Table of Contents |

Operating leverage can be defined as the degree to which a firm incurs a combination of fixed and variable costs. Specifically, it is the use of fixed costs over variable costs in production.

EXAMPLE

Replacing production workers (variable cost) with robots (fixed cost)Operating leverage is also a measure of how revenue growth translates into growth in operating income.

Recall that variable costs are those that change alongside the volume activity of a business, and fixed costs are those that remain constant regardless of volume. Utilizing operating leverage will allow variable costs to be reduced in favor of fixed costs; therefore, profits will increase more for a given increase in sales. This is, of course, after the breakeven point has been reached. In other words, because variable costs are reduced, each sale will contribute a higher profit margin to the company.

As operating leverage increases, more sales are needed to cover the increased fixed costs. Therefore, companies with a low output would not benefit from increased operating leverage. Moreover, high levels of fixed costs increase business risk, which is the inherent uncertainty in the operation of the business. Manufacturing companies tend to invest heavily in fixed assets. Therefore, operating leverage is used much more than financial leverage for these types of firms. Operating leverage also increases forecasting risk. Therefore, even a small error made in forecasting sales can be magnified into a major error in forecasting cash flows.

Various measures can be used to interpret operating leverage. These include the following:

Recall that operating leverage describes the relationship between fixed and variable costs. Having a high operating leverage, meaning having a larger proportion of fixed costs compared to variable costs, can lead to much higher profits for a company. However, increasing operating leverage can also cause substantial losses and put more pressure on a business. The key to understanding the appropriate amount of operating leverage lies in the analysis of the breakeven point.

Breakeven analysis tells a company how much it needs to sell in order to pay for an investment—or at what point expenses and revenue are equal. To find the amount of units required to be sold in order to break even, we simply divide the total fixed costs by the unit contribution margin.

Unit contribution margin can be thought of as the fraction of sales, or the amount of each unit sold, that contributes to the offset of fixed costs. It is simply the unit net revenue minus the unit variable cost.

When sales have exceeded the breakeven point, a larger contribution margin will mean greater increases in profits for a company. By inserting different prices into the breakeven formula, you will obtain a number of breakeven points—one for each possible price charged.

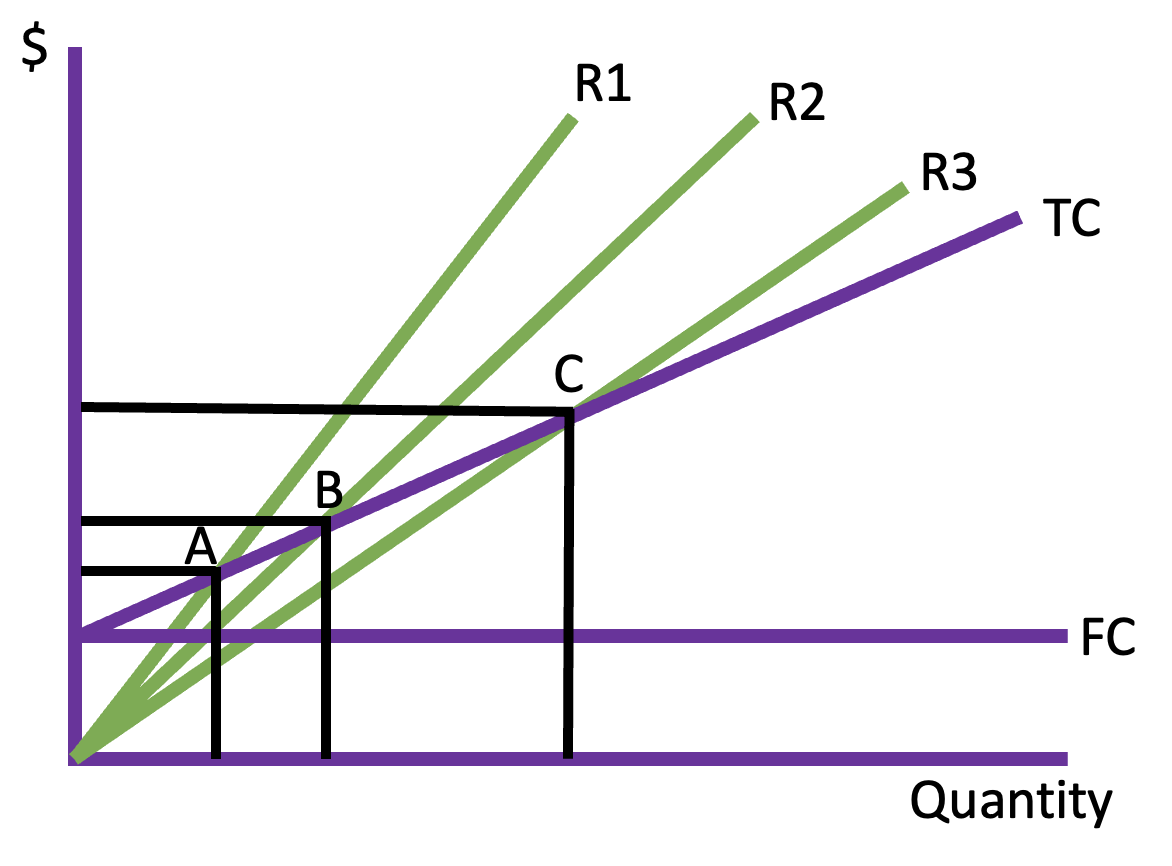

In the graph below, R1, R2, and R3 are revenues at different chosen prices. TC is the total cost curve, and FC is the fixed cost curve.

Points A, B, and C are the breakeven points. The breakeven quantity at each selling price can be read off the horizontal axis, and the breakeven price can be read off the vertical axis.

Breakeven analysis helps provide a dynamic view of the relationships between sales, costs, and profits. By providing a better understanding of the amount of success an investment or project must attain, the breakeven analysis gives companies a benchmark to compare to and an idea about what level of operating leverage will be ideal for generating greater profits.

IN CONTEXT

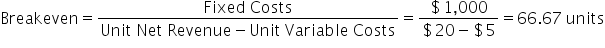

Suppose a company has $1,000 in fixed costs, which includes costs for rent and insurance. The selling price of the company’s product is $20, and the variable cost for manufacturing the product is $5. What is the breakeven point?

This company has to produce and sell 66.67 units in order to cover its total expenses. At this point, it will just break even, making no profit.

Operating leverage is largely predicated on fixed costs. When fixed costs are high and variable costs are low, there is quite a bit of risk if the volume of production is low. However, strong increases in revenues will eventually result in a substantially higher profitability (as the relative impact of variable costs is lower, and the fixed cost is being divided by a higher quantity).

The equations below will demonstrate this concept in practice and clarify the concept. What is important to keep in mind is the importance of fixed costs compared to variable costs and the impact this can have on financial leverage.

IN CONTEXT

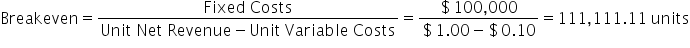

Suppose you own a business selling coffee. Each cup of coffee you sell costs you about $0.10 to make. You want to beat out the competition on price, so you sell your coffees pretty low at $1.00/coffee. As you can see, your variable cost is only 10% of the overall revenue.

The rest of those costs, plus the profit left over, fall into the fixed costs category. After being in business for 1 year, you have spent a total of $100,000 acquiring the fixed assets you need, including a small location, coffee machines, grinders, chairs, tables, and other random necessities.

If you sell one cup of coffee, you’ve spent $100,000.10 and made $1.00. It’s not so profitable at this point, as you can see. Your fixed costs compared to your total costs are pretty much 100%. To find out where you’ll break even, simply subtract the variable cost from the sale price and divide that by the fixed costs.

Around your 111,111th cup of coffee, you’ll find yourself just about even. After this point, pretty much every cup of coffee you sell will result in 90% profit and 10% cost. Not bad, right? But it’ll take a lot of leverage to get there; therefore, there is always the risk you’ll go out of business before you make it to your 111,111th cup of coffee.

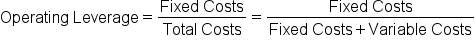

Using fixed costs and variable costs, the model of leverage that can be used is the ratio of fixed costs to total costs.

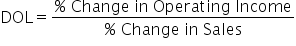

Calculating the overall degree of operating leverage (DOL) is an important strategic consideration to make as often as possible. The DOL can be expressed as the overall change in operating income compared to the overall change in sales:

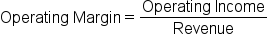

It is also useful to frame this as the operating margin, which compares the overall revenue to the overall operating income. This is more of a snapshot of the current situation, while the DOL above is more in tune with relative changes over time.

At the core of DOL is the same concept discussed in the example above. The overall amount gained per new unit sold changes based on the ratio between fixed and variable costs, and this change is what is being modeled when talking about leverage.

Leverage, in general, can be defined as any technique that is used to multiply gains and losses. By this definition, the use of leverage creates risk and, thus, will always necessitate a trade-off between risk and return. As in any situation of this sort, added risk can produce benefits for a firm, but it can also lead to detrimental consequences.

When considering the benefits of operating leverage, it is appropriate to consider the contribution margin, or the excess of sales over variable costs. When variable costs are lower, the contribution of sales to profits will be greater. In other words, a company with higher operating leverage has the potential to generate much larger profits than a company with lower operating leverage.

EXAMPLE

The variable costs for a software company, such as packaging and the cost of various media devices (like CDs), are very low compared to its fixed costs, such as research and development. Therefore, once a certain breakeven point is reached, the contribution that sales make to profits is much higher than it would be if a greater portion of the costs were variable.Problems can arise if a company has very high fixed costs and if a company has difficulty selling enough units to break even on a particular investment. This is referred to as “business risk,” since it arises from the inherent risk of doing business. In other words, the uncertainty of generating the necessary amount of sales is a dilemma all businesses face. Just as the use of operating leverage can lead to greater profits if a company is able to reach a given breakeven point, so too can the use of leverage drastically multiply losses if that point is not reached.

Source: THIS TUTORIAL HAS BEEN ADAPTED FROM "BOUNDLESS FINANCE" PROVIDED BY LUMEN LEARNING BOUNDLESS COURSES. ACCESS FOR FREE AT LUMEN LEARNING BOUNDLESS COURSES. LICENSED UNDER CREATIVE COMMONS ATTRIBUTION-SHAREALIKE 4.0 INTERNATIONAL.