Table of Contents |

LIFO is an inventory valuation method, which stands for Last In First Out:

As an inventory valuation method, LIFO helps to provide information about cost of goods sold and ending inventory. Under LIFO, goods are assumed to be sold newest to oldest, meaning goods that were purchased last or most recently are the first to be sold. The oldest goods, or goods that were purchased first, are assumed to remain in inventory.

The argument for using LIFO centers on matching current costs with current revenues. Newer purchases, which represent current costs, are recorded as cost of goods sold, and that expense is matched with current revenues.

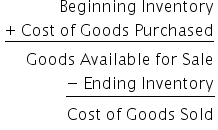

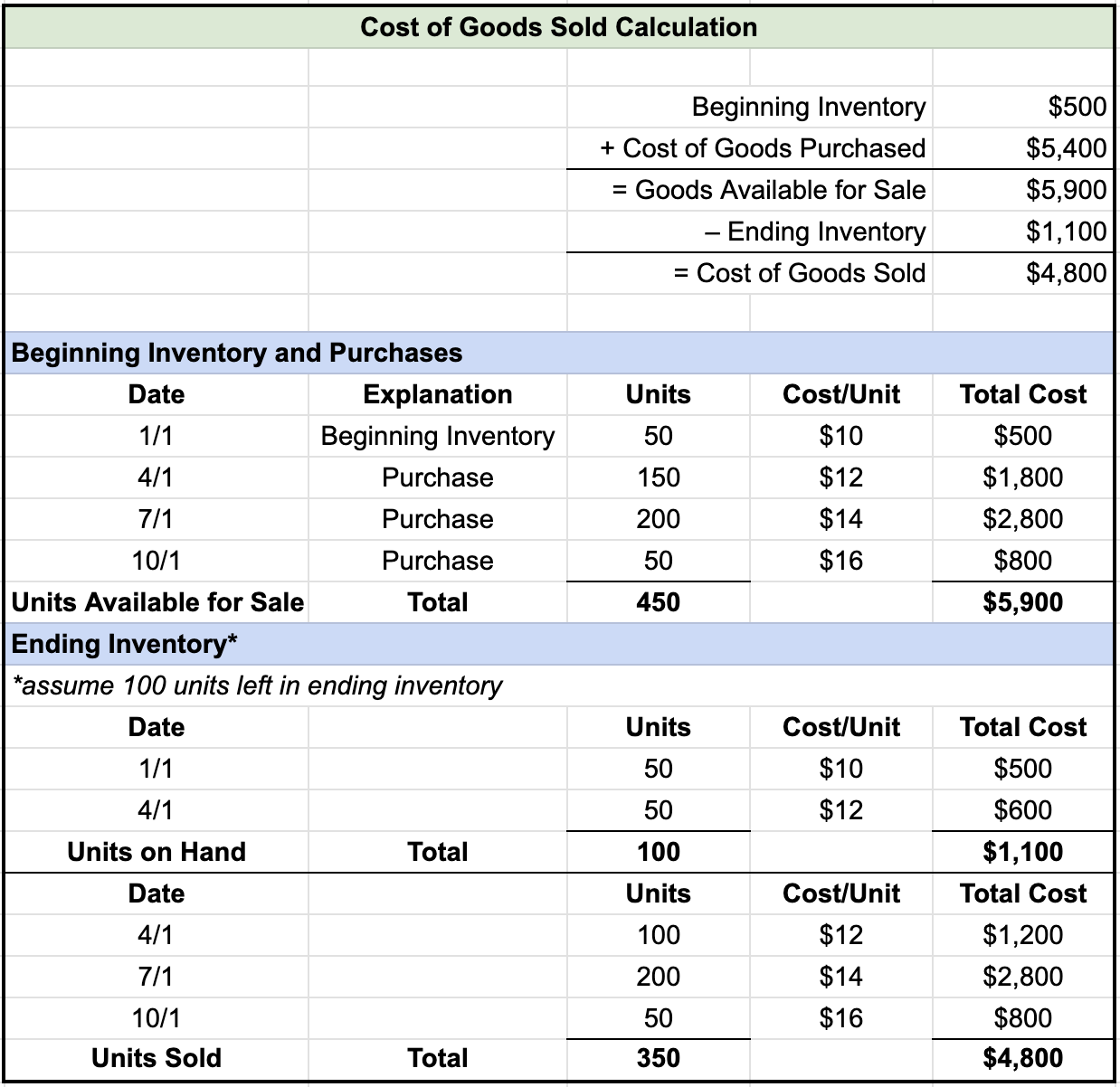

Next, let's discuss LIFO and costs of goods sold. We will start by revisiting the cost of goods sold calculation, which starts with beginning inventory, then we add costs of goods purchased to give us goods available for sale. Then, we subtract out ending inventory to equal cost of goods sold.

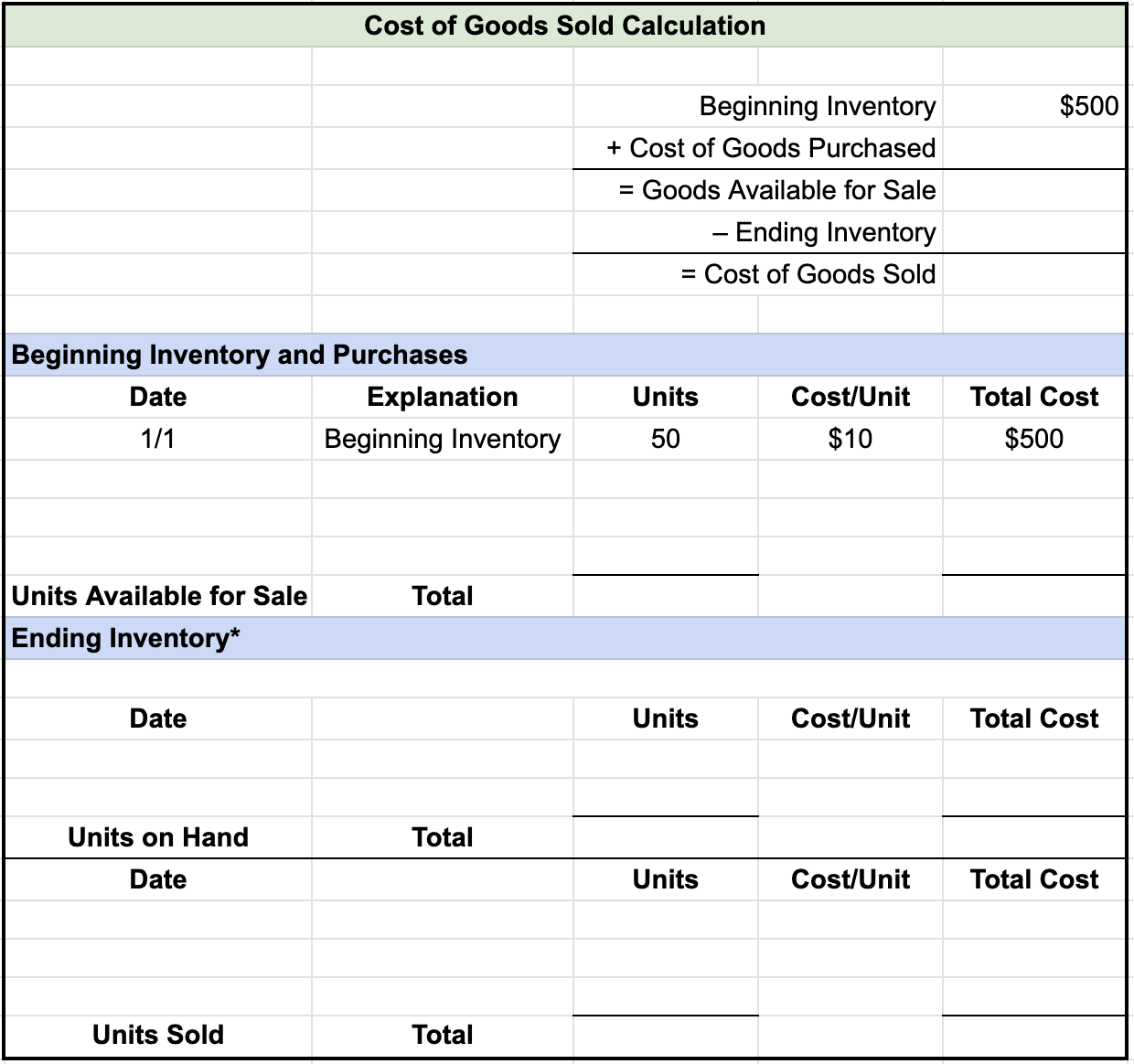

Let's look at an example of calculating cost of goods sold using the inventory valuation method of LIFO. Below you will see a spreadsheet outlining the cost of goods sold calculation. We will begin with the first line, beginning inventory. Beginning inventory is pulled from our balance sheet or from our trial balance. You can also see there is a schedule, detailing beginning inventory and purchases.

Once we have plugged in beginning inventory, we need to determine cost of goods purchased. If you look at the detail of all the purchases made, you can see that we made three purchases throughout the year.

We can take the total of those purchases, which is $5,400, and drop that into the schedule, which means we now have total goods available for sale of $5,900. Note that this is the total of beginning inventory plus all of the purchases.

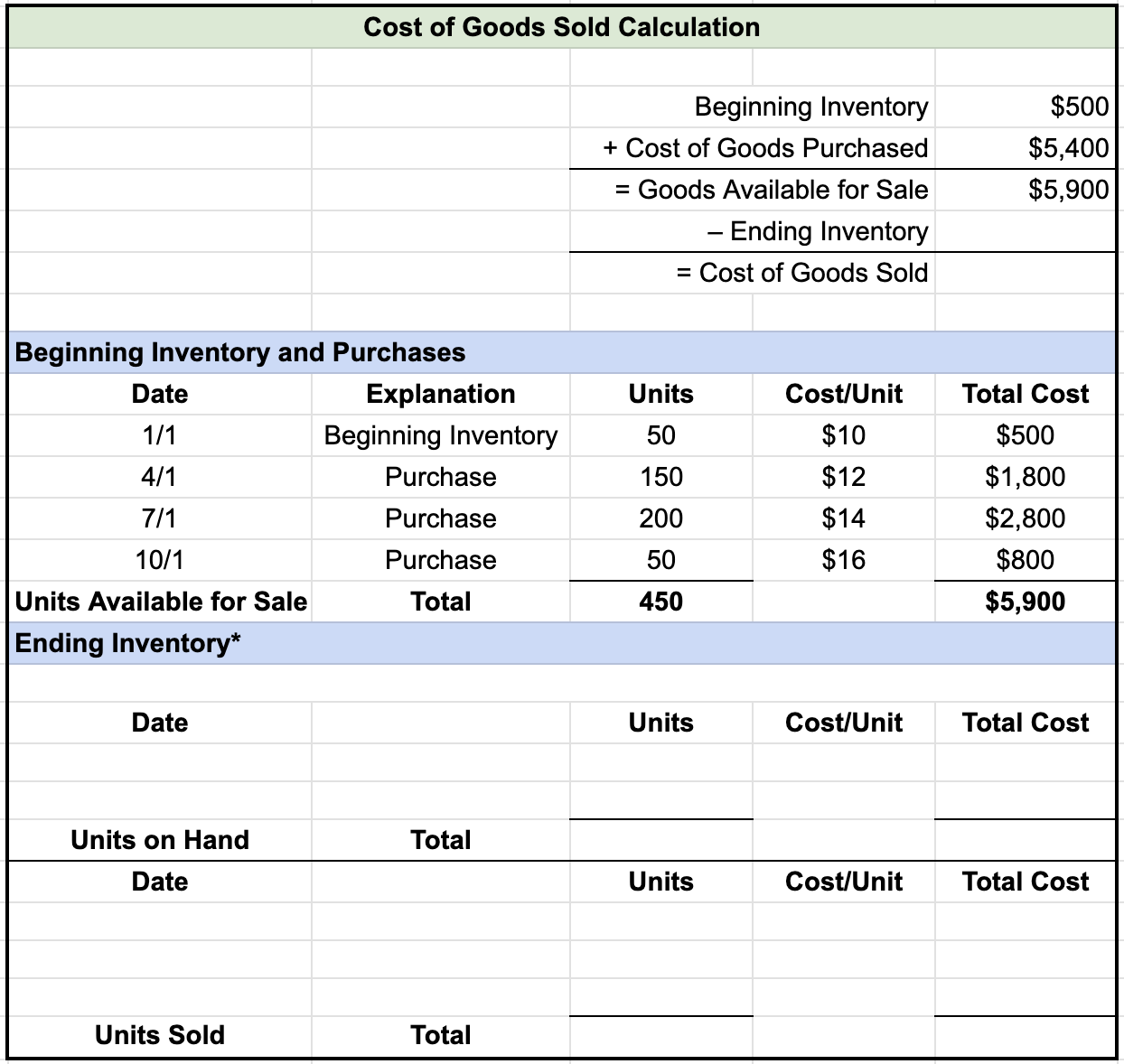

Now we need to know what our ending inventory is. If you look at the ending inventory schedule below, we're going to make the assumption that we have 100 units left in our ending inventory.

Using LIFO means that the last units in are the first ones out--that the most recent purchases are the purchases that our sales came from. In turn, this means that the oldest units are what comprise our ending inventory.

Therefore, we can take 50 units in our beginning inventory on January 1, our oldest units, and work our way forward through our purchases. We can take another 50 units from the purchase made on April 1. Once we have that information, we can total our ending inventory, which is $1,100, based on those 100 units.

Then, we take that number and drop it into our cost of goods sold schedule to calculate our cost of goods sold, which in this case is $4,800.

We can confirm this by calculating the units sold. If we have all 50 units from the beginning inventory and 50 units from 4/1 in our ending inventory, that means we sold the remaining 100 units from 4/1, all 200 units from 7/1, and all 50 units from 10/1. Calculating our cost of goods sold is equal to $4,800, which is the same result as using our formula.

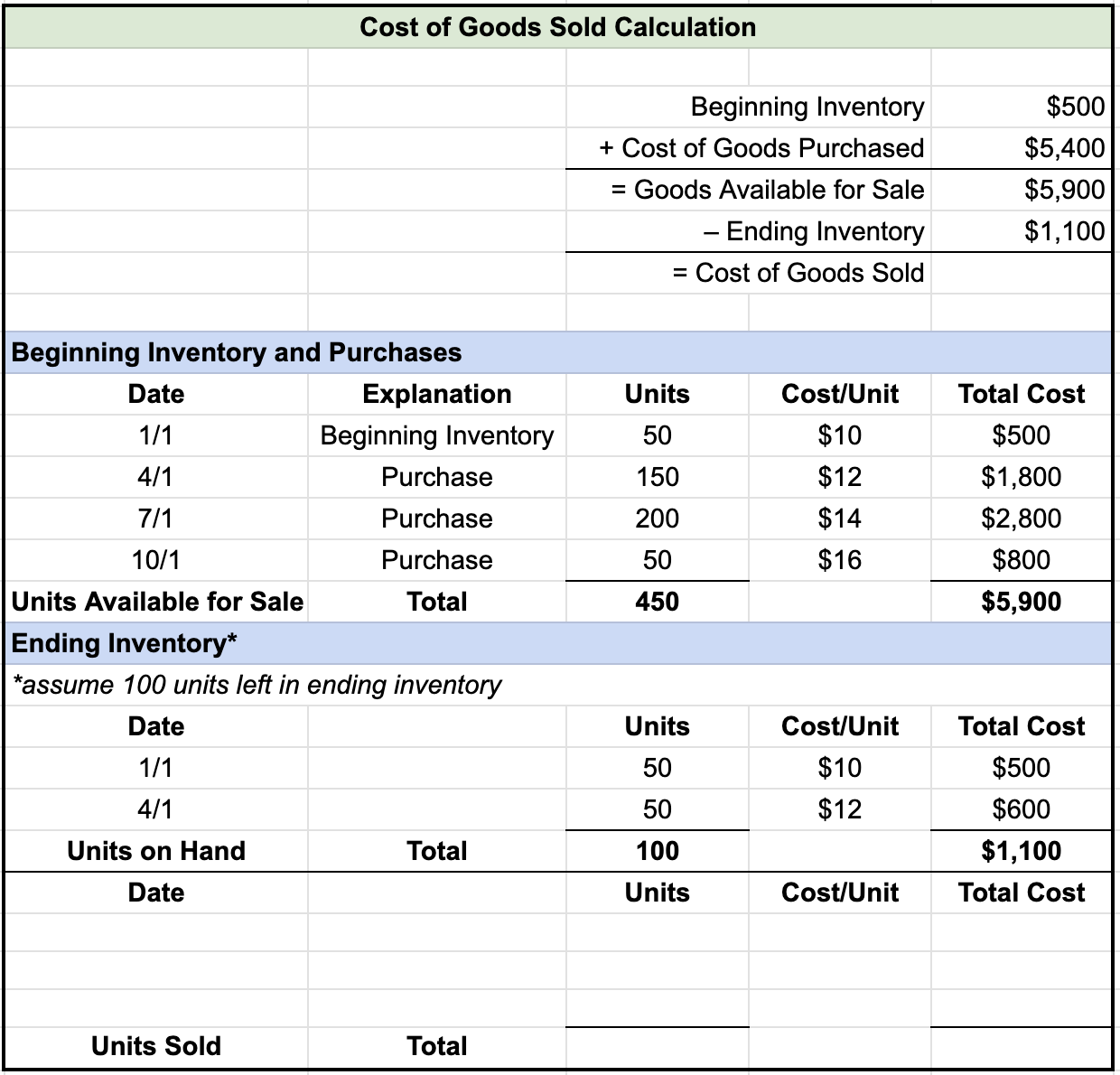

Consider the following table:

| Beginning Inventory and Purchases | |||

|---|---|---|---|

| Purchased | Units | Unit Cost | Total Cost |

| Beginning Inventory | 100 | $5 | $500 |

| September | 120 | $6 | $720 |

| October | 140 | $7 | $980 |

| November | 130 | $8 | $1,040 |

| Units Available For Sale | 490 | $3,240 | |

| Ending Inventory | |||

| Units on Hand | 290 | Cost of Units on Hand | $ |

| Units Sold | 200 | Cost of Goods Sold | $ |

Using the LIFO method and the information in this table, what is the cost of units on hand and cost of goods sold during this period?

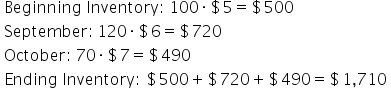

First, find the ending inventory. With LIFO, the ending inventory is going to be our oldest units. We have 290 items on hand, which means we will take all 100 units from the beginning inventory, all 120 units from September, and 70 units from October:

The ending inventory, or cost of units on hand, for these 290 items is $1,710. Now we can subtract this value from the goods available for sale to find the cost of goods sold.

The cost of goods sold using LIFO method is $1,530.

| Beginning Inventory and Purchases | |||

|---|---|---|---|

| Purchased | Units | Unit Cost | Total Cost |

| Beginning Inventory | 100 | $5 | $500 |

| September | 120 | $6 | $720 |

| October | 140 | $7 | $980 |

| November | 130 | $8 | $1,040 |

| Units Available For Sale | 490 | $3,240 | |

| Ending Inventory | |||

| Units on Hand | 290 | Cost of Units on Hand | $1,710 |

| Beginning Inventory | 100 | $5 | $500 |

| September | 120 | $6 | $720 |

| October | 70 | $7 | $490 |

| Units Sold | 200 | Cost of Goods Sold | $1,530 |

| October | 70 | $7 | $490 |

| November | 130 | $8 | $1,040 |

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.