Beginning with some basics, businesses or firms demand the factors of production, known as inputs, and supply goods and services, or outputs.

The field of economics studies this behavior of firms and, given that not all firms are created equal, how it varies depending on certain characteristics:

All of these factors affect how firms behave.

We will start with perfect competition, though it should be noted that perfect competition in this market structure is mostly hypothetical.

You may notice that many of the characteristics discussed in this tutorial do not have any basis in the real world, which is partially true. So, why in the world do we study it?

Well, it helps to start with a simplified model, which allows us to break down some of the complexities that we see in the real world and provides a place to start for comparison.

Even though we are not discussing all of these types of competition in this tutorial, this visual illustrates the whole market structures spectrum for context.

Perfect competition is on one end of the spectrum, while most businesses will fall somewhere in the middle. A monopoly, in which there is only one company selling something, would be on the opposite end of the spectrum.

Today, though, we will start at the top, at perfect competition.

So perfect competition is defined as an industry market structure characterized by a very large number of firms selling a homogeneous, or identical, product. Firms have essentially no market power.

You can likely see why this would be the exact opposite of a monopoly.

Let's explore the different characteristics of perfect competition.

So, what does it mean that they are selling a homogeneous product?

Well, perfect competitors sell identical products. There is no way to differentiate one seller's product from the next seller's product, and there are no brand names.

EXAMPLE

Commodities offer a good example of homogeneous products. Regardless of who is selling, it is all the same.Because of this, we don't care who we buy it from--we're basically looking for whoever is going to sell it at the lowest price.

In perfect competition, there are many, many firms selling the exact same product.

This means that no one firm is large enough to have any market power at all, and because of this, they have no ability to set their own price.

EXAMPLE

They can't decide to charge $1 more because they have a better quality product, because remember, they can't differentiate.Therefore, this makes them what we call "price-takers." They are going to have to take the price that is the going rate, or the market price of the good.

You may be wondering where in the world this is actually the case, so let's look at an example.

IN CONTEXT

Tropicana purchases oranges from many different orange farmers. No individual orange farmer can raise prices on Tropicana because the company will not pay it.

A single orange farmer can't decide that since their oranges are better, they're going to charge $1 more.

They have no ability to do that because Tropicana has contracts with these farmers, and if any one farmer says they are charging a higher price, then Tropicana will simply go to somebody else--there are many sellers to choose from.

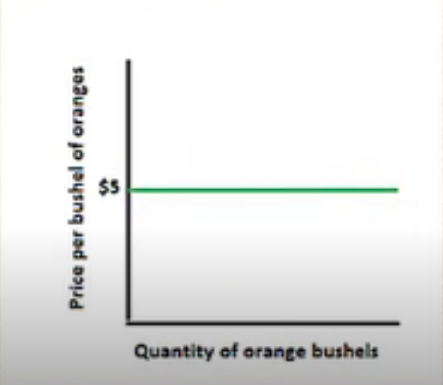

So, what does that mean for their graph?

Well, it means if we graph the price of a bushel of oranges and the quantity, there is only one price that they can charge. If they charge even hypothetically one cent higher than that, they would not be able to sell to Tropicana at all.

This is what we call perfectly elastic demand.

The next characteristic is that there is perfect information.

Well, in perfect competition, this does not happen.

Information flows freely, and firms and consumers know everything about each another, such as:

There are no secrets and everything is in real time. Again, we understand that this sounds very hypothetical, and it is.

However, it is an ideal situation where there is perfect information, so there would be no uncertainty in the market.

Next we have instantaneous entry and exit, which means there are no barriers to entry or exit. A barrier is anything that is going to make it difficult to get in or get out of this business.

In perfect competition, it is very easy to get in and get out of this business. For instance, there would be:

This last point is important to note because once there are large producers in the market, it becomes very difficult for small companies to then enter and compete with them.

As a reminder, this is a simplified view of a market, and it is hard to find examples of perfect competition in real life. The agricultural examples or commodities are the closest thing that we can find.

So, why study it?

Well, studying the extremes gives us a place to start when looking at the complexities of the real world. It's going to help us compare and contrast.

Referring back to the spectrum, for example, we might say that the closer we are to the perfect competition end of the spectrum, the better that is going to be for consumers.

Conversely, the closer we are to a monopoly, the worse it will be for consumers.

Therefore, keep in mind that although perfect competition is rather hypothetical, it is a good place to start for comparison's sake.

Source: Adapted from Sophia instructor Kate Eskra.