand the meaning and impact of these statements, we become better citizens, because we are educated about them and are better able to participate in our government and society.

Often, students come into an economics course knowing how they feel about social issues. You very well may know, for instance, whether you are socially conservative or liberal. However, how you feel about the economy and economic policies is just as important—sometimes even more important—when deciding how to vote.

Now, key economic indicators are the things reported in the media that help provide a picture of what the economy is doing, and, as mentioned before, it is crucial to understand what they tell us.

There are three different kinds of economic indicators, but all of them are data specific to some economic outcome or behavior that indicates the direction of past, present, or future economic activity:

EXAMPLE

Some economic indicators that you may be familiar with are the unemployment rate, the inflation rate, and the stock market. Also, a more specific indicator would be new building permits. We will discuss all of these in this macroeconomics course.It is very important to understand how our economy functions overall, because we can only participate in something effectively when we understand how it functions.

If, for example, you hear that interest rates might rise in the near future and you do not know how that might impact you, then you are not effectively participating in society. It is important for you to understand that an issue like this might impact your spending and saving habits now or in the future—it is important to you personally and also as a participant in the economy.

When our government or Federal Reserve System decides to enact some economic policy, we need to be able to understand why they are doing it and how it is expected to help the economy.

There are two different kinds of economic policies that work to stabilize the economy and make sure that we maintain movement through the natural business cycle:

It is important to understand that both of these can be valuable in helping our economy move through the natural business cycle, for example, ensuring we are not stuck in a recession for a significantly extended time.

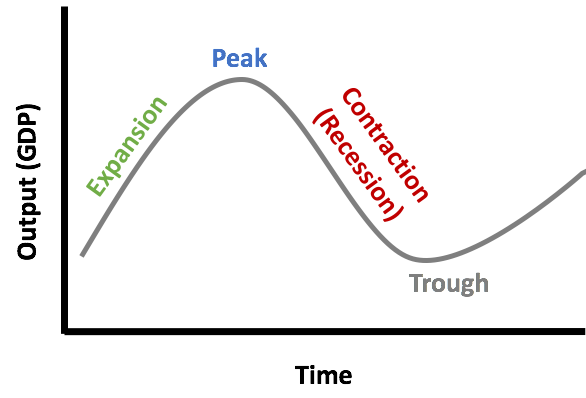

Business cycles are the movement of an economy through expansion, peaks, contraction, and troughs. Then, the process repeats itself, as the name “cycle” indicates.

This is what a business cycle looks like; the vertical axis is the economy’s output, and the horizontal axis represents time.

As you can see, as the economy produces more, it undergoes expansion and ultimately peaks. Then, as the output shrinks, there is a brief contraction. If it lasts longer, it’s called a recession. Finally, there is a bottoming out, or a trough, and the cycle repeats itself.

It is normal for the economy to go through periods of growth and contraction like this. As the economy moves in these cycles, most people become concerned about issues like the unemployment rate and inflation.

Lastly, let’s discuss the issue of international impacts on the macroeconomy.

Most people today are well aware that countries are interconnected. Our economy is closely tied to the economies of nations worldwide, and we certainly have a significant impact on those nations as well. Almost everyone in the world is concerned about the U.S. economy, because when something happens in the United States, you can be assured that it is going to impact economies worldwide.

Therefore, it’s important to understand concepts like international trade and the flow of capital among nations. Note that we will have separate lessons on both of these, but let’s briefly define them here.

Global trade, or international trade, is trade that occurs across nations, typically involving foreign exchange transactions.

Capital flow is a bit different, because it’s not necessarily goods and services moving between countries, but rather the movement of capital, typically referencing financial capital, into and out of countries.

EXAMPLE

When countries invest in or loan money to other nations, this is the flow of financial capital. This has a huge impact on our economy and the economies of the other countries as well. We will certainly be talking about this capital flow throughout macroeconomics.Source: Adapted from Sophia instructor Kate Eskra.