Table of Contents |

Recall that margins provide the information the firm needs to make decisions about what to do in order to be profitable in the short run. Depending on the margins, the firm can make a decision about whether to keep the level of production the same, or to increase or decrease the production level. In order to make such a decision, the firm needs to analyze data to understand how well the firm is doing in the short run. The average total cost is used to decide if the firm is making short-run profit. The average variable cost is used to decide if the firm should continue to operate in the short run or shut down temporarily. A firm may choose to shut down temporarily in the short run if its price per unit does not cover its average variable cost. The labor is assumed to be the variable input. If a firm’s revenue cannot cover paying its workers, then shutting down temporarily is an appropriate temporary solution in the short run.

Recall that in the short run the firm has two types of cost, one fixed and the other variable. Variable cost is dependent on the variable input, which is labor in this case. The average variable cost (AVC) will vary depending on how many workers are hired. If the firm employs no workers, the AVC will be zero. Having more workers increases the AVC, and having fewer workers reduces it. Recall that fixed costs associated with leases, contracts, and interest payments on capital equipment purchases do not change in the short run. Fixed costs must be paid whether or not the business is producing any output.

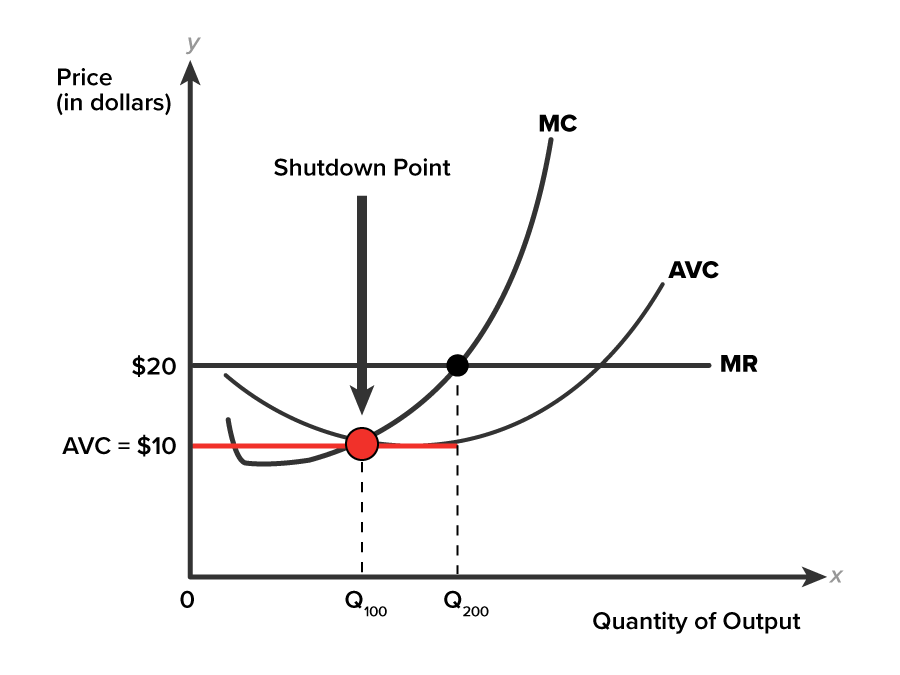

At a minimum, sales revenue must at least cover variable costs. And, in particular, price per unit must equal or exceed the per unit variable cost. If the average variable cost is $10 at the profit-maximizing point of output, then the product price must at least cover the AVC.

Let’s review a graph with price and cost curves to see what this means. First, locate the profit-maximizing level of output. Search for the point where MR = MC in the graph (black dot). What is the level of output where MR = MC? MR = MC at a quantity of 200 units of output. The price for that level of output is $20 per unit. Does the price of $20 cover the per unit variable cost?

Follow the dashed line down from the MR = MC point to a quantity of 200 units. This is the profit-maximizing level of output. Notice at 200 units of output where the MC curve touches the AVC curve. AVC is approximately $10 per unit. If the firm receives $20 of revenue for each unit sold and AVC is $10, then the firm can cover its workers’ wages. It should continue to produce 200 units, and sell at the price of $20 per unit.

Suppose the market price fell to $10 per unit, should the business continue to operate? Think about workers’ wages. Will $10 cover the wage bill? Yes, the firm can still cover its workers’ wages, at the average variable cost of $10 per unit.

The point at which the selling price is equal to the average variable cost is known as the shutdown decision point. The firm can choose to continue to produce at this level of output, or to shut down its operations temporarily. Neither decision is better than the other. If the firm chooses to operate, then the selling price covers the average variable cost per unit, but does not cover any fixed cost. If the firm chooses to shut down temporarily, then there are no variable costs, and only fixed costs remain. Either choice leads to the same conclusion: fixed costs remain unpaid.

EXAMPLE

There are some rare production operations in which shutting down temporarily might be more problematic. For example, if your firm produces industrial metals using a blast furnace that runs temperatures up to 2,300 °F, temporarily shutting down and reheating your blast furnace could become very expensive. The decision to shutdown will need to take this situation into consideration.What if the market price falls below $10 to $6 per unit? What should the firm do then? In this situation, the firm is not covering its fixed cost, and only partially covering variable costs. Workers will not be happy about not being paid in full. A bank loan may be needed if the firm chooses to continue to operate.

EXAMPLE

If you operated a small oceanside resort in northern Maine, would you continue to operate during the winter months? Many businesses are seasonal. Ice cream shops and outdoor swimming pools shut down during the off-season. Summer destinations like amusement parks shutdown once the school year begins. It doesn't mean that they are out of business forever; they are simply shutting down because they would not make enough revenue to justify operating during the off-season. Workers would need to be paid if the business continued to operate. These types of seasonal businesses reopen the following season.Break-even is a situation in which total revenue covers total costs. This is the point where total profit is equal to zero. As a reminder, the definition for total profit reflects economic profit, which includes both explicit and implicit costs. When a firm breaks even, it has earned normal profit. It has earned nothing above normal profit. Anything above normal profit is more than breaking even. When profit exceeds normal profit, or break-even profit, it is called positive economic profit. Normal profit is the benchmark for determining if a business has been successful.

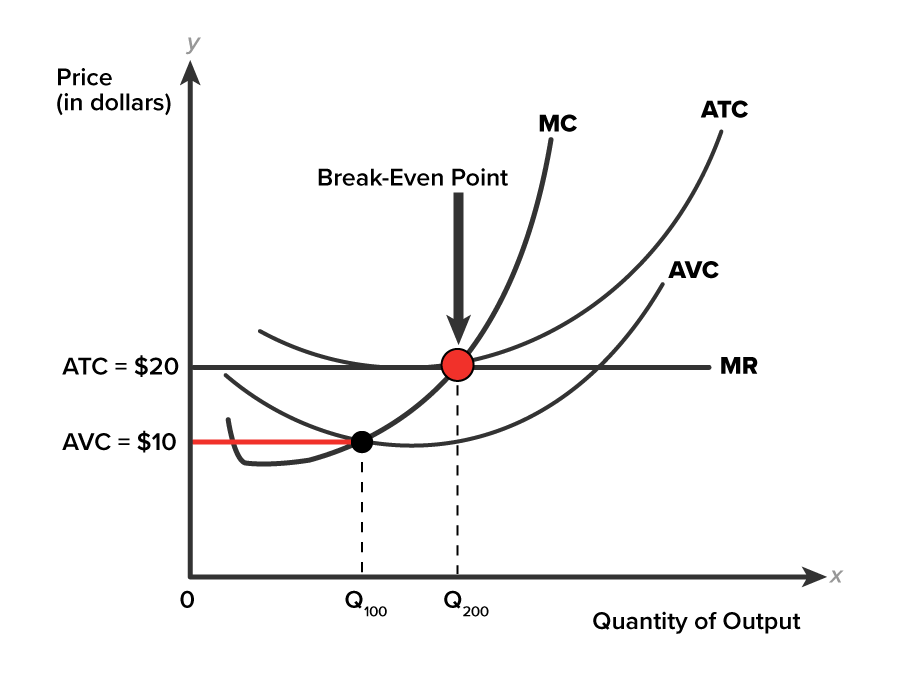

The average total cost helps the firm determine what type of short-run profit it is making. Average total costs are the sum of average variable and average fixed costs. If the selling price per unit is enough to cover the average cost per unit of the product, then the firm breaks even.

EXAMPLE

Suppose you are selling T-shirts for the price of $15 each, while your calculated per unit cost is $15. This means that you are exactly covering all your costs, and are breaking even.Locate the break-even point in the graph, which includes price and cost curves. First, locate the profit-maximizing level of output. This is the point where MR = MC. What is the level of output? MR = MC at a quantity of 200 units of output. The price for that level of output is $20 per unit. Next, locate the ATC curve for the profit-maximizing level of output, which is a quantity of 200 units. In this graph, MR = MC at the selling price of $20, and ATC is also $20 at the quantity of 200 units. The break-even point is where price is equal to ATC.

At the break-even point the firm is breaking even or earning a normal profit. You might wonder how it is profit, if revenue just covers costs. This is because total profit reflects the economic definition of profit. When revenue covers all costs, including the implicit cost of a fair return on your investment, it is known as break-even profit. Break-even profit is also referred to as normal profit. If the selling price generates revenue from sales that is greater than the sum of implicit and explicit costs, the firm is earning positive economic profit. That is, earning profit above normal, or break-even, profit.

EXAMPLE

Suppose you are selling T-shirts for the price of $20 each T-shirt, while your calculated per unit cost is $10. This means that your selling price is more than covering your average cost per unit. Congratulations on earning an economic profit!In the short run, a firm is simply trying to do the best that it can. The firm may not always make a profit. A firm could experience a loss in the short run. When the selling price per unit falls below the average per unit cost, then economic loss is incurred. Loss is the opposite of profit.

As you learned in the first lesson of this challenge, the average revenue is the firm’s product demand, and the average revenue curve is the firm’s demand curve in the market. The demand curve is the average revenue curve, where each point on the curve represents the price of the product and quantity sold in the market. The firm also has a supply curve. A supply curve is a visual representation of the relationship between the price of a product, and the quantity of a good or service a supplier is willing and able to offer during a given time period.

In the lesson on firm costs, we learned about marginal cost and average costs. Both types of costs provide information on per unit pricing of the product. The firm may choose average cost pricing. The average measures cost on a per unit basis. Or the firm might choose marginal cost pricing. The margin analyzes the cost of each additional individual unit produced.

The practice of average cost pricing treats each unit of production as if the cost is the same, whether it’s unit one or unit five million. Average cost pricing, while convenient from a data collection perspective, may overstate costs, meaning that the price may be set higher than the true average cost. This is likely to make a firm’s product less price competitive in the market. Using marginal cost pricing, however, the firm would set the price based on the added cost of the last unit produced. From an economic perspective, marginal cost pricing leads to the most profitable pricing in any type of market.

When a firm sets the product price at the marginal cost per unit, this is marginal cost pricing. With this pricing practice, a supplier charges only the addition to the total cost from the variable inputs for each unit of product, which rises with larger production output and falls with smaller output.

EXAMPLE

For an airline, an empty seat generates no sales revenue but carries variable costs. The airline staff needs to be paid, and the plane needs to be fueled. To fill the next seat, firms will use reduced price incentives to attract certain groups of customers, who might not otherwise consider taking a flight. During the off-season, an airline might offer 50% off or more to passengers looking for bargains.EXAMPLE

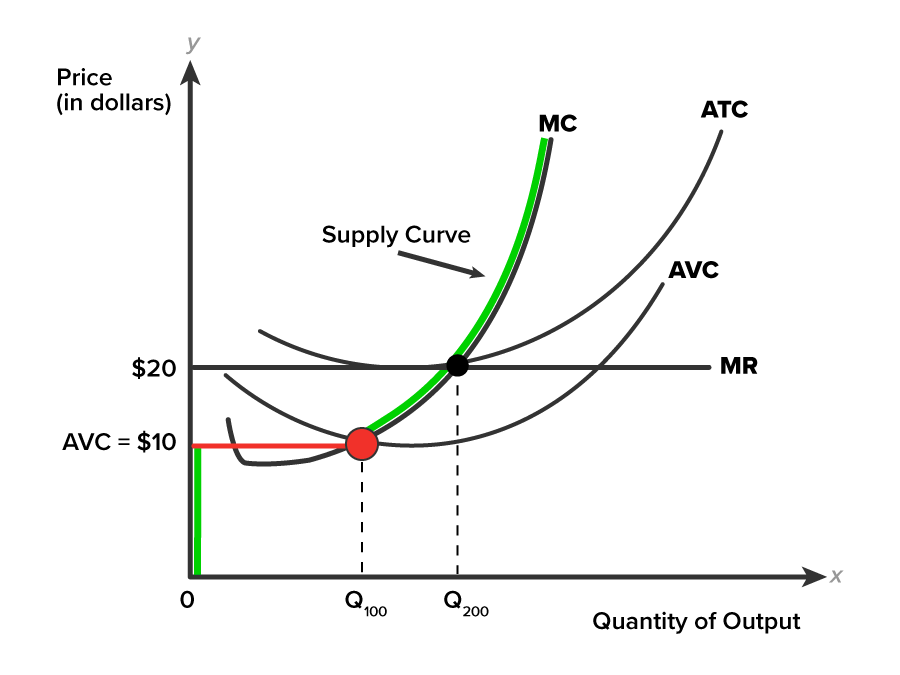

Suppose you are producing baseball gloves. The marginal cost of the fifth unit of production is $160.00. The marginal cost of the 6th unit is $155.00. If you are using marginal cost pricing, you would sell the fifth glove for $160 and the sixth for $155.You have learned that the point at which the selling price is equal to the average variable cost is known as the shutdown decision point. At this decision point, a firm can choose to either continue to operate, or to shut down temporarily. Neither decision is better than another because fixed costs remain. The shutdown decision point is the bottom point of a firm’s supply curve.

If a firm engages in marginal cost pricing, then it is operating upward along the marginal cost curve, beginning where the selling price is equal to the average variable cost.

In the following graph, let’s locate the firm’s supply curve. The graph shows the marginal cost curve and two average cost curves. The marginal cost curve has a J-shape. The shutdown point where the price is equal to AVC occurs at a price of $10, and a quantity of output of 100 units. The firm is willing and able to produce output for sale if the price at least covers variable cost per unit.

Any price at or above the shutdown point is acceptable (Price ≥ AVC). Every point along the MC curve beginning at or above price equal AVC is the firm’s short-run supply curve.

In the graph the supply curve begins at the red circle, the shutdown point, and continues up along the MC curve. Below the shutdown point, the firm is unwilling to supply its product. Its output is zero units of production. If the price falls below the average variable cost (P < AVC), the firm is not profitable.

To be clear, a firm’s supply curve is made up of two pieces: a segment along the vertical axis down to “0” for all prices below P = AVC and a second segment up along the MC curve beginning at its shutdown point (P ≥ AVC).

Source: THIS TUTORIAL WAS AUTHORED BY SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.