Table of Contents |

Let's begin today's lesson by discussing vertical analysis, which is used to evaluate financial statement items by expressing those items as a percent of a base amount.

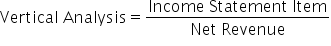

Vertical analysis involves analyzing the relationship of each item on the financial statement to some base amount. So, for the balance sheet, for example, we will be expressing each item as a percentage of total assets. For the income statement, we will be expressing each item as a percent of net revenue.

We can use vertical analysis to evaluate how the percentages change over time:

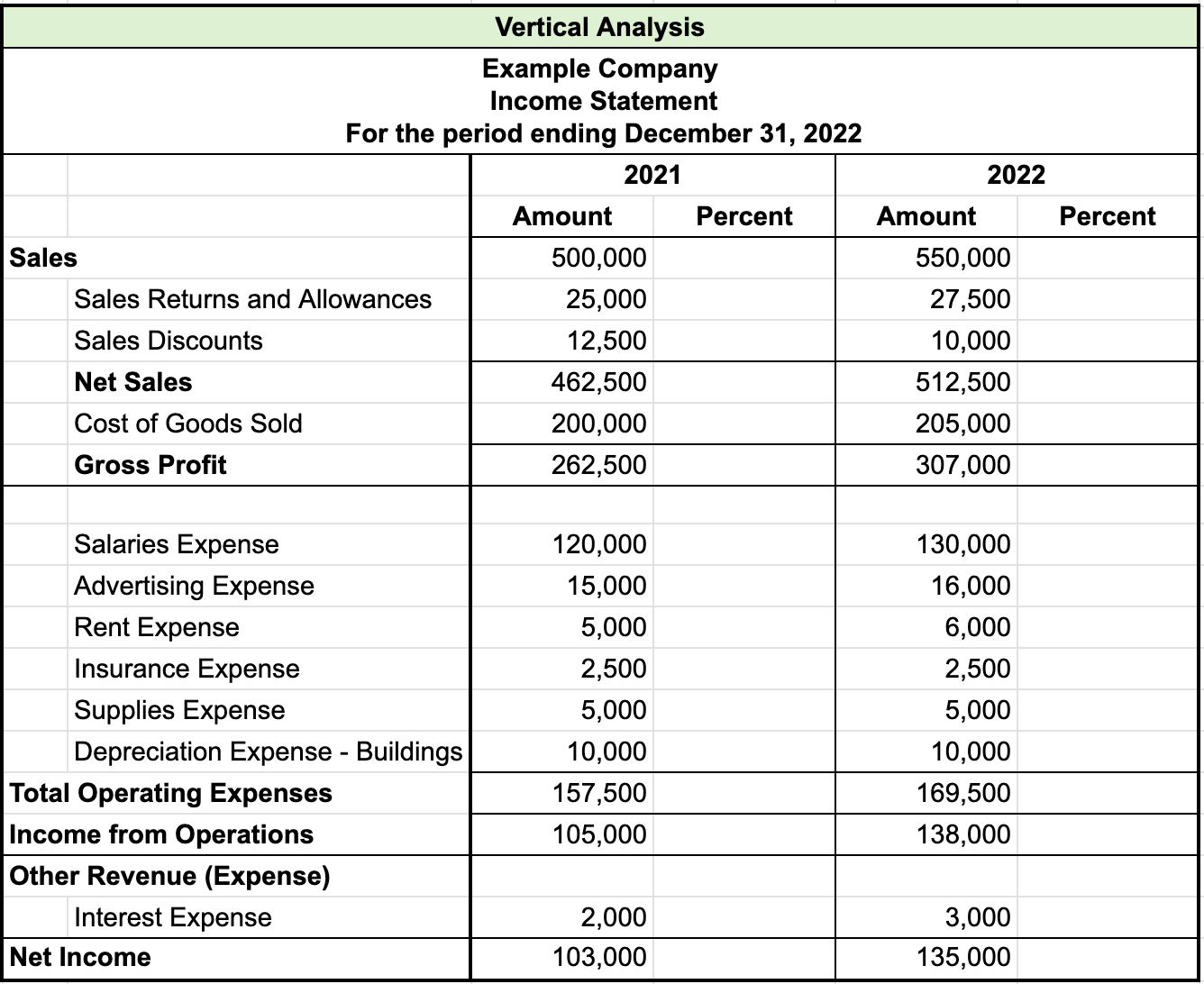

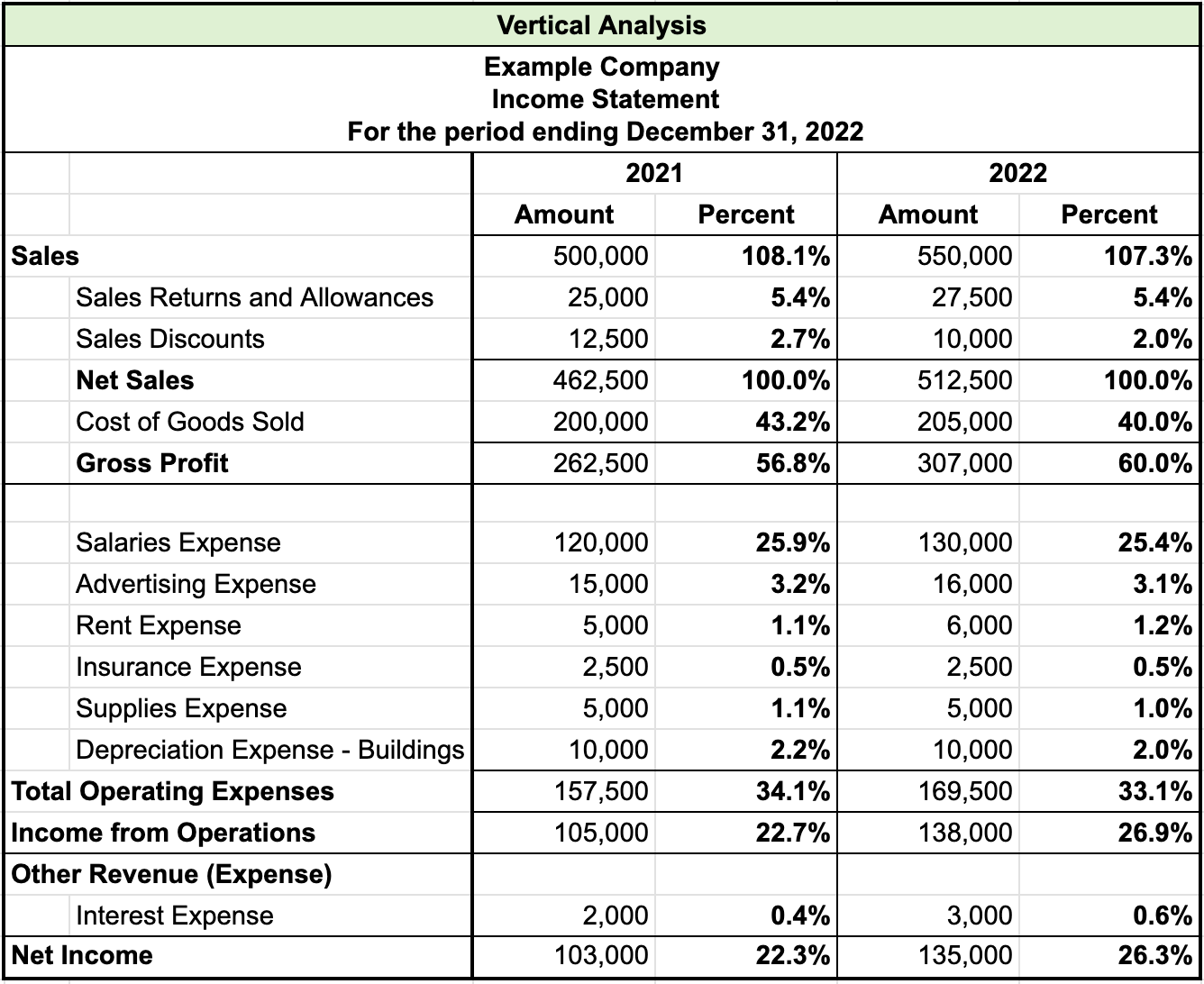

We're going to start with vertical analysis of our income statement, shown below. Again, vertical analysis is where we express these values as a percentage of a base amount.

Note, the base amount is going to be our net sales, and we have two years to compare.

We're going to express all of these line items--sales returns and allowances, sales discounts, operating expenses, etc.--as a percentage of our base amount, which again, for the income statement, is our net sales.

Once we drop those figures in, below, if you look at the percentage column, you'll see that our base amount is our net sales, which represents 100%.

We're expressing all of these individual line items as a percentage of that base amount so that we can understand the relationship between these specific line items and that base amount.

EXAMPLE

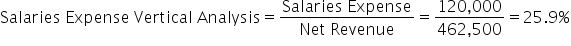

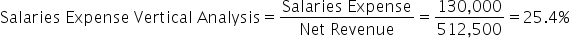

Let's compare the salaries expense between 2021 and 2022.

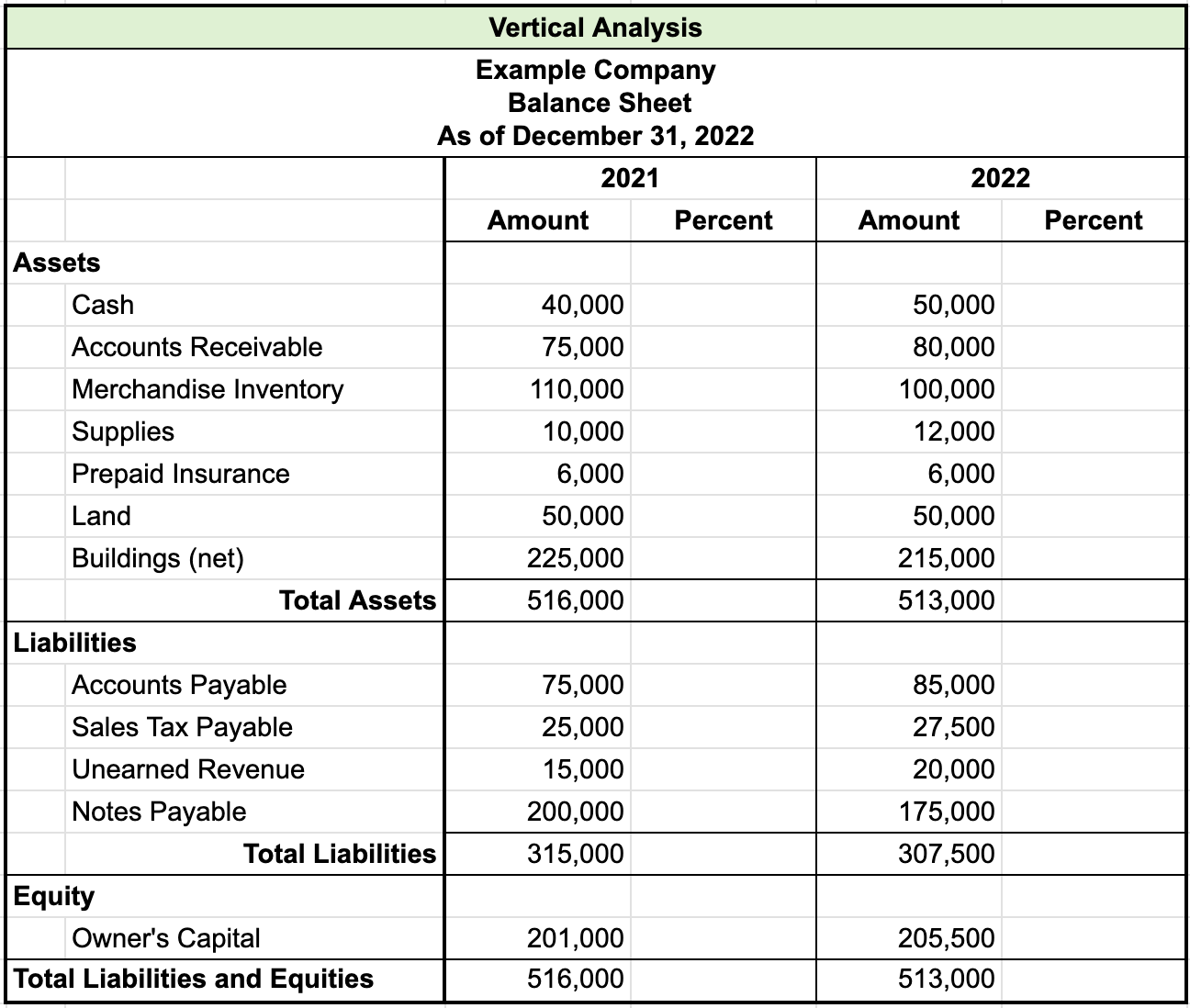

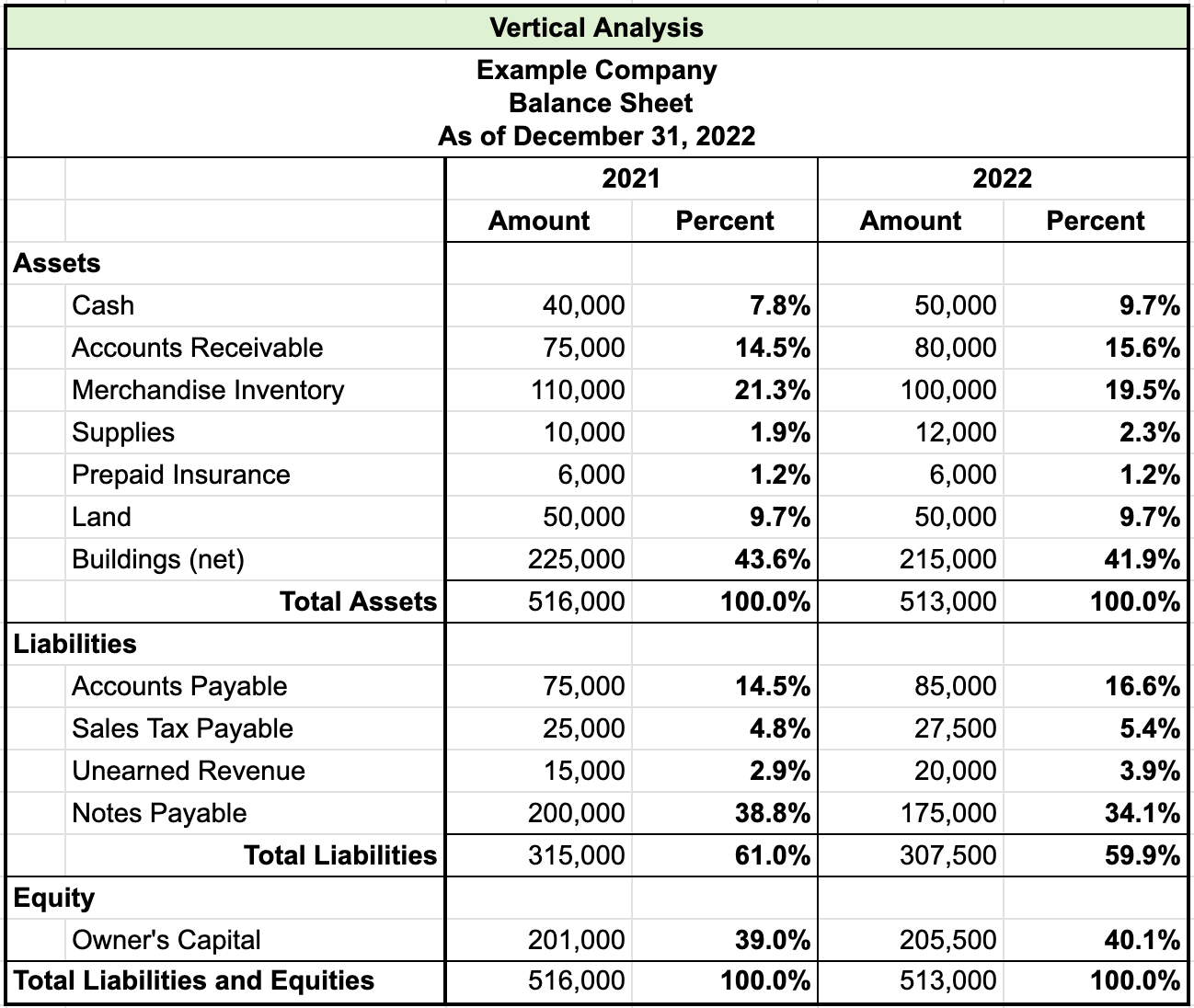

Now, continuing with vertical analysis, we can do the same thing we we did for the income statement for the balance sheet. Again, we're going to express all of these individual line items of our balance sheet as a percentage of our base amount, which for the balance sheet is our total assets.

So, if we express all of these financial statement line items as a percentage of our total assets, we can understand the relationship between these individual lines and our base amount.

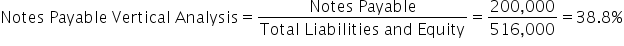

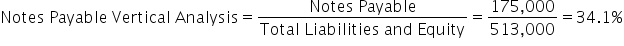

EXAMPLE

Let's compare notes payable over the two years.

Now that we've seen how to perform vertical analysis, let's turn our attention to horizontal analysis, which is used to evaluate percentage changes in financial statements from one period to another.

We are looking at the percentage changes within these individual financial statement items across periods, which helps us to analyze changes from one period to another. Now, not only can we express changes in percentages, but we can also express these changes in dollars, meaning we can see the percentage change of each line item as well as the dollar change of each of those financial statement items.

Again, this helps us to perform both internal and external comparisons, evaluating any internal changes within the company structure, or externally comparing ourselves to competitors, as well as industry standards.

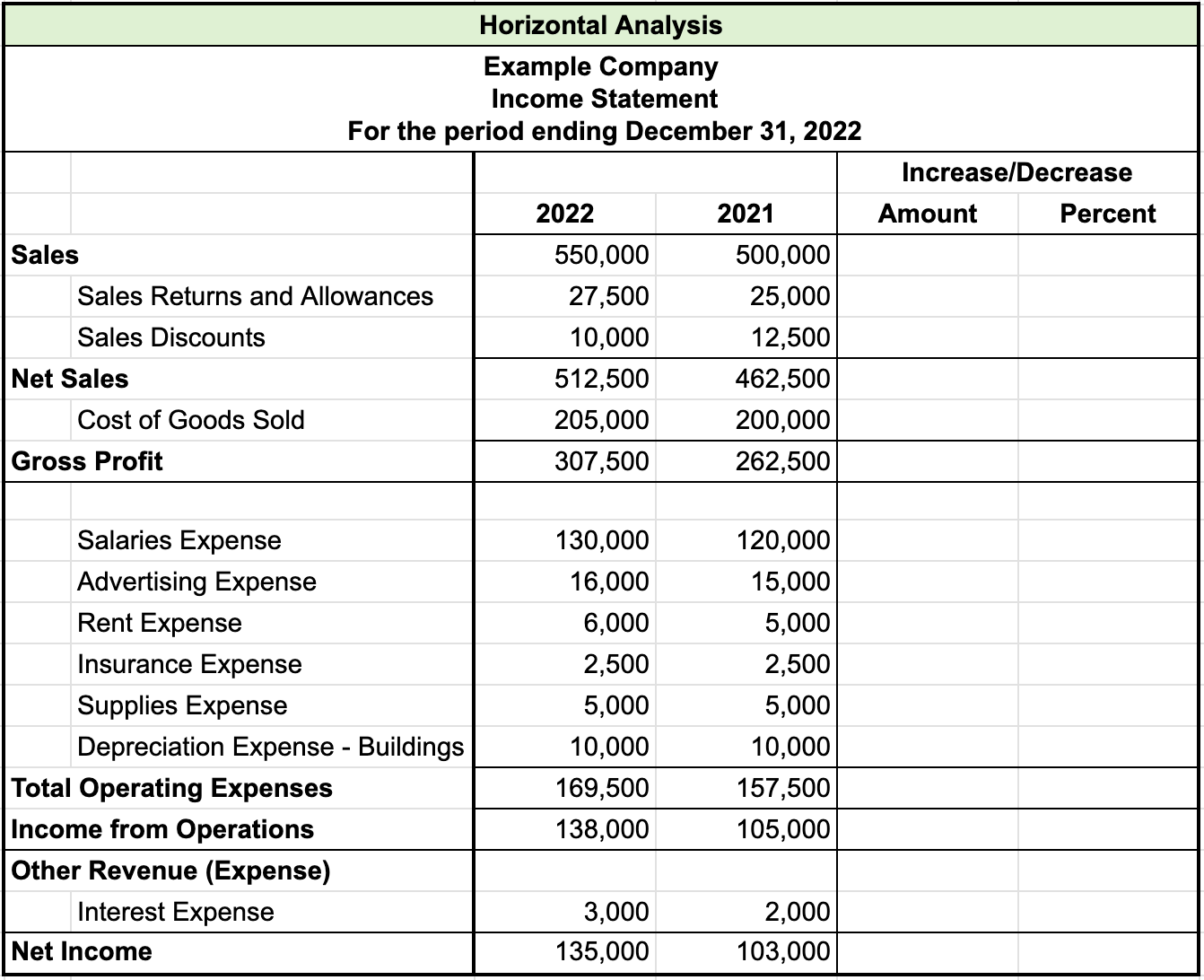

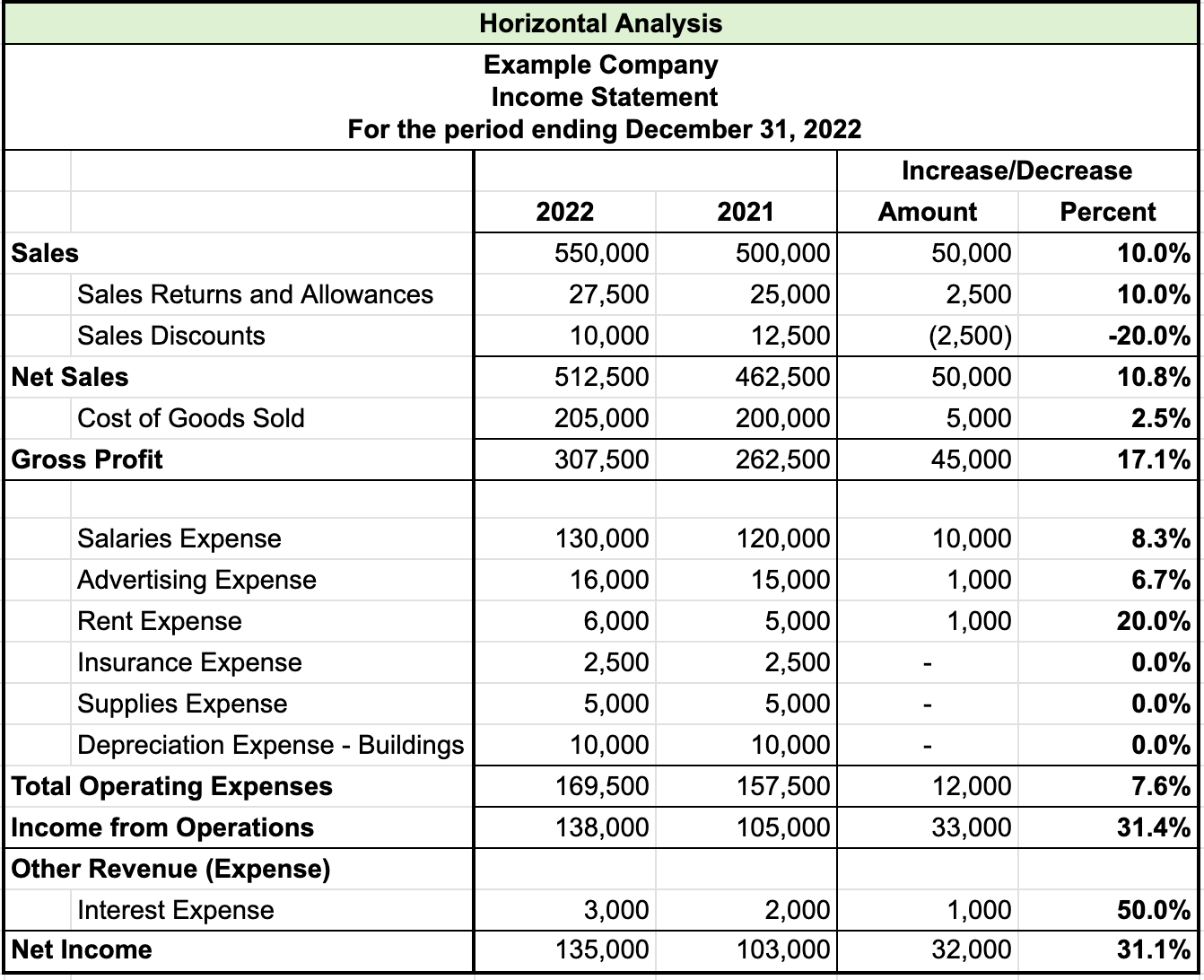

Let's look at an example of performing horizontal analysis.

Now, horizontal analysis is going to help us to look at these individual financial statement lines on our income statement, and how they are changing from one period to the next. Note, we are focusing on the individual line items and the changes within those line items themselves.

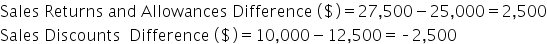

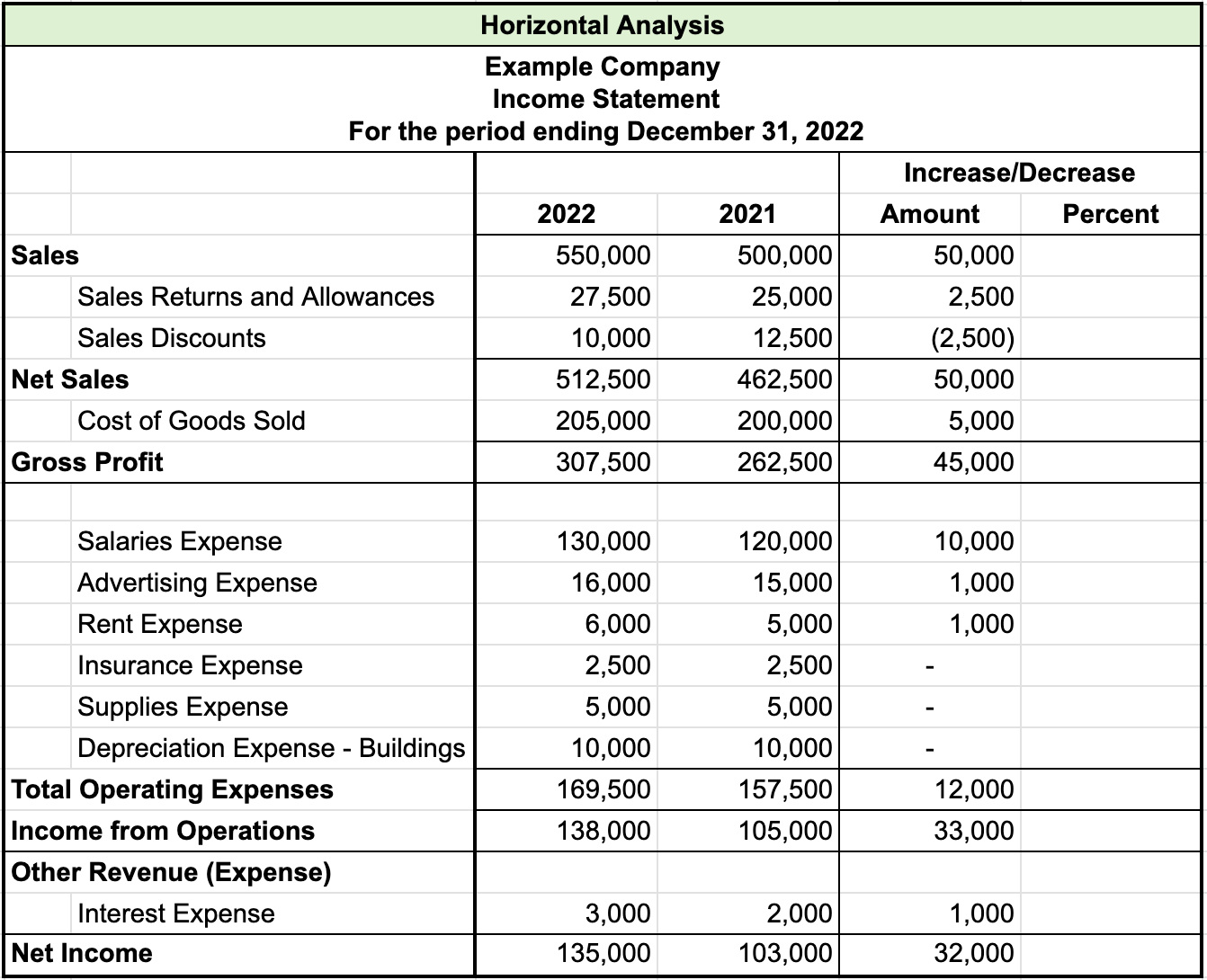

The first thing we can do is express those changes in dollar amounts so that we can see what the dollar increase or decrease is in these individual financial statement lines. For instance, there was a $2,500 increase from 2021 to 2022 for Sales Returns and Allowances, however there was a $2,500 decrease in Sales Discounts from 2021 to 2022.

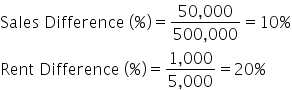

Now we can convert that increase or decrease amount to a percentage, to show us the percentage increase or decrease of these individual financial statement lines, to better understand how they are changing over time.

We can see, for instance, that our sales increased 10% from 2021 to 2022, and rent expense went up 20%. Again, this helps us to understand the changes that are taking place at the individual financial statement line item.

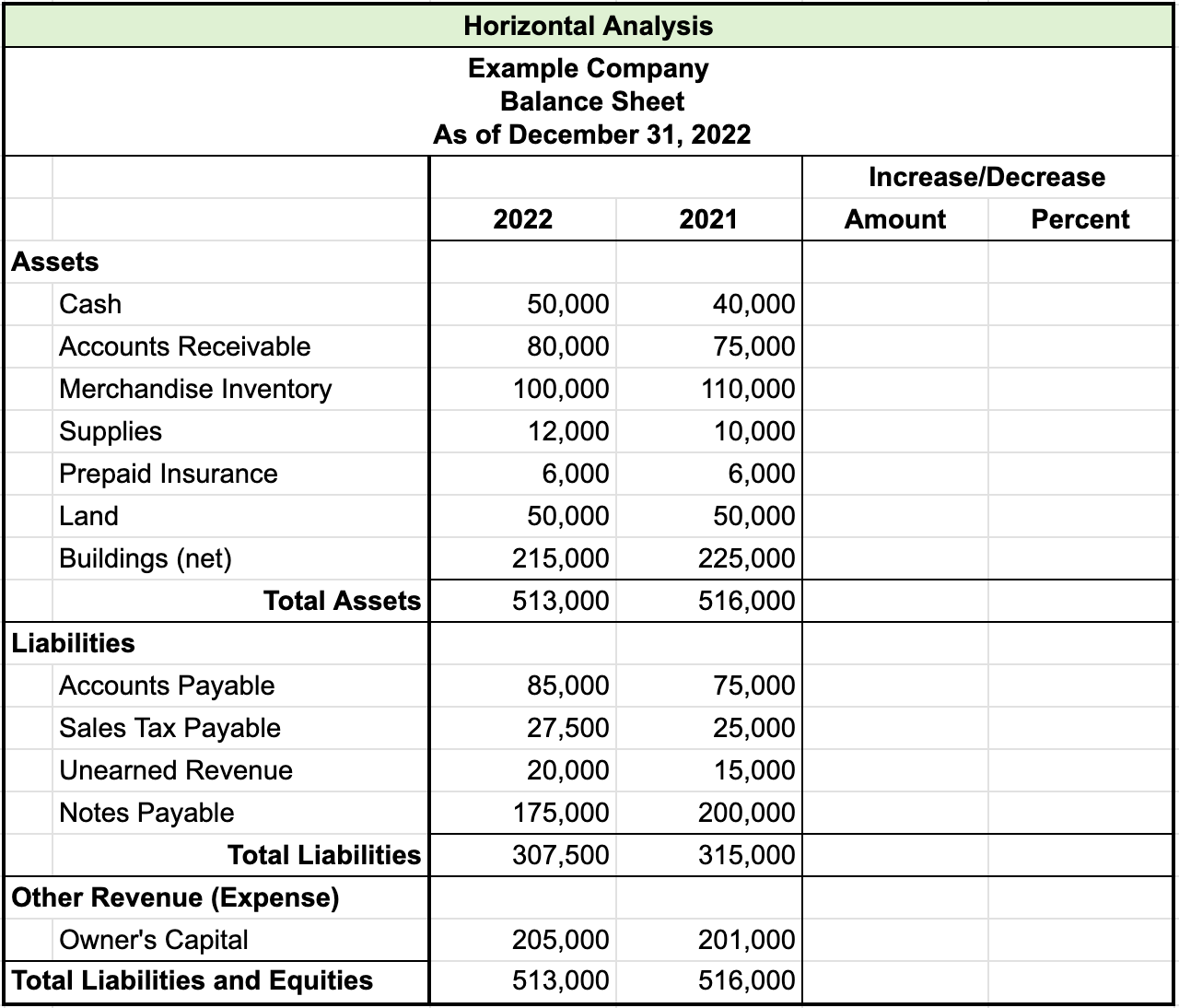

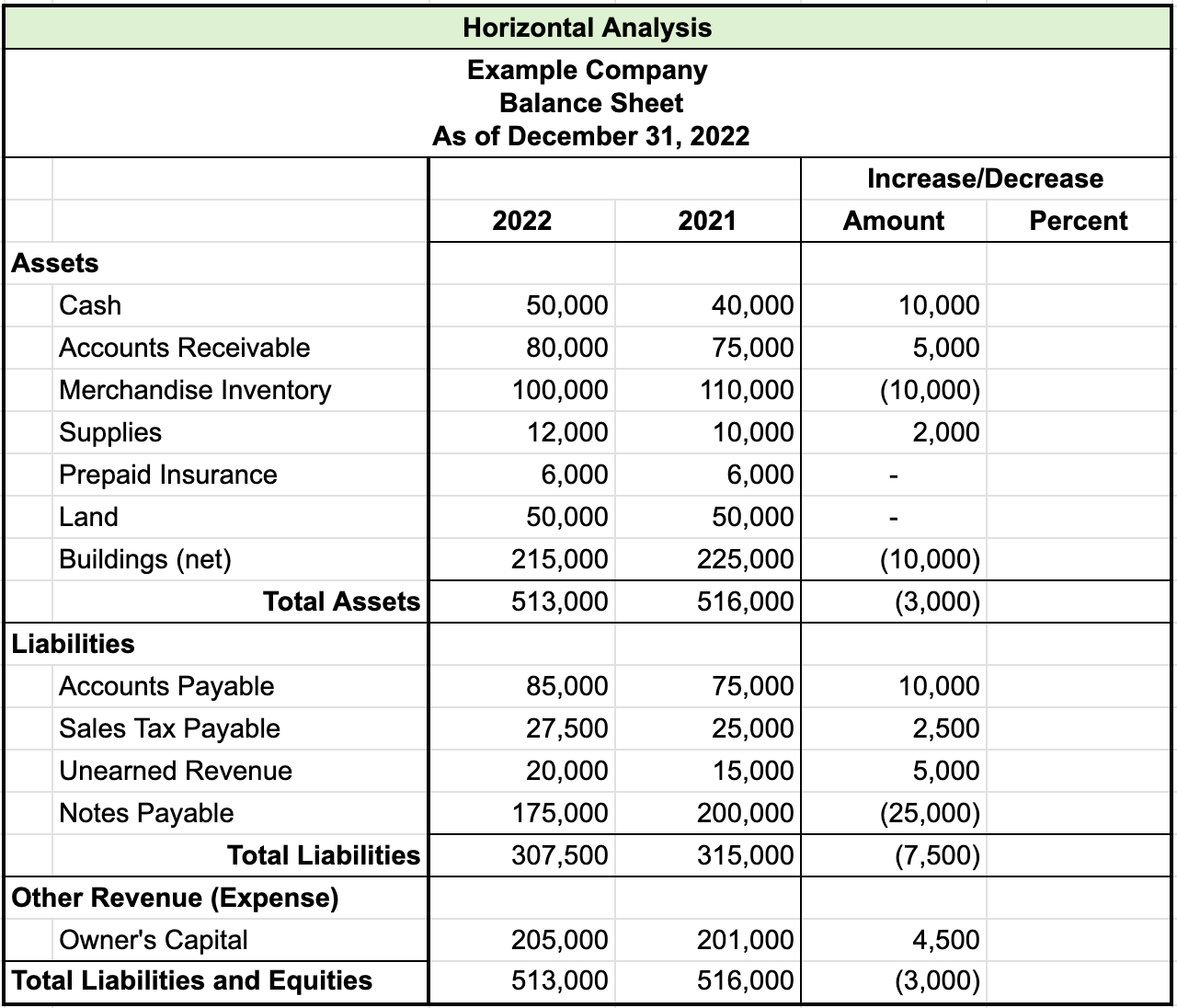

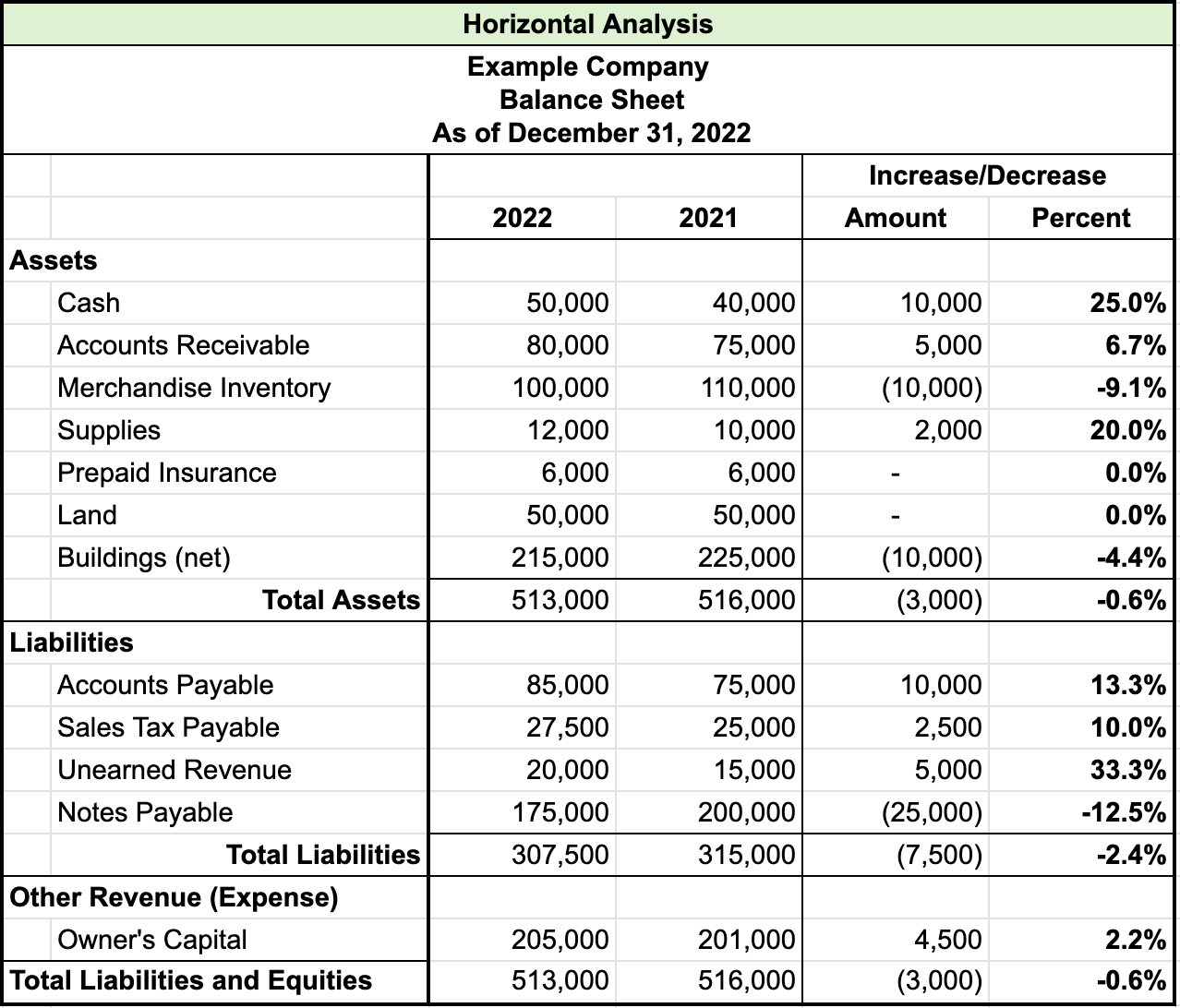

Now we can perform the same horizontal analysis for our balance sheet. Again, we're looking at changes in the individual financial statement line items from one period to the next.

The first thing we do is express the change in dollar amounts, in this case, from 2021 to 2022. We want to know, from a dollar perspective, how these individual financial statement line items are changing.

As you can see, for example, cash increased $10,000 and notes payable went down $25,000.

Next we can convert increase or decrease in dollars to a percentage, to increase our understanding of what changes are taking place.

For instance, supplies went up 20% and unearned revenues also went up by 33%. Sales tax payable went up 10%, which makes sense if you think back to our income statement, because our sales were increasing.

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.