Table of Contents |

Operating expenses are the ordinary expenses and necessary expenses of conducting a business, trade, or profession. These expenses are deducted on Schedule C, Part II. We will discuss them in the order they appear on the form.

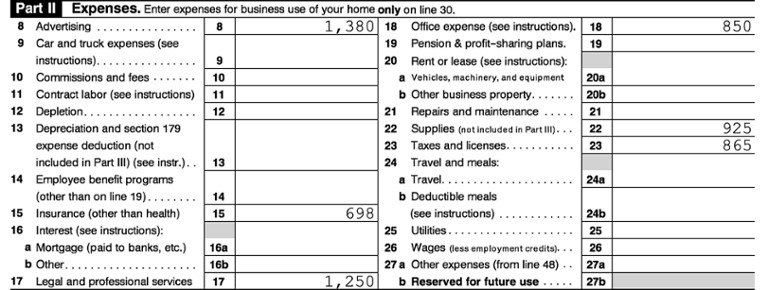

EXAMPLE

During the year, James Gordon had the following expenses for his business:| Advertising | $1,380 |

| Insurance | $698 |

| Legal and Professional Fees | $1,250 |

| Office Expenses | $850 |

| Supplies | $925 |

| Taxes and Licenses | $865 |

The following explanations will help you complete the business expense portion of the form.

Advertising: These are expenses to promote the business, including newspaper ads, flyers (including the cost of distributing them), television and radio promotions, internet banners, and business cards.

Car and Truck Expenses: These can be deducted using the actual expense method (including things like gas, repairs, insurance, lease payments, and property tax) or the standard mileage rate. If the actual expense method is used, depreciation of the vehicle is still reported on the depreciation line.

Deducting the actual expenses requires calculating the business-use percentage of the vehicle by dividing the business miles by the total miles for the year and then multiplying the total expenses by this percentage.

EXAMPLE

Shawn would like to deduct his car and truck expenses using the actual method. He has a total of $1,500 in car expenses for the year. He drove the car 2,000 business miles and 8,000 personal miles.To use the standard mileage rate (SMR), the taxpayer must own or lease the vehicle and use the SMR in the first year that the vehicle was placed into service. The deduction is calculated by multiplying the business miles by the standard mileage rate for the tax year. The standard mileage rate includes an allowance for gas, repairs, insurance, and depreciation.

Normally, the standard mileage rate is the same for the entire year. For 2022, it changed mid-year and was:

EXAMPLE

Zachary used the standard mileage rate to deduct his expenses for the year that the car was placed into service. This year, he drove a total of 2,040 business miles during the year: 1,000 miles during the first half of the year and 1,040 miles during the second half.If the taxpayer used the standard mileage rate for the first year the vehicle was placed into service, either method may be used in subsequent years. But if actual expenses were used in the first year, that method must be used for all years that the vehicle remains in service. For leased vehicles, if the standard mileage rate is used in the first year, it must be used for the entire lease period. Part IV on the second page of Schedule C requests information about the vehicle used in the business.

Commission and Fees: Amounts paid to other individuals or businesses for services and not included on any other line of Schedule C are deducted here. Do not enter wages or benefits paid to the taxpayer’s employees, or any amounts paid to independent contractors or subcontractors who worked for the taxpayer. Form 1099-NEC may be required if $600 or more is paid to an individual.

Contract Labor: These payments are the compensation paid to independent contractors and subcontractors (non-employees) for services rendered. The proprietor should provide Form 1099-NEC to any independent contractor who worked for them and earned $600 or more. The distinction between an independent contractor and an employee is an important one because the proprietor is required to withhold various payroll taxes for an employee. As mentioned in the Self-Employed Taxpayer section of this chapter, we do not cover all the factors that go into making this determination in this course, but IRS Publication 15-A, Employer’s Supplemental Tax Guide, provides considerable information on this topic.

Depletion: The only properties subject to depletion are oil or gas wells, exhaustible natural deposits, and timber.

Depreciation: Business property with a useful life of more than one year is depreciated annually to recover the cost or other basis of the property (this is covered in the Depreciation chapter.) If, for example, a proprietor buys a computer for use in their business, they generally do not deduct its full cost in the year of purchase. Rather, they deduct a portion of the cost every year for five years.

Employee Benefit Programs: Amounts contributed by an employer to employee fringe benefit programs are deductible. Contributions to employee benefit programs include those to education, recreation, health, dependent care, and adoption assistance programs.

Insurance (Other Than Health): Premiums paid to protect the business against losses are deductible as an operating expense. Regardless of whether the cash or accrual method of accounting is used, advance payments may be deducted only in the year to which they apply. Types of insurance for which premiums are deductible include fire, theft, flood, merchandise and inventory, credit, workers’ compensation, business interruption, errors and omissions, disability (for employees), malpractice, and product liability. Note that the business-use percentage of vehicle insurance, if the standard mileage allowance is not claimed, is deducted on line 9 along with other actual car and truck expenses.

Mortgage Interest (Paid to Banks, etc.): Mortgage interest that is reported on Form 1098 for business-use real property is reported on this line. However, if the business is located in the taxpayer’s home, the qualified business portions of mortgage interest, real estate taxes, rent, and utilities are entered as home office expenses after they are computed on Form 8829, Expenses for Business Use of Your Home. Also, see the Form 8990 explanation below.

Other interest: This category includes interest on business indebtedness other than mortgage interest reported on line 16a. Include finance charges on business loans and business credit card purchases. Any interest, including mortgage interest, that is paid in advance must be deducted only in the year to which it applies.

IN CONTEXT: Form 8990, Limitation on Business Interest Expense Under Section 164(j)

For tax years beginning after 2017, the business interest expense deduction may be limited. Refer to the instructions to Form 8990, Limitation on Business Interest Expense Under Section 163(j), for more information on when a business interest expense deduction is limited, who is required to file Form 8990, and how certain businesses may elect out of the business interest expense limitation.

Exclusions from filing Form 8990 include:

- Businesses with average annual gross receipts of $26 million or less (qualified small business)

- Services performed as an employee

- An electing real property trade or business

- An electing farming business

- Certain utility businesses

Legal and Professional Services: These expenses include attorney, accounting, and other professional fees that are ordinary and necessary to conduct business, including expenses for the preparation of tax forms related to the business.

Office Expense: This category includes consumable office supplies, such as pads, pens, pencils, order books, and receipt books; supplies for computers, printers, calculators, cash registers, and copy machines; stamps, express delivery charges, registered or certified mail expenses, postage, the rental of a postage meter and post office box.

Pension and Profit-Sharing Plans: Amounts paid as contributions to pension, profit-sharing, or annuity plans for employees are deducted here. If the plan includes the sole proprietor, the amount contributed for the proprietor can be deducted only as an adjustment on Schedule 1 (Form 1040), line 16.

Rent or Lease: Amounts paid for business rent or lease are deducted as an operating expense in the tax year for which the rent is due. Lease payments for assets used in the business are deductible as rent. Rent or lease payments are reported on separate lines:

It is important to distinguish between expenditures for repairs and those for improvements because an expenditure for an improvement is a capital expenditure and must be added to the basis of the property and depreciated. A capital expenditure is incurred to increase the value of the asset, increase the productivity of the asset, prolong the asset’s useful life, or adapt it to a different use.

For example, fixing a broken shutter on a business building is a repair. Replacing the roof for the same building is a capital expenditure and will be subject to depreciation.

IN CONTEXT: De Minimis Safe Harbor Election

The de minimis safe harbor election allows a taxpayer to deduct amounts paid for tangible property for a) any property that costs $2,500 or less per invoice, including depreciable property, or b) property that has a useful life of 12 months or less. The threshold increases to $5,000 per item if the taxpayer files applicable financial statements.

Supplies: Any supplies not included in Part III, Cost of Goods Sold, that are necessary to the proprietor’s business are deductible in the Expenses section. The taxpayer can deduct the cost of books, professional instruments, equipment, etc., if they are normally used in the business and have a useful life of less than one year.

Taxes and Licenses: Only those taxes that are directly attributable to the trade or business are deductible. Such taxes may include:

| MFJ | $250,000 |

| S/HOH/QSS | $200,000 |

| MFS | $125,000 |

Taxes and other amounts withheld from employees’ wages are not separately deductible because they are already included in gross wages. The portion of payroll tax the sole proprietor paid on behalf of their employees is a deductible business expense and is reported on the Taxes and Licenses line.

EXAMPLE

Panyin is a sole proprietor with one employee, Ebele. Panyin paid Ebele $1,000 in wages during the year. The following amounts are the employer and employee portions of the payroll tax.| Wages Paid: $1,000 | Employer Portion (deductible) | Employee Portion (NOT deductible) |

|---|---|---|

| Social Security tax of 6.2% up to $147,000 of wages: | $62.00 | $62.00 |

| Medicare 1.45%, unlimited: | $14.50 | $14.50 |

| Employer deductions: | $1,076.50 [$1,000 (wages) + $76.50 (taxes) = $1,076.50] |

Licenses (such as occupational, chauffeur, or building) and regulatory fees paid annually to state and local governments in connection with the trade or business are also deducted on this line.

Travel and Meals: The meal expenses for a self-employed person are generally subject to a 50% limit. Meals that are not subject to the 50% limitation include meals that are being provided by an employer for the convenience of the employer.

Taxpayers who deduct travel and meals must substantiate these expenses. Records may be maintained in a book of account, diary, statement of expense, or similar record along with the documentary evidence that supports each element of the expense. Documentary evidence includes but is not limited to such items as receipts, canceled checks, and invoices marked paid. For more information, see IRS Publication 463, Travel, Gift, and Car Expenses.

Travel Within the United States

If a business trip within the United States is entirely for business purposes, all travel expenses are deductible. If the trip is primarily for personal purposes but some business is conducted, then travel, lodging, and food expenses not attributed to business are not deductible. Only expenses incurred that are attributable to business are deductible.

If the trip is primarily for business purposes but includes or is extended for non-business activities, then travel to and from the destination is fully deductible, and food and lodging during the business portion are deductible.

EXAMPLE

Ray went to Florida for a five-day business seminar. He had never been to Florida before, so he extended his trip an additional three days for sightseeing. The total length of this trip was eight days. Ray incurred the following expenses: $700 for airfare, $200 for meals during the business portion of the trip, $75 for meals during the personal portion of the trip, and $800 for hotel ($100 per night). His deductible amount is calculated as follows:| Airfare: | $700 (all deductible) |

| Meals: | $200 (Business meals are fully deductible in 2022, meals during the personal portion are nondeductible) |

| Hotel: | $500 [$100 per night × 5 business nights = $500] |

| Total: | $1,400 [$700 + $200 + $500 = $1,400] |

Expenses of an individual who accompanies a taxpayer on a business trip are deductible only if the companion is an employee of the person or the company is paying the expenses and there is a legitimate business reason for the companion’s travel. Typing notes for the sole proprietor/employee isn’t a good enough reason for the companion’s expenses to be deductible.

Travel Outside the United States

When traveling outside of the United States, travel expenses are fully deductible only when the entire trip is devoted to business activities. If the trip is made primarily for business but the taxpayer engages in non-business activities, costs are allocated between business and personal. Any round-trip travel expenses must be prorated based on the number of business and personal days spent on the trip.

Utilities: This includes the cost of heating and cooling, lights, power, telephone, and internet access. The taxpayer must allocate between the business-use portion and personal-use portion of such expenses when separate utility meters are not installed. However, if the business is located in the taxpayer’s home, the qualified business portions of the utilities are entered on line 30 after they are computed on Form 8829, Expenses for Business Use of Your Home.

Additionally, if the business is located in the taxpayer’s home, no portion of the base rate for the first telephone line into the home is deductible. However, if a second line is added for business purposes, or if extra services, such as call waiting, are added for business reasons, the business portion of such charges is deductible. Also, long-distance charges incurred for business purposes are deductible.

Wages: To be deductible, compensation must be an ordinary and necessary expense of carrying on the business, reasonable in amount, for personal services actually rendered, and actually paid or incurred during the tax year. Gross salaries, wages, or other compensation paid to relatives (including the proprietor’s spouse and children) are deductible, provided the above requirements are met.

The cost of meals and lodging furnished to employees is deductible as compensation paid, regardless of whether the value is taxable to the employees. This is considered a fringe benefit because the employee received this benefit for their performance of services. The value of meals and lodging furnished for the employer’s convenience is not included in the employee’s Form W-2 gross wages. If furnished as an additional employment incentive, the value of meals and lodging is included in the employee’s Form W-2 gross wages.

Employment Credits: Several credits are available to employers who hire workers from certain groups or certain areas of high unemployment. If you ever need more information about these credits, you’ll find it in IRS Publication 334, Tax Guide for Small Business.

Fringe Benefits: If the proprietor provides their employees extra benefits that help to supplement the employee’s salary, the proprietor may be able to include the cost of the fringe benefit provided on their Schedule C in the category in which the cost falls. Examples of fringe benefits include group term life insurance coverage, cafeteria plan, employee use of the business car, tickets to entertainment or sporting events, education assistance, etc.

Depending on the type of fringe benefit provided to the employee, the employer may or may not be required to include these costs of fringe benefits in the employee’s wages. For more information on fringe benefits, see IRS Publication 334, Tax Guide for Small Business, and IRS Publication 15-B, Employer’s Tax Guide to Fringe Benefits.

Other Expenses: This category covers all ordinary and necessary business expenses not entered on the other lines of Part II. Examples include bad debts (see below), dues paid to professional and trade organizations, the cost of business-related publications, business startup costs, and the de minimis safe harbor for tangible property. All “other expenses” must be itemized in Part V on the second page of Schedule C, and the total from line 48 is entered on line 27a of Part II.

Gifts may be deducted, but no more than $25 for each gift can be deducted.

Personal expenses are never deductible as business expenses. If an expense is partly personal and partly business, only the business portion is deducted on Schedule C. An example of a part-personal, part-business expense is the fee paid for tax preparation of the previous year’s return. The portion of the fee pertaining to the preparation of Schedule C and any other business-related forms would go on line 17, Schedule C, as mentioned earlier. State and local income taxes on the net profit from a business are personal expenses and deductible only on Schedule A.

A bad debt is a customer account receivable and note receivable determined to be uncollectible. Such debts are only deductible if the income was previously included in gross income. Cash-method taxpayers ordinarily are not entitled to claim a deduction for business bad debts because sales are not included in gross income until payment is received.

EXAMPLE

David Brooks makes and sells custom skateboards. He sold 12 boards to a sporting goods store in December 2022 for $700. The terms of the sale specified that the merchandise would be paid for within 60 days. Because he uses the accrual method of accounting for his inventory and gross receipts, David included $700 in his income in 2022.EXAMPLE

Sandra Balderson runs a bookkeeping business. In 2022, she performed $300 worth of work for a client who left town without paying the bill. Because she uses the cash method of accounting, she did not include $300 in her income, because the client had not yet paid. Thus, even though her client disappeared without paying, she cannot take a bad debt deduction because $300 was never included in her income.Home Office Expenses: If a proprietor uses a portion of their home regularly and exclusively as their principal place of business or as a place to meet customers, they may deduct the expenses of operating the home office. Such expenses are calculated on Form 8829, Expenses for Business Use of Your Home, and entered on line 30 of Schedule C. A more detailed discussion is in the Home Office Expenses section.

Net Loss: A net loss is allowed as a subtraction from other income and as a net operating loss only up to the amount the taxpayer has at risk and the amount of passive income if they did NOT materially participate in the business.

All Investment Is at Risk: At-risk amounts are the actual cash invested in the business by the taxpayer and the adjusted basis of other property contributed by the taxpayer to the activity. In addition, the taxpayer is at risk for amounts they borrow for use in the activity if they are personally liable for the repayment or if they have pledged property (other than property used in the business) as collateral.

The at-risk rules prevent a taxpayer who has borrowed money through a nonrecourse loan (a loan for which the taxpayer is not personally liable for the repayment) from deducting income losses greater than the amount actually invested in the business activity.

Some Investment Is Not at Risk: If the taxpayer has amounts for which they are not at risk in the activity, Form 6198, At-Risk Limitations, must be completed to determine the allowable loss on Schedule C. Form 6198 is not covered in this course.

EXAMPLE

Alexander tells you that he began mowing yards in his subdivision to make extra money and was always paid in cash, but never kept track of his income or expenses, so he reconstructed them.