Table of Contents |

Think of personal credit like borrowing a friend’s jacket. You’re using something that isn’t yours with the promise to return it in good shape. Credit works in a similar way, except instead of a jacket, it’s money—and instead of a friend, it’s a bank or credit company. When you use credit, you’re borrowing money to buy things now and agreeing to pay it back later, often with an extra cost called interest. Let's see how interest works to your advantage and disadvantage with personal credit.

Personal credit can come in a few forms, and many of these you are most likely familiar with:

Now that you understand what personal credit is and the different forms it can take, in the next topic, we'll look at the advantages of using it. Credit has some powerful benefits that can help you reach your financial goals and manage life’s expenses.

Credit can be a powerful financial tool when used responsibly—meaning you don’t borrow more than you can afford to pay back. It offers benefits like convenience, rewards, and the ability to build a strong credit history that can open doors for future opportunities.

One of the biggest perks of using personal credit is the convenience it offers. Credit cards let you pay for items without carrying cash (which, let’s face it, most of us don’t have in our wallets anymore) and are accepted practically everywhere. Plus, having access to credit gives you flexibility—whether it’s to cover an unexpected car repair, snag that limited-time sale, or finally book that dream vacation.

However, if you’re planning to use your credit card abroad, there’s one extra step: You may need to set up your card for international use. A quick call to your card issuer or a quick request through your banking app lets them know you’re traveling, which prevents them from flagging your purchases as suspicious. Some cards also charge foreign transaction fees, so it’s a good idea to check that too.

EXAMPLE

Imagine you are on your way to work and notice that you have a flat tire. After a visit to the mechanic, you are told you need four new tires that cost $800. Instead of draining your savings, you could pay with a credit card and pay the total off over a few months, making the expense more manageable. However, if you don’t pay it off in full, you will owe interest, making the cost of the tires more expensive.Using credit responsibly can improve your credit history and boost your credit score, both of which are important for future financial decisions. In an upcoming lesson, we’ll cover everything you need to know about credit scores in detail. For now, all you need to know is that credit scores range from 300 to 850. Having a good credit score (typically, from 670 to 850) shows lenders that you’re reliable, which can lead to better loan terms, lower interest rates, and easier approval when you need financing.

EXAMPLE

Paying off a credit card balance in full each month demonstrates that you can handle credit responsibly. Over time, this behavior builds a strong credit history and positively affects your credit score. Having a good credit score is helpful when you want to take out a loan or buy a house or a car because the better your credit score, the lower the amount of interest you need to pay on your loan.So, what do credit card issuers get if you always pay your balance off in full each month? Good question, and the answer is that they still win. Here are the perks for credit card issuers:

Many credit cards offer rewards like cashback, travel miles, or points that you can redeem for products or services like restaurants and shopping. Credit cards can provide added benefits at no extra cost if used wisely as a perk for being a card member. Essentially, you can earn money or points for spending money you would be spending anyway.

EXAMPLE

If your credit card offers 2% cashback on groceries, it means that you’ll earn 2 cents back for every dollar spent on grocery purchases. So, if you spend $100 a week on groceries, you’d earn $2 each week in cashback. Over a month, that’s about $8, and over a year, it adds up to around $100 in cash rewards just for buying your usual groceries!Credit allows you to make large purchases, such as a laptop for work or booking a flight home, without waiting until you’ve saved up the total amount or draining your savings. Credit is almost essential for some expensive purchases, like a car or a house, as most people don’t have the cash to cover the entire cost up front.

EXAMPLE

Buying a home typically requires a mortgage because of the cost of housing—a long-term loan that allows you to buy the house now and pay over time, building equity in the process. Here is an interesting article on the average housing prices per state in 2024.As mentioned previously, having a credit card or line of credit can act as a financial cushion in emergencies, giving you peace of mind that you have options when unexpected costs arise, such as needing four new tires that are expensive.

EXAMPLE

Imagine you suddenly face an urgent medical expense, like surgery or an emergency room visit, costing $3,000. Your insurance covers a portion, but you’re still left with a $1,500 bill. If you don’t have that much saved up, paying it all at once could be stressful. However, if you have access to a credit card or personal line of credit, you can pay the bill immediately, ensuring you receive the care you need without delay and pay off the balance over time.While these advantages make credit appealing, knowing the risks of spending more than you can afford is essential. Let’s look at some of the potential downsides of credit so you can use it in a healthy way and hopefully avoid some of the pitfalls.

Credit can be a helpful tool, but it also has its downsides that can impact your financial health if you’re not careful. It’s easy to swipe a credit card for things you want now, but the convenience can lead to interest costs piling up, tempting you to overspend or take on more debt than you can handle. This can quickly create financial stress, especially if balances grow beyond what’s easy to pay off each month. Misusing credit can lead to a cycle of debt that impacts your budget, your goals, and your overall sense of financial control.

Credit isn’t free money; it often comes with a cost. If you carry a balance on a credit card or have a high-interest loan, the interest payments can add up quickly, costing you more than the original purchase. We’ve already talked about the impacts of interest, but let’s review how interest impacts a purchase when you use credit.

EXAMPLE

Imagine you decide to buy a $1,000 TV using a credit card with a 20% interest rate. You plan to pay it off gradually, so you start by making the minimum monthly payments, which might be around $25 per month. It sounds manageable, but because you’re only paying a small portion of the balance each month, interest starts to add up quickly.Credit can make overspending easy because it removes the need to have cash to make a purchase. With credit cards, in particular, we tend to buy things we might not otherwise consider if we had to pay using cash.

Using a credit card during a sale can make it tempting to buy more, thinking you’ll “pay it off later, it will be fine.” This is especially the case with all those emails from online retailers that use persuasive language to get you to buy more. This thinking can lead to accumulating more debt than you planned over time, as impulse buying adds up quickly without the immediate impact of seeing cash leave your wallet.

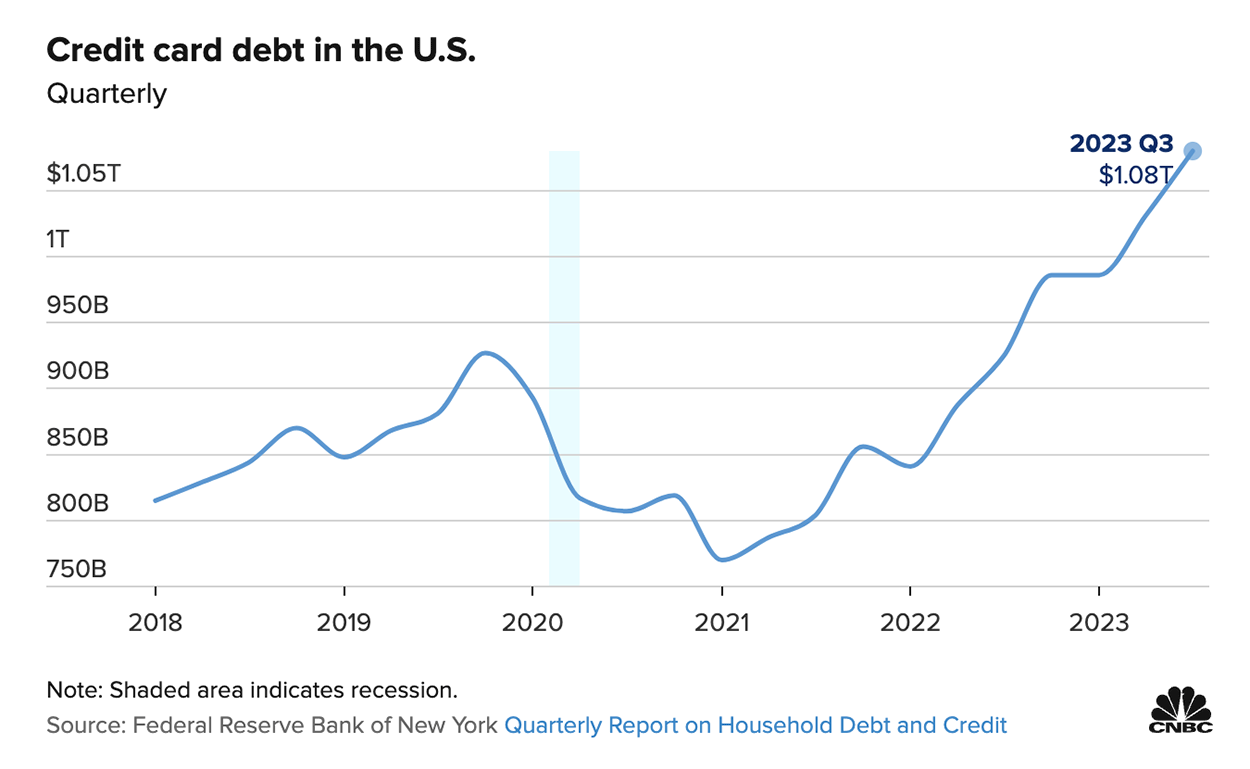

Unmanaged credit use can lead to high levels of debt, which can be challenging to pay off and can cause financial stress. The cycle of debt can impact mental health, relationships, and overall well-being.

Carrying a large balance on several credit cards can make it hard to keep up with monthly payments, leading to stress and possibly even missed payments, which only adds to the problem.

While good credit habits can boost your credit score, missed payments, maxed-out cards, or too many credit applications can harm it. A lower credit score can make it harder to qualify for loans or secure good rates in the future.

EXAMPLE

Missing credit card payments can significantly hurt your credit score, often dropping it by 60–100 points for just one missed payment. If you are approved for a loan, you may face higher interest rates as well. For example, dropping from 700 to 580 because of missed payments can make it difficult to secure a new loan for a purchase.Using credit comes with the risk of fraud and identity theft. Identity theft is when someone illegally uses your personal information, like your Social Security number or credit card details, to commit fraud or theft, often for financial gain. If your card information is stolen, this can be a hassle to resolve, and it may temporarily affect your financial health.

Understanding both the positives and negatives of credit brings us to an essential question: How does credit impact your overall financial health? Credit can play a big role in your financial stability and well-being, depending on how you manage it.

Personal credit can have a big impact on your financial health. Think of personal credit as a partner on your financial journey. When managed well, it’s like a helpful friend—always there to help you out when needed. Maybe you’re planning a big move, handling an unexpected car repair, or building up points for that vacation you’ve dreamed about. Credit can make these plans possible, helping you pay these expenses over time.

But like any relationship, it requires care. Without regular attention, this friendly help can quickly become a burden in terms of debt and increasing interest.

The long-term effects of credit depend on how you manage it today. Good habits, like paying off balances and using credit within your means, keep your finances flexible and your credit score strong. This opens doors to better loan terms for future goals, like buying a house or starting a business. However, falling into a cycle of debt can limit options, with high balances making it harder to qualify for new loans and increasing stress over time.

So, think of using personal credit as a balancing act. It’s a tool that can help you move toward your goals without adding financial strain. Embrace it as an ally, but always stay mindful of the promises you make when borrowing. This way, credit benefits your financial health, helping you handle life’s ups and downs with more control and confidence.

Source: THIS TUTORIAL WAS AUTHORED BY SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.

REFERENCES

Jessica Dickler (2023). Average credit card balances top $6,000, a 10-year high, as delinquencies rise. CNBC. www.cnbc.com/2023/11/09/average-credit-card-balances-top-6000-a-10-year-high.html

Jack Caporal (2024). Average House Price by State in 2024. Motley Fool Money. www.fool.com/money/research/average-house-price-state/