Table of Contents |

With job order costing, direct materials and direct labor are traced to individual jobs; however, actual overhead costs are not traced directly to individual jobs. Instead, the total cost for each job will include an estimate of overhead costs. The four steps that are used to account for overhead costs are as follows:

We will discuss each of these steps in detail in the next few lessons.

Step 1 is to set the predetermined overhead allocation rate.

Overhead allocation is the distribution of the indirect costs that are used to complete a product. The most accurate allocation of overhead can be made when managers are aware of what the actual overhead costs for the period are; however, the actual overhead costs are not known until the end of the period.

In order to appropriately and effectively calculate the product or service costs, the overhead costs must be included in the total costs. Since the actual overhead costs are not known until the end of the period, managers will estimate the overhead at the beginning of the period to have an idea of how much the overhead will be.

When allocating overhead to jobs, it is important to identify the most appropriate allocation base for each job. The allocation base is the activity, or base, that overhead costs are linked to. When choosing an allocation base, managers need to think about how many and which activity bases to use when calculating overhead for each job. There should be a cause-and-effect relationship between the allocation base and the overhead costs. A manager’s decision on which allocation base to use will impact the accuracy of the overhead costs, which can ultimately have an impact on pricing and performance decisions.

In general, the allocation base should be the primary cost driver of the overhead costs. A cost driver is the factor that causes or drives a cost to increase or decrease.

EXAMPLE

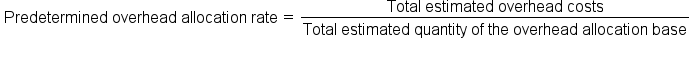

The costs for Bob’s Construction will increase or decrease depending on the amount of labor that is used to complete each building. The cost driver in this case is direct labor costs, and the allocation base is direct labor dollars.Managers will use the predetermined overhead allocation rate to estimate the overhead before the period begins. The predetermined overhead allocation rate will allow managers to allocate the estimated overhead costs to individual jobs. They add the estimated overhead amount to the direct materials and direct labor in order to find the total costs that are attributed to each job. The predetermined overhead allocation rate is calculated by dividing the total estimated quantity of the overhead allocation base by the total estimated overhead costs.

EXAMPLE

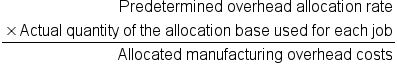

Bob’s Construction needs to determine how much overhead to apply to each job so it will use the predetermined overhead allocation rate to estimate the overhead. Bob uses labor as the cost driver or allocation base to calculate the predetermined overhead rate. The estimated total direct labor cost is $125,000 for the year and the total estimated overhead cost is $200,000 for the year. With these estimates, Bob calculates a predetermined allocation rate of 160% ($200,000/$125,000).Once the predetermined overhead allocation rate is calculated, the next step is to allocate or apply the overhead to each job during the period. We allocate the overhead by multiplying the overhead allocation rate and the actual quantity of the allocation base used for each job.

EXAMPLE

At the beginning of the year, the production manager at Bob’s Construction estimated a total direct labor cost of $125,000 and a total overhead cost of $200,000. With these estimates, the manager calculates a predetermined allocation rate of 160% ($200,000/$125,000). The company used $985 of direct labor during the month of March for job A1. Based on the 160% allocation rate and the $985 of direct labor, it is determined that the applied overhead is $1,576.Once the amount of overhead is calculated for each individual job, it is applied to cost sheets and the general ledger accounts. The estimates are used during the period to allow managers to account for overheads prior to knowing the actual overhead.

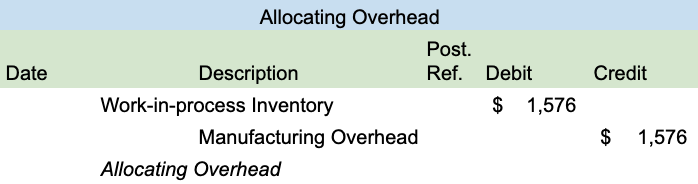

When we allocate or apply the overhead, a journal entry is created to show a debit to the work-in-process inventory and a credit to the manufacturing overhead.

EXAMPLE

Here is a journal entry recording the overhead allocation for Bob’s Construction.

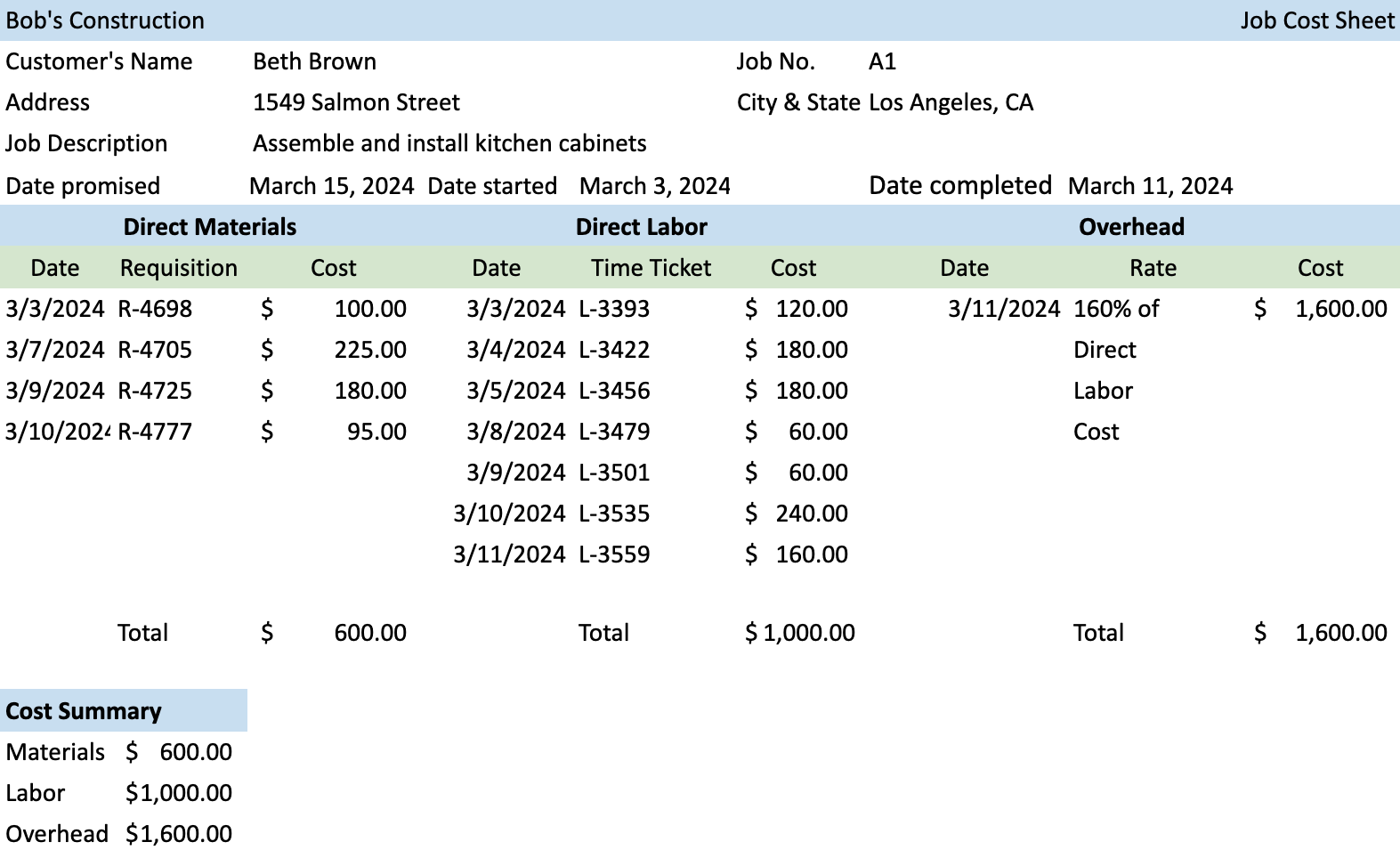

Now that we have determined the costs for direct materials, direct labor, and estimated overheads, the accountant has all the information they need to complete the job cost sheet.

EXAMPLE

Let’s return to Bob’s Constructions’ job A1—building new kitchen cabinets for a client named Beth Brown. The job cost sheet shows the total production costs for the kitchen cabinets, with columns for the direct material (wood slabs), direct labor (employee Mary’s labor on the job), and overhead (rent, utilities, and insurance).

During the period, managers use estimated overhead costs in the calculation of the total manufacturing costs. At the end of the period, the actual overhead costs are available; therefore, adjustments are made to show the actual overhead costs that were incurred for each job. As discussed in previous lessons, the two major sources of overhead costs are indirect labor and indirect material.

Indirect materials and indirect labor are recorded from materials requisition forms for indirect materials and from time tickets for indirect labor. Actual manufacturing overhead costs are recorded by debiting manufacturing and crediting the corresponding accounts.

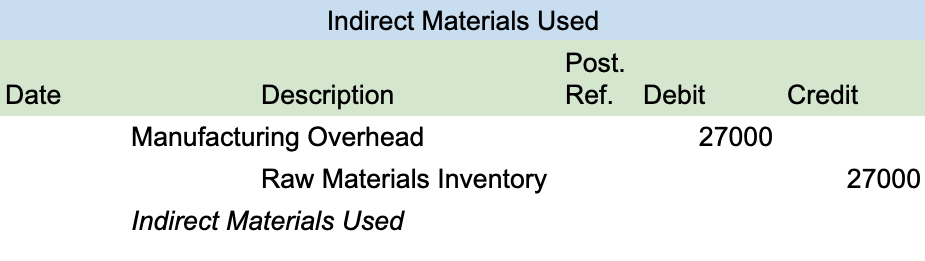

Some of the common adjustments that need to be made are for indirect materials, indirect labor, and other indirect costs. When indirect materials are adjusted, a journal entry is created recording the debit to the manufacturing overhead and the credit to the raw materials inventory. This adjustment is posted to the general ledger and the indirect materials subsidiary ledger. A difference between the recording of direct materials and indirect materials is that actual indirect materials costs incurred are not recorded in the work-in-process inventory and are not posted to job cost sheets.

EXAMPLE

Bob’s Construction used $27,000 of indirect materials to complete job A2, as you can see in the following journal entry.

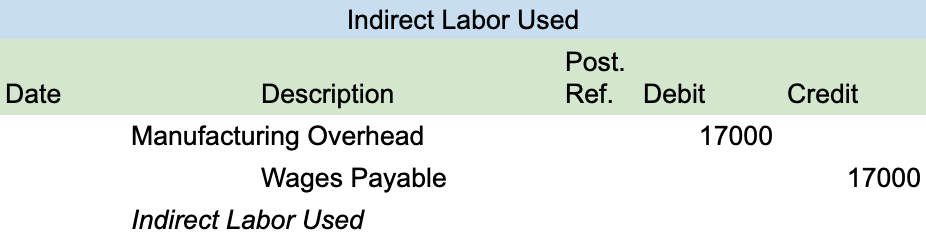

When indirect labor is adjusted to show the actual direct labor costs, the journal entry will consist of a debit to the manufacturing overhead and a credit to the factory wages payable. The factory wages payable are supported by the time tickets that employees use to record the hours that they work on each job. The entry for indirect labor used is posted to the manufacturing overhead and factory wages payable general ledger accounts. The indirect labor costs incurred are not recorded in the work-in-process inventory, nor are they posted to job cost sheets.

EXAMPLE

The indirect labor for Bob’s Construction totaled $17,000 and is shown in the following journal entry.

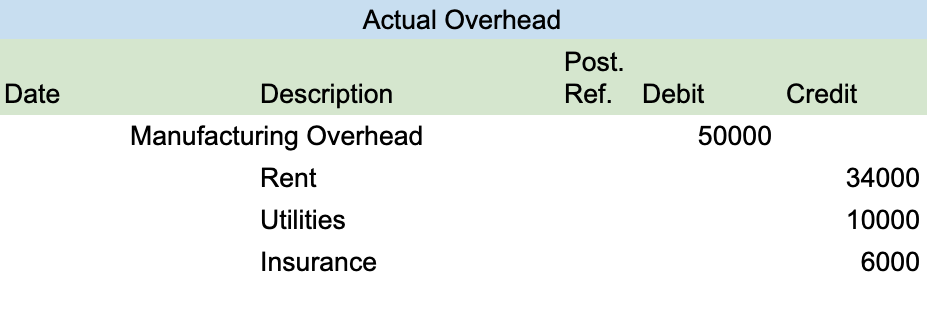

Another adjustment is made to show the actual amount of overhead incurred. This entry is similar to the direct materials and direct labor entries with the difference being that we record a separate credit for each overhead account. For example, if we have overhead costs for rent, utilities, and insurance, we will record a separate line item for each overhead cost. Our journal entry will consist of a debit to overhead and credit for rent, utilities, and insurance. The general ledger accounts for the factory overheads, and each of the different overhead accounts is posted at the end of the period. The estimated overhead is recorded in the work-in-process inventory.

EXAMPLE

Bob’s Construction incurred overhead costs for rent, utilities, and insurance. These costs are allocated to overheads since they are not directly related to the production process.

Companies usually adjust their overhead account at the end of the year for differences between the actual and applied overhead. When comparing the actual and applied overhead, management will determine if the factory overhead is underallocated or overallocated. Underallocated overhead occurs when less overhead is applied than is actually incurred, and overallocated overhead occurs when more overhead is applied than is actually incurred. When overhead is underallocated, the individual jobs have not been charged enough overhead during the year, and as a result, the cost of goods sold is too low. On the other hand, when overhead is overallocated, the cost of goods sold is too high, and too much overhead was applied during the period.

Accountants adjust for either underallocated or overallocated overhead at the end of the period when they close the manufacturing overhead account. As you might recall, closing entries are used to reset or zero out the balances of temporary accounts such as overhead. When we have underallocated overhead, the journal entry will consist of a debit to the cost of goods sold and a credit to the manufacturing overhead, increasing the cost of goods sold and showing a zero balance in the manufacturing overhead account. If the overhead is overallocated, the journal entry will show the reverse: a debit to the manufacturing overhead and a credit to the cost of goods sold.

Source: THIS TUTORIAL HAS BEEN ADAPTED FROM “ACCOUNTING PRINCIPLES: A BUSINESS PERSPECTIVE” BY hermanson, edwards, and maher. ACCESS FOR FREE AT www.solr.bccampus.ca. LICENSE: CREATIVE COMMONS ATTRIBUTION 3.0 UNPORTED.