There are several kinds of loans on which taxpayers may pay interest. Among them are personal loans, business loans, loans to purchase investments, and home mortgage loans.

Interest paid on personal loans, such as car loans, credit card finance charges, and installment plans (other than acquisition debt), is not deductible at all. Interest paid on student loans will generally be deducted as an adjustment to income on Schedule 1 (Form 1040). Interest on business loans is deductible from business income on the appropriate schedule. Qualified home mortgage interest and investment loan interest are deductible on Schedule A (Form 1040). Both are described in this section. For either of these types of interest to be deductible, the taxpayer must be legally liable for repayment of the loan.

A home mortgage is any loan that is secured by a taxpayer’s main home or second home. This includes first and second mortgages, home equity loans, and refinanced mortgages.

The term “home” includes the following types of spaces:

Most interest paid on home mortgages is fully deductible, but there are exceptions. It is important to distinguish qualified home mortgage interest from personal interest, because the former is usually deductible, while the latter is not deductible.

Home mortgage interest (interest on debt secured by a principal residence or second residence) must be categorized as interest on acquisition debt. Acquisition debt is debt incurred to acquire, construct, or substantially improve the taxpayer’s principal or secondary home.

The deduction for home mortgage interest is subject to several limits, including limits on the amount of the mortgage loan. See IRS Publication 936, Home Mortgage Interest Deduction, if any of the following limits apply.

| Debt Secured | Limit |

|---|---|

| After December 15, 2017 | $750,000 ($375,000 if MFS) |

| After October 13, 1987, and prior to December 16, 2017 | $1,000,000 ($500,000 if MFS) |

| Before October 13, 1987 | No limit. Treated as having been used to buy, build, or substantially improve the home. |

EXAMPLE

Yelda is filing a separate return from her spouse. They are still legally married but did not live together all year. They jointly own a home they purchased in 2020 for $950,000. Yelda lives in the home and has continued making the mortgage payments. She will be itemizing her deductions.EXAMPLE

Lauren and Dean are married and filing a joint return. They purchased their main home in May of 2016 for $950,000. They will be itemizing their deductions.EXAMPLE

In 2014, Martha Mahoney purchased her principal residence for $500,000. In 2016, when she owed $400,000 on the original mortgage, she borrowed $60,000 secured by the home and used the proceeds to build a sunroom and install an indoor pool. By 2022, the home was worth $700,000, so Mary borrowed $130,000 secured by the home to pay off her credit card debt. On her 2022 return, Mary was able to deduct, as qualified home mortgage interest, the interest she pays on:EXAMPLE

Jack Michaels purchased his home for $80,000 in 2016. His debt remaining on his original mortgage used to acquire the house is $70,000. The 2021 fair market value of the house is $95,000. Jack used a home equity line of credit in 2022 to borrow $15,000 to purchase a new car. All of the interest paid in 2022 on the original mortgage (acquisition debt) is deductible as qualified home mortgage interest. However, the interest on the $15,000 home equity line of credit is not deductible because it was used to purchase a car.Prepaid interest (interest paid in advance, for a period extending beyond the current tax year) generally is deductible in the tax years to which the payments apply. The taxpayer may deduct in each year only the interest for that year.

The term “points” is generally used to describe certain charges, such as loan origination fees, maximum loan charges, or loan discounts, paid upfront by a borrower to obtain a home mortgage. One point equals 1% of the mortgage loan amount. Points paid to refinance a residence, however, must be deducted over the life of the loan.

“Points” is a term used to refer to one of the following:

Deduction in the Year Paid. Because points represent interest paid in advance, they generally must be deducted over the life of the loan. However, in some circumstances, points incurred to finance the purchase or improvement of the taxpayer’s main home may qualify to be deducted in full in the year they were paid.

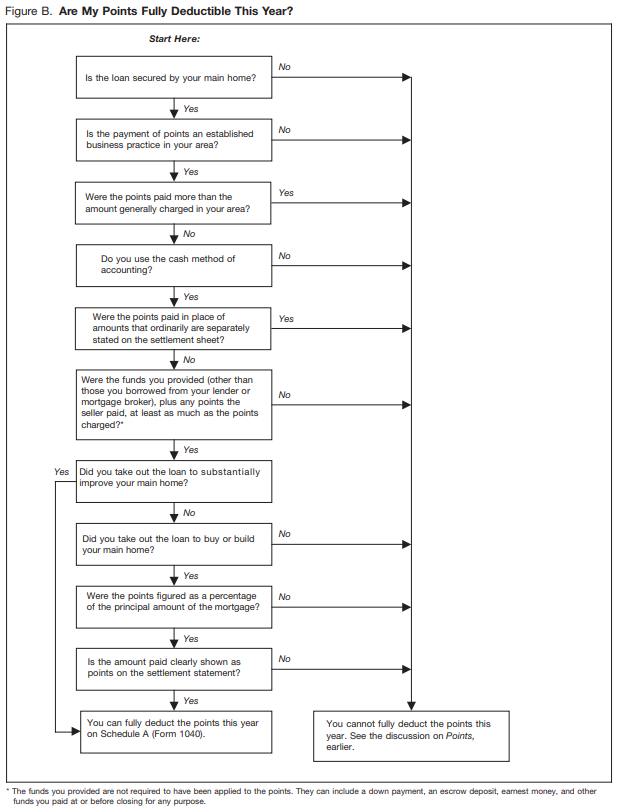

Points are fully deductible in the current year if the mortgage loan was secured by the taxpayer’s main residence and the charging of points is an established business practice in the area. The deduction may not exceed the number of points usually charged in the area. Further, funds obtained from the lender cannot be used to pay the points. If the taxpayer is buying the home, they must provide funds prior to or at the time of closing at least equal to the points charged. If any of these conditions are not met, the points must be deducted over the life of the loan. The flowchart from IRS Publication 936 can help you determine whether points are fully deductible in the year paid.

Note that even if a taxpayer qualifies to deduct the full amount of points when paid, a taxpayer who does not benefit from itemizing deductions for the first year of the mortgage may choose to deduct the points over the life of the loan.

EXAMPLE

Sandy Briggs, a taxpayer filing as head of household, purchased her first home in October 2021. She paid three points ($3,000) to acquire her 30-year, $100,000 mortgage. Her first mortgage payment was made on January 1, 2022.Refinanced Mortgages and Home Improvement Loans. Points paid to refinance a home mortgage (often referred to as a “refi”) or to purchase a second home may or may not need to be deducted over the life of the loan. Again, there is specific information on the requirements to be met in Publication 936. Generally, points deducted are done so over the life of the loan. These rules are complex, and we do not cover them in this course. However, cash-method taxpayers may use a simplified method and deduct the points ratably (equally) over the life of the loan if certain tests are met.

Loan Ends Early. If points are being deducted over the life of a loan and the mortgage is paid off early, any remaining points can be deducted when the loan is paid off. In cases where the mortgage is refinanced with a new lender, the remaining points on the original loan are deducted when the loan is paid off. However, if the mortgage is refinanced with the same lender, the remaining points must be deducted over the life of the new loan.

EXAMPLE

Amanda Probst refinanced her original home mortgage in 2022. The original 30-year loan, made in July 2014, was for $125,000. Amanda paid 2½ points to obtain the loan, a total of $3,125 [$125,000 × 2.5% = $3,125]. Her first payment was made on September 1, 2014. She has been deducting the points over the life of the loan at $8.68 per month [$3,125 ÷ 360 monthly payments = $8.68], from September 2014 through December 2021. Prior to 2022, she has deducted $764 [$8.68 per month × 88 = $764]. Amanda made her last payment on the original loan on February 1, 2022.Seller-Paid Points. Points paid by the seller in connection with a loan to the buyer are usually considered for tax purposes to be paid by the buyer and are deductible by the buyer. The taxpayer must reduce the basis of the home by the amount of points paid by the seller.