Table of Contents |

Before we begin our discussion on the statement of cash flows, let's take a step back to review the definition of financial statements. These are reports providing financial information about a business at a given time.

The statement of cash flows, then, is a financial statement that reports cash receipts and cash payments for a specific period, providing information about the business and cash.

It generally covers one year or less, similar to our income statement, and it tells us how the business used cash--meaning the cash payments that were made--as well as how the business generated cash, or cash receipts.

The statement of cash flows can be thought of as a modified income statement. So, if we were to prepare our income statement on the cash basis, the amounts would look very similar to what is in the statement of cash flows.

The statement of cash flows is categorized by type of activity and cash performance is outlined in three main business areas.

To find the statement of cash flows, we can follow this formula:

Lastly, we add our beginning cash balance to net change in cash to give us our ending cash balance for the period. It's important to note that the ending cash balance should equal the cash on our balance sheet.

Now we're going to walk through an example of preparing our statement of cash flows in those three main areas.

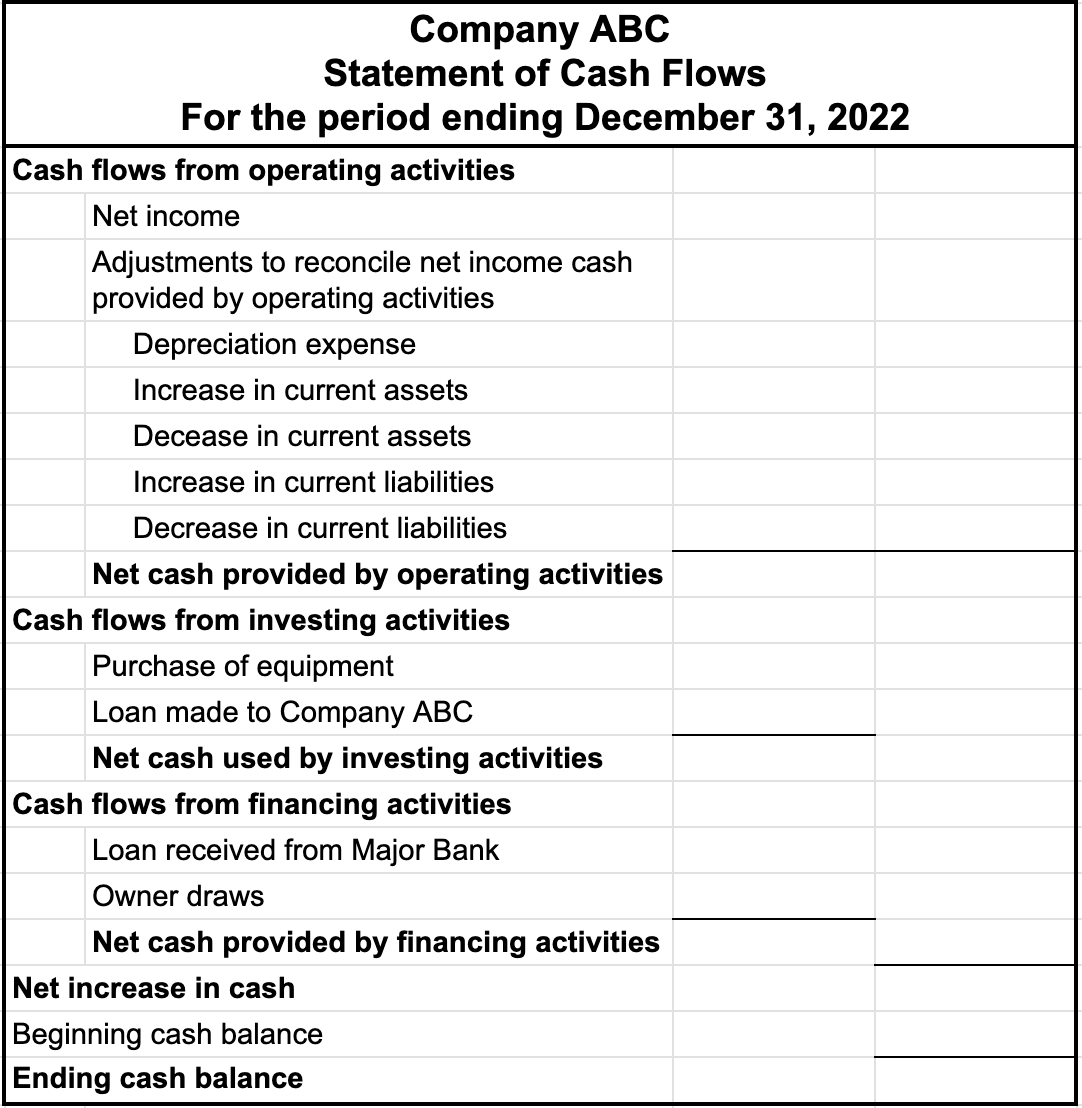

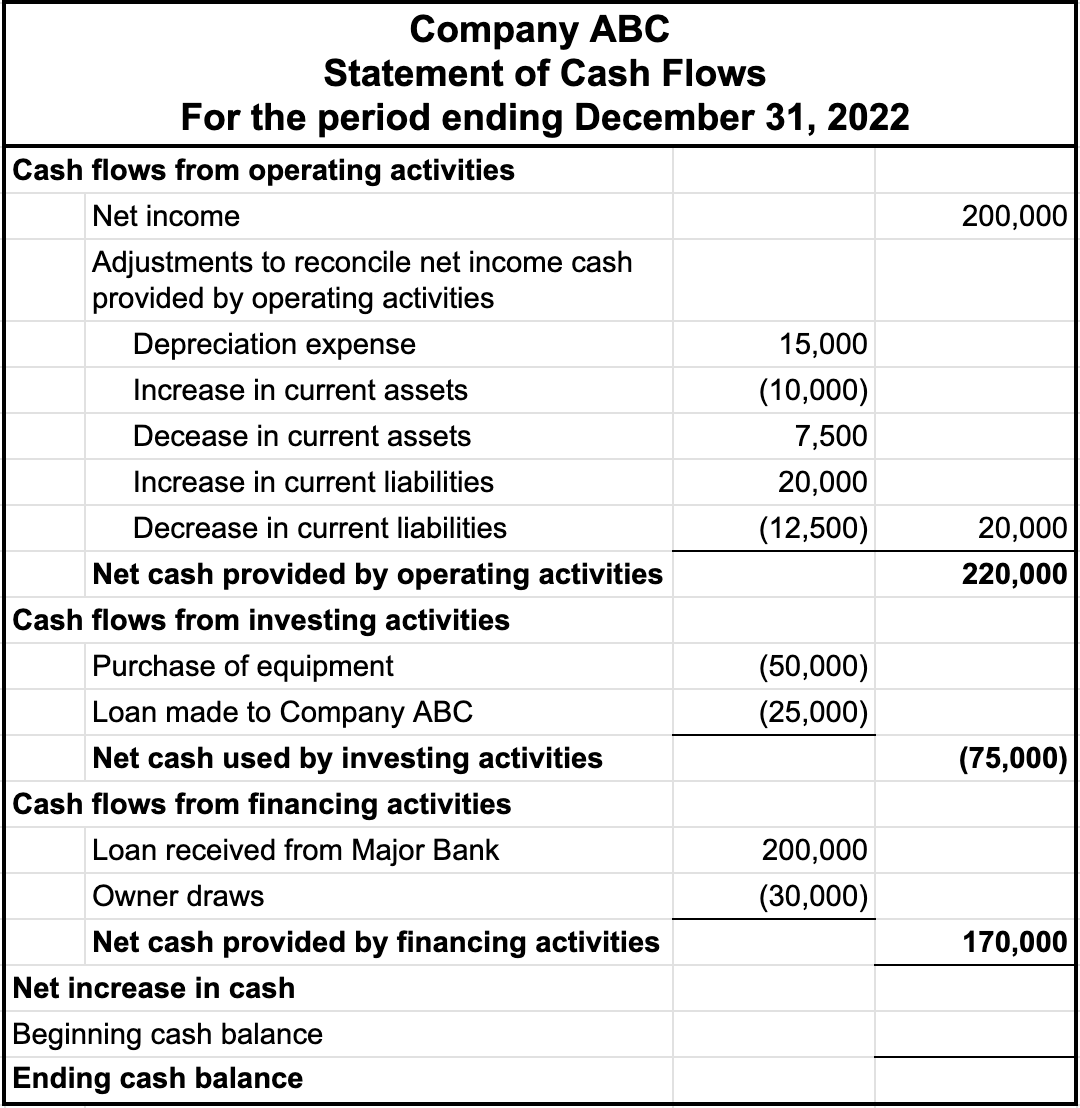

Here is our statement of cash flows. The starting point for our statement of cash flows is the header, where we list our company name, "Statement of Cash Flows," and then, because the statement of cash flows is period-based, "For the Period Ending...", in this case, December 31, 2022.

Now, the first section of the statement of cash flows comprises cash flows from operating activities.

To calculate this, we start with our net income and make what we call "adjustments" to reconcile net income to cash provided by operating activities. This means we're going to adjust our net income for any non-cash items, so that we can only pull the cash flow piece out of our net income to calculate net cash provided by operating activities.

We start with our net income of $200,000.

Then, in this example, we need to take out the following items:

We total all of our net income adjusting items, which equals $20,000, then we add this to our net income to get to net cash provided by operating activities ($220,000).

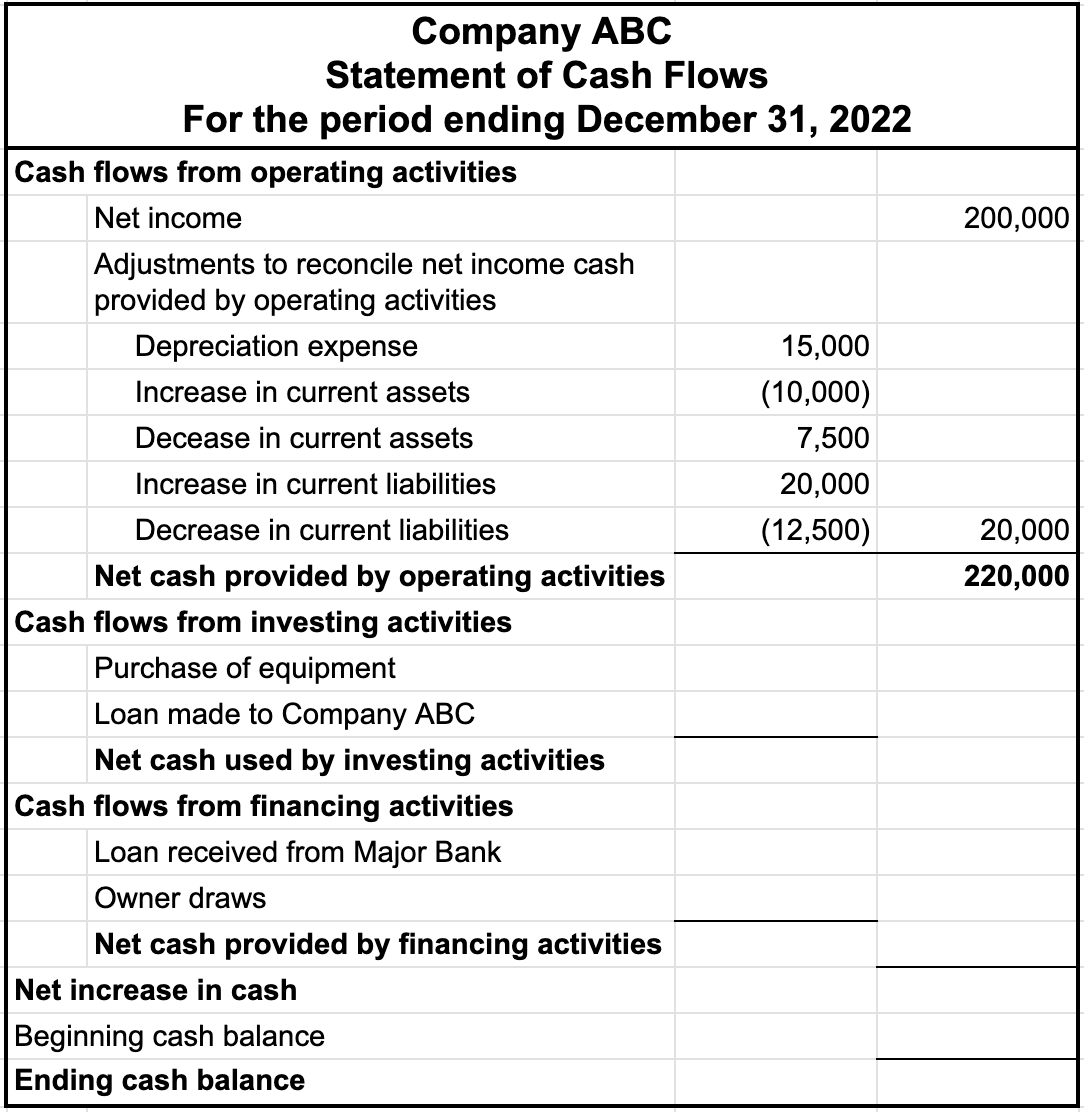

The next section of the statement of cash flows is cash flows from investing activities. This represents all transactions involving sale or purchase of long-term assets, loaning money, and collecting principal amounts of monies loaned.

So, in this example, we have a purchase of equipment and a loan made to ABC Company. These are both going to be outflows.

Since we purchased equipment, we had to spend cash, so we have to subtract that in this section.

The same applies to a loan made to another company. In this case, we gave another company cash in exchange for agreeing to this loan, which means we had net cash used.

Now, remember, in the previous section, we had net cash provided, because it was a positive cash flow. Now, we have net cash used by investing activities, resulting in a $75,000 outflow.

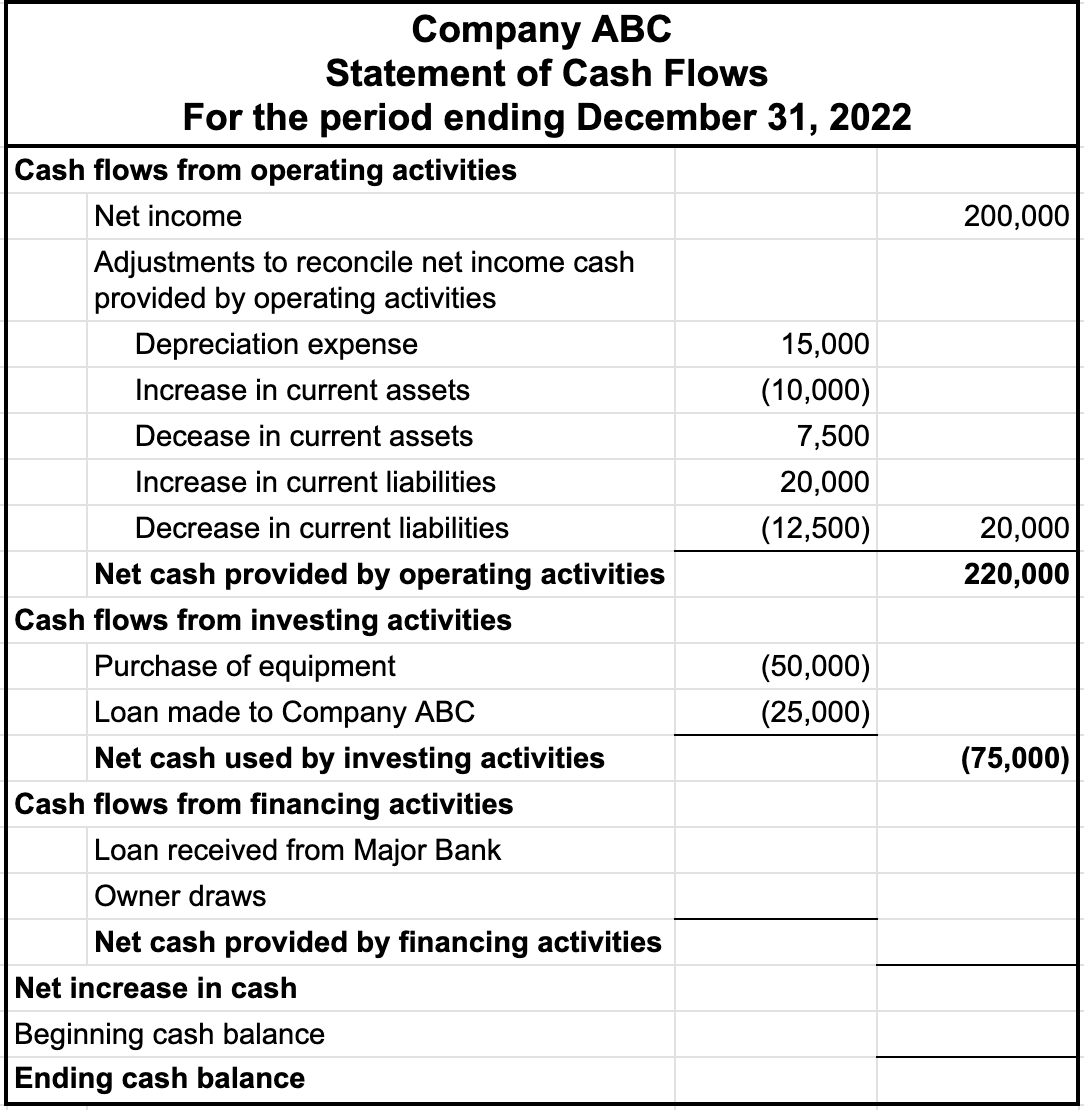

The next section is cash flows from financing activities. This represents all of our cash received from financing to fund operations, cash paid to owners in drawings, and repayments of loans.

So, in our example, we received money from a loan; that's an inflow of cash. In addition, the owners pulled $30,000 out of the business; that's an outflow of cash.

Therefore, the net cash provided by financing activities was $170,000.

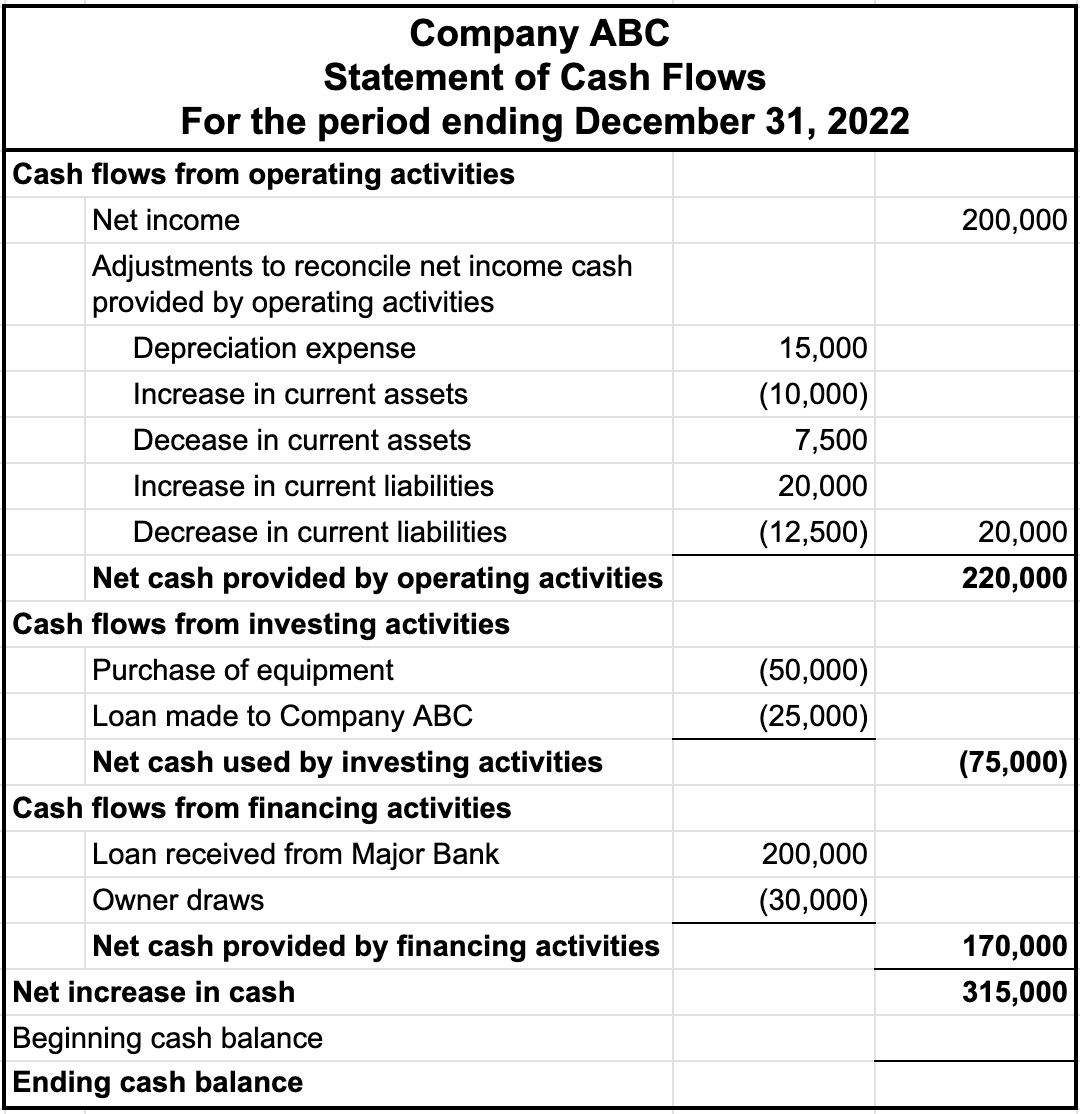

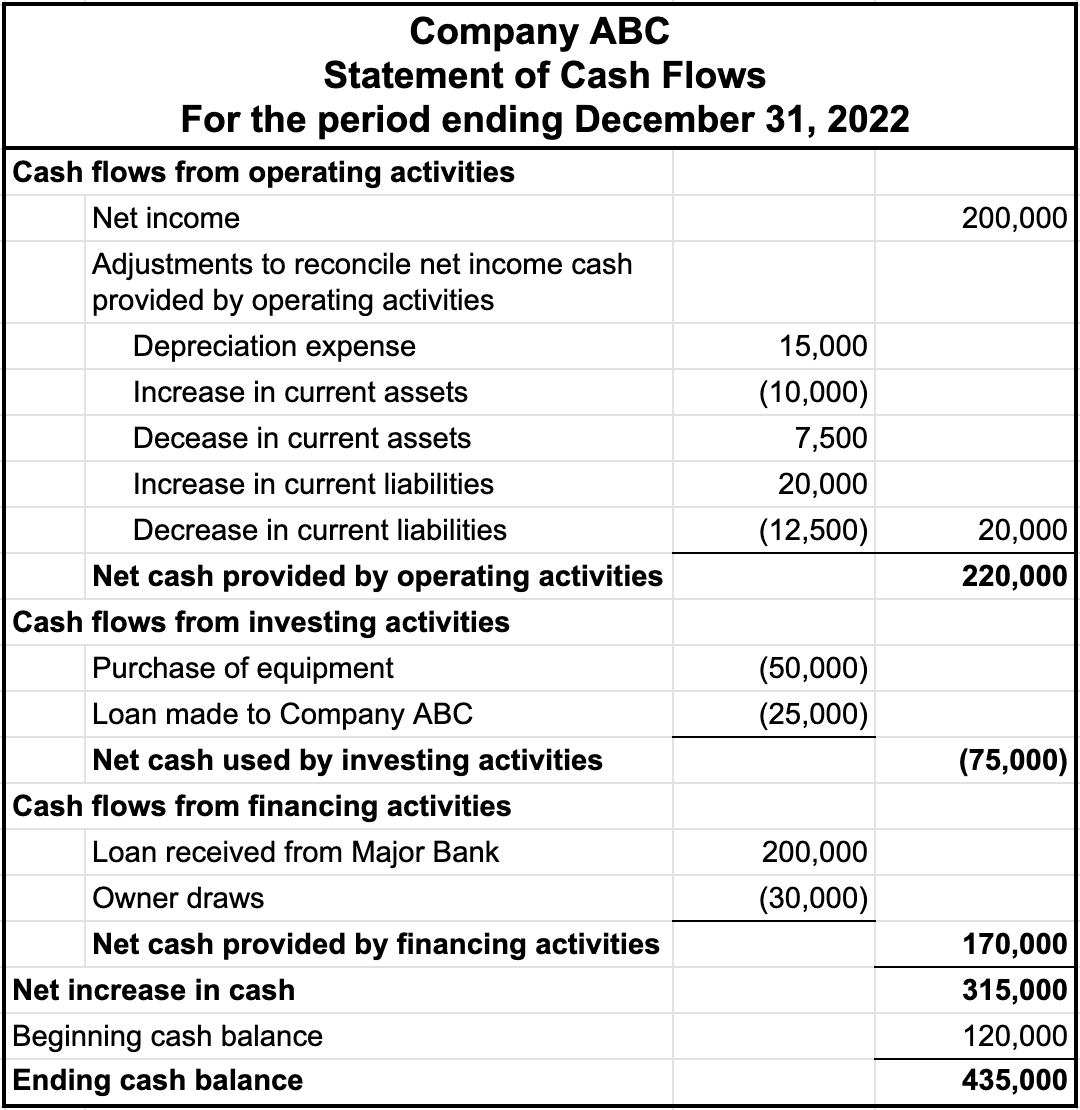

Now we total together our cash flow provided by operating activities, cash flow used by investing activities, as well as net cash provided by financing activities, to get to the net increase in cash.

Finally, we add the beginning balance in cash to arrive at our ending cash balance of $435,000, which should equal the cash on our balance sheet.

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.