In this lesson, you will learn about the different types of taxes and how to file a tax return. Specifically, this lesson will cover the following:

-

Taxes might not be anyone’s favorite topic, but they’re absolutely essential for the functioning of society. The concept of taxation dates back thousands of years to ancient civilizations like Mesopotamia and Egypt, where citizens contributed goods or labor to support the ruling class and public projects. Over time, this evolved into the tax systems we know today.

In the United States, the federal income tax was officially established in 1913 with the ratification of the 16th Amendment. Since then, taxes have been used to fund everything from infrastructure and education to health care and national defense. Here’s why taxes are so important:

- Taxes pay for essential services like law enforcement, firefighting, and public health programs.

- They fund the construction and maintenance of roads, bridges, and public transit systems.

- Schools, teachers, and educational programs are largely supported by taxes.

- Programs like Social Security, Medicare, and unemployment benefits rely on tax contributions.

Think of taxes as an investment in the community. They’re the reason we have functioning schools, safe streets, and a safety net for those in need. While paying taxes might not feel rewarding in the moment, they’re a way for all of us to contribute to a better society.

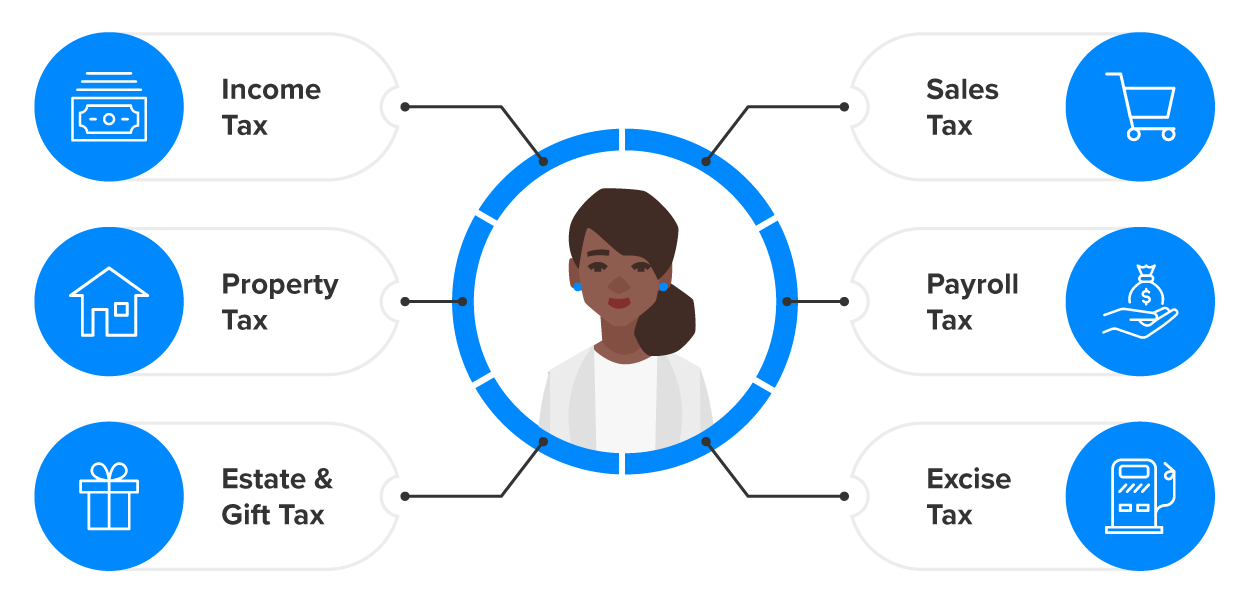

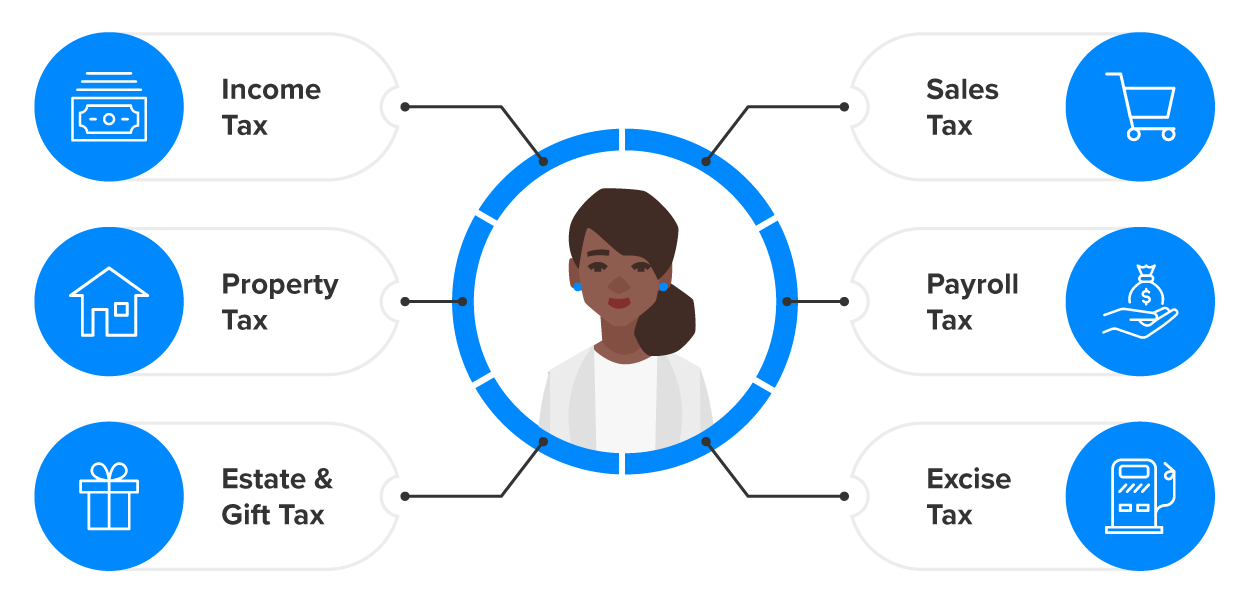

1. Types of Taxes

Taxes are everywhere in our daily lives. Every time we work, buy something, or even inherit something, taxes often play a role. But why do taxes matter? Taxes are the financial backbone of our society. Simply put, taxes refer to the money we all pay to the government (federal, state, or local) to fund things like schools, roads, health care, and public services. They’re a way for all of us to chip in to keep our communities running and growing.

Here’s a closer look at the most common types of taxes and how they might affect you:

-

Income Tax: This is the tax you pay on the money you earn. It applies to wages, salaries, and even side hustles. For example, if you make $50,000 a year, part of that will go to federal and, in most states, state income taxes.

-

Payroll Tax, Also Known as FICA (Federal Insurance Contributions Act): If you’ve ever noticed deductions on your paycheck labeled Social Security and Medicare, those are payroll taxes. These taxes ensure programs that support retirees and provide health care for seniors. We’ll dive deeper into payroll taxes in an upcoming lesson.

-

Sales Tax: This is the extra percentage added to most purchases. Whether you’re buying a cup of coffee or a new TV, sales tax is applied at checkout. For example, in a state with a 6% sales tax, a $100 item will cost you $106.

-

Property Tax: Homeowners pay this tax based on the value of their property. It’s often used to fund local needs like schools, public safety, and community parks.

-

Excise Tax: This is applied to specific goods like gasoline, cigarettes, and alcohol. The price you pay at the pump includes excise taxes built into the cost.

-

Estate and Gift Taxes: These taxes come into play when transferring significant amounts of wealth, like large gifts or inheritances.

Taxes aren’t just about what you pay; they’re about what you support. When you understand the different types of taxes, you can make better financial decisions and even spot opportunities to save.

-

Taxes are collected by different levels of government—federal, state, and local—to fund essential services. Here’s how it works:

Tax by Whom

|

Tax

|

Level of Government

|

|

Income Tax

|

Both the federal and state governments tax the money you earn. In some areas, cities also collect income tax. These funds support national and state programs like health care, education, and infrastructure.

|

|

Payroll Tax

|

The federal government collects these taxes from your paycheck for Social Security and Medicare programs. Employers also contribute a share.

|

|

Sales Tax

|

State and local governments add this tax to most purchases, like groceries or clothes. The money funds local schools, roads, and public services.

|

|

Property Tax

|

Local governments (like counties or cities) tax homeowners based on the value of their property. This money often goes to fund schools, fire departments, and parks.

|

|

Excise Tax

|

Both federal and state governments apply this tax to specific goods, like gas or cigarettes. It’s usually included in the price and helps fund things like transportation and public health programs.

|

|

Estate and Gift Taxes

|

The federal government taxes large gifts or inheritances, and some states add their own taxes on wealth transfers.

|

Each level of government has a role in collecting taxes to pay for the services we use every day.

-

The more you understand where your tax dollars go, the more you can see the value in paying your fair share.

Now that you know the different types of taxes, let’s explore how to navigate the process of filing your federal income tax return—one of the most important annual tax responsibilities.

-

- Tax

- The money you pay to the government to fund public services like schools, roads, and health care.

- Income Tax

- A tax on the money you earn from work, investments, or other sources.

- Payroll Tax (Also Known as FICA)

- A tax taken from your paycheck to fund Social Security and Medicare.

- Sales Tax

- A tax added to the price of most things you buy.

- Property Tax

- A tax on the value of your home or land.

- Excise Tax

- A tax included in the price of specific items like gas, alcohol, or tobacco.

- Estate and Gift Tax

- Taxes on large inheritances or gifts of money or property.

2. Filing a Tax Return

Filing a federal income tax return is a yearly task that most individuals and businesses need to complete. While the process may seem intimidating at first, it’s essentially a way to report your income and verify that you’ve paid the correct amount of tax. Think of it as balancing your financial books with the government.

The federal tax system works like this: A portion of your paycheck is deducted throughout the year to cover your taxes. When you file your tax return, it’s like you’re settling the bill. If too much was deducted, you would get a refund. If not enough was deducted, you might need to pay the difference.

When preparing your tax return, you should also claim deductions and credits that could lower your tax bill. For instance, did you pay for higher education, donate to a charity, or contribute to a retirement account? These actions can reduce the amount of tax you owe and may even increase your refund. We’ll talk more about deductions and credits later on in this lesson.

Filing taxes isn’t just about compliance; it’s also a chance to get a clearer picture of your financial health. By reviewing your income, expenses, and withholdings, you can set better financial goals for the year ahead. Whether you’re using tax software, hiring a professional, or filing on your own, the key is to stay organized and tackle the process step by step.

Here’s how to break it down:

- Gather Your Documents: You’ll need tax forms like the W-2 form (from your employer) or the 1099 form (if you’re a freelancer). These forms summarize how much money you made and how much tax was withheld.

- Note: If you worked two jobs, you’ll need a W-2 form from each employer.

- Choose Your Filing Status: This determines your tax rate and eligibility for credits. Are you single, married, or supporting someone?

- Your filing status is important because it affects how much tax you owe and what benefits you qualify for. It’s like telling the tax system about your life—whether you’re single, married, or supporting someone else. The right status can lower your tax bill or make you eligible for valuable credits, so it’s worth choosing carefully!

- Complete a Tax Form: The 1040 form is the most common. It’s where you list your income, deductions, and credits to figure out how much tax you owe.

- File Electronically or by Mail: Electronic filing is faster and less prone to errors. Plus, it often results in quicker refunds.

-

Start early to avoid last-minute stress. Keeping all your documents organized makes the process smooth.

Filing your taxes is just the start. Next, we’ll explore deductions and credits—your secret weapons for lowering your tax bill.

-

- Federal Income Tax Return

- A form you file to report income, calculate taxes owed, and claim refunds.

- Federal Tax System

- The process where taxes are collected to fund national programs and services.

- W2 Form

- A form showing how much you earned and how much tax was taken from your paycheck.

- 1099 Form

- A form for reporting the income you earned outside a regular job, like freelance work.

- Filing Status

- Your category (single, married, etc.) that determines your tax rate and credits.

- 1040 Form

- The main form used to file your federal income taxes.

2a. Deductions and Credits

When it comes to lowering your tax bill, deductions and credits are your best allies to help you reduce your adjusted gross income. These tools help reduce the amount of tax you owe, making them essential to understand.

First, let’s learn about adjusted gross income (AGI).

Your AGI is the starting point for calculating your taxes. It’s your total income—like wages, side hustle earnings, and investment returns—minus certain adjustments, such as contributions to retirement accounts or student loan interest. Many deductions and credits are based on your AGI, so lowering it can increase your savings.

Think of deductions as ways to shrink the portion of your income that’s taxable. There are two main types: The standard deduction and itemized deductions. Most people take the standard deduction because it’s straightforward and covers a significant amount. However, if you have big expenses like medical bills, mortgage interest, or charitable donations, itemizing might save you more money.

-

EXAMPLE

Let’s say your total income is $60,000. Before applying deductions, you subtract adjustments (e.g., $2,000 for a retirement contribution), leaving you with an AGI of $58,000.

Now, you have two options for deductions:

- Standard Deduction: The government gives you a flat amount—say $13,850—reducing your taxable income to $44,150.

- Itemized Deductions: If your specific expenses total $15,000 (e.g., $8,000 in mortgage interest, $3,000 in medical bills, and $4,000 in donations), you reduce your taxable income to $43,000, saving you more.

In this case, itemizing is better because your deductions exceed the standard amount. But if your expenses were less than $13,850, the standard deduction would make more sense.

Tax credits are even better than deductions because they directly reduce the amount of tax you owe, dollar for dollar. Some credits, like the Child Tax Credit or Earned Income Tax Credit (EITC), are refundable—meaning you could get money back even if you don’t owe taxes. We’ll list some of the most popular tax credits below.

-

EXAMPLE

If you owe $3,000 in taxes but qualify for a $2,000 Child Tax Credit, your bill drops to $1,000. If the credit is refundable and exceeds what you owe, you could even receive a check for the difference.

-

Here’s a list of some of the most beneficial tax credits to help reduce your tax bill or even give you money back if it is a refundable tax credit. Note: These credits can change from year to year, so be sure to check the

IRS website for the latest information.

1. Child Tax Credit (CTC)

- Provides financial relief to parents with children under the age of 17.

- Credit amount can be up to $2,000 per qualifying child.

2. Earned Income Tax Credit (EITC)

- Designed for low-to-moderate income earners.

- Amount varies based on income and number of dependents but can be over $6,000 for families with multiple children.

3. American Opportunity Tax Credit (AOTC)

- Helps offset education expenses for college students in their first 4 years of higher education.

- Offers up to $2,500 per eligible student.

4. Lifetime Learning Credit (LLC)

- Available for any postsecondary education or skills training.

- Provides up to $2,000 per tax return (not per student).

5. Saver’s Credit

- Encourages low-to-moderate income earners to contribute to retirement accounts.

- Credit is worth up to $1,000 for individuals and $2,000 for married couples filing jointly.

6. Premium Tax Credit (PTC)

- Helps cover health insurance premiums for plans purchased through the Health Insurance Marketplace.

- Amount depends on income and family size.

7. Child and Dependent Care Credit

- Helps cover childcare expenses so parents can work or look for work.

- Credit can cover up to 35% of the qualifying expenses, with a maximum of $3,000 for one child or $6,000 for two or more.

8. Energy-Efficient Home Improvement Credit

- Rewards taxpayers for making energy-efficient upgrades to their homes, such as installing solar panels or new windows.

- Credit amounts vary by type of improvement.

Now that we’ve covered how to reduce your tax burden, let’s talk about how to prepare to file your tax return and discuss some helpful resources.

-

- Adjusted Gross Income (AGI)

- Your total income minus specific adjustments; used to calculate taxable income and qualify for deductions or credits.

- Deductions

- Expenses that reduce your taxable income.

- Standard Deduction

- A flat amount you can subtract from your income.

- Itemized Deduction

- Specific expenses (like medical bills or donations) you list to reduce your income.

- Tax Credits

- Dollar-for-dollar reductions in the taxes you owe.

- Refundable Credits

- Tax credits that can give you money back even if you don’t owe taxes.

2b. Tax Return Preparation

If the thought of filing your taxes has you feeling overwhelmed, take a deep breath. You’re not alone, and there are many resources available to guide you through the process. Whether you’re filing for the first time or dealing with a more complex situation, here are your options:

1. IRS Free File

- The Internal Revenue Service (IRS) offers a free filing program for individuals earning below a certain income threshold. It’s a straightforward tool that walks you through your tax return step by step.

- It’s simple, reliable, and designed to make filing accessible to everyone.

2. Tax Software

- Programs like TurboTax, H&R Block, and TaxAct simplify the tax filing process. They ask easy-to-understand questions about your income and expenses, then fill out the forms for you.

- Many of these platforms offer free versions for simple tax returns and premium options for more complex needs, like self-employment income. They usually allow you to file electronically, so you don’t need to print your forms and physically send your taxes.

- These tools check for deductions and credits you might qualify for and help reduce errors.

3.

Volunteer Income Tax Assistance (VITA)

- VITA provides free tax preparation for individuals who meet certain income, disability, or language requirements.

- IRS-certified volunteers help you prepare your return, ensuring accuracy and compliance.

- It’s free, and the volunteers are trained to make taxes easier to understand.

4. Tax Professionals

- Certified Public Accountants (CPAs) and enrolled agents can help with more complicated tax situations, like owning a business, managing investments, or dealing with tax debt.

- This is a good option if you’re unsure about how to handle certain aspects of your taxes or if you simply want peace of mind.

-

Start with a method that feels manageable. If you’re new to taxes, tax software or a program like VITA might be the easiest way to learn the basics. Visit the

IRS VITA information page to find a VITA location near you.

Taxes can seem complicated, but with a clear understanding and some planning, they become much more manageable. By knowing about the types of taxes, learning how to file a return, leveraging deductions and credits, and using available resources, you’ll be ready to tackle tax season confidently. Remember, taxes are more than just numbers—they’re a chance to take control of your financial future.

-

- Internal Revenue Service (IRS)

- The government agency that collects taxes and enforces tax laws.

- Volunteer Income Tax Assistance (VITA)

- A free tax help program for people with low income, disabilities, or language barriers.

- Enrolled Agents

- Tax experts licensed to help with tax preparation and represent you to the IRS.

In this lesson, you took a deep dive into the different types of taxes and learned where your tax money goes. You then learned how to file a tax return and gained an understanding of deductions, credits, and tax return preparation.