We know that profit equals revenues minus cost.

Profit = Revenues - Costs

If total revenue is greater than total cost (TR > TC), then the firm makes a profit. On a per unit basis, this occurs when price is greater than average total cost (P > ATC).

If total revenue is less than total cost (TR < TC), then the firm sustains a loss--or per unit, when price is less than average total cost (P < ATC).

If total revenue equals total cost (TR = TC), then the firm breaks even, or where price equals average total cost (P = ATC).

For the purposes of this tutorial, we'll be focusing on what happens when a firm sustains a loss.

Now, a loss is simply when expenses exceed revenue.

There are two different time frames that impact a firm's operation, and while today we are primarily focusing on the short run, it is important to note that there is a difference between short run and long run.

However, let's focus on the short-run for now.

If a firm is sustaining a loss, their first option in the short run is to continue to operate at a loss.

They can hope that conditions improve and decide to operate at a loss in the short run, then exit the industry in the long run, once they can get out of their rent, for instance.

The other option is to shut down right now. They are not exiting the industry immediately, because they still have fixed costs that they cannot recover, that need to be paid, like rent.

In this option, perhaps they will exit the industry in the long run or re-open at a later date.

However, for whatever reason, sometimes this is the more profitable thing to do--and by more profitable, we mean minimizing loss.

We need to compare these two options and see what will minimize their loss.

As mentioned, the firm still has a fixed cost regardless of what they do.

Since they have to incur this sunk cost in either of the options, we primarily focus on variable costs instead, in the decision to shut down versus operate.

If they can make enough revenue to at least cover the cost of operating--meaning price is greater than their average variable cost (P > AVC), covering workers, materials, etc.--then they can put at least a little revenue towards this fixed expense.

However, if revenues will not even be enough to cover the cost of staying open (P < AVC), then it is better to simply shut down.

A shutdown is defined as the factors of production no longer operating.

IN CONTEXT

Many seasonal businesses like ice cream stores and pool shut down during the off-season.

It doesn't mean that they are completely out of business forever; they are simply shutting down because they would make little or no revenue to justify operating in the winter.

Why would they pay employees to come in if they are not generating any business at all?

They are so profitable once they reopen in the summer that it makes up for the winter losses.

An exit is a different situation. This is a long run decision where a shareholder sells the investment in a firm.

Comparing shutdown versus exit, shutdown is a short run decision to minimize loss. A company would shut down if prices are not covering their average variable costs or operating expenses.

They still have a fixed cost but the firm is not operating; they are not paying for labor, materials, or other factors of production.

An exit is a long run decision. They are selling off all investments in the firm, and there are no more fixed costs because everything becomes variable in the long run.

| Shutdown | Exit |

|---|---|

| Short run decision | Long run decision |

| P < AVC | Sell off all investments |

| Still have fixed costs | No more fixed costs |

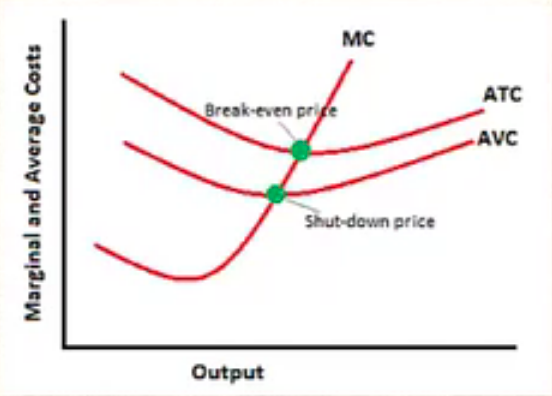

Let's look at it graphically.

When a firm produces where price equals average total cost, they are breaking even.

Anything above that, if P > ATC, they are profitable, which is not our focus in this tutorial, but it always helps to remember the larger context.

When a firm cannot cover its average variable costs (P < AVC), they should consider shutting down.

If a firm is incurring a loss anywhere between the breakeven price and shutdown price, they are going to operate, because they are covering over and above their average variable cost.

At the shutdown price, though, the firm is no longer covering their average variable costs, and that is when they should consider shutting down.

Source: Adapted from Sophia instructor Kate Eskra.