Table of Contents |

To review, FIFO is an inventory valuation method, which stands for First In First Out:

First

In

First

Out

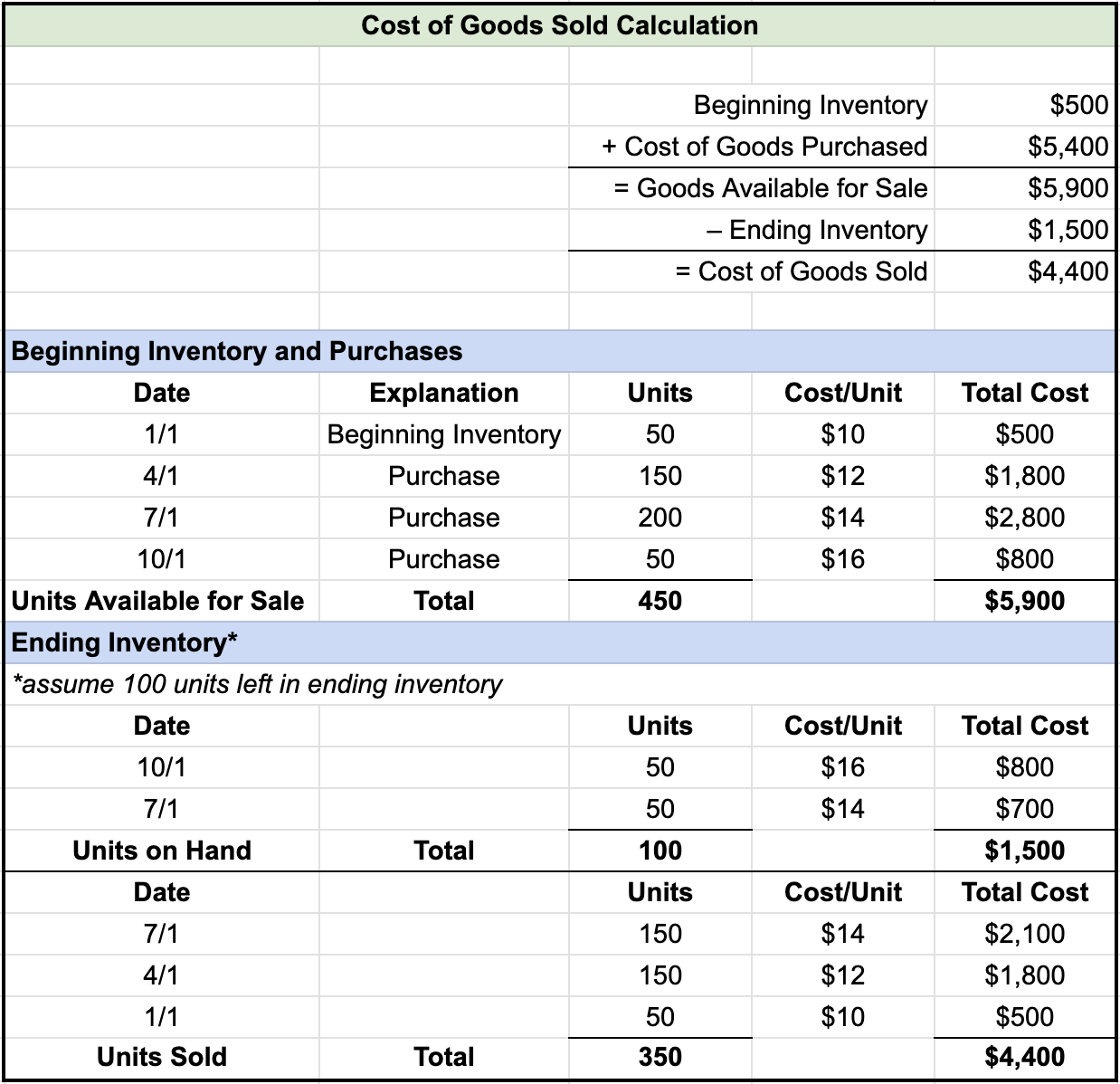

Under FIFO, goods are assumed to be sold oldest to newest. Goods that were purchased first are the first to be sold and the newest or latest goods are assumed to remain in inventory.

A benefit to using FIFO is that it resembles the physical flow of goods.

EXAMPLE

Grocery stores or electronic stores, for example, want the inventory that they purchased first--their oldest products--to be sold first. In the case of grocery stores, they want to sell the oldest merchandise first so that their food doesn't spoil.LIFO, you may recall, is an inventory valuation method, which stands for Last In First Out:

Last

In

First

Out

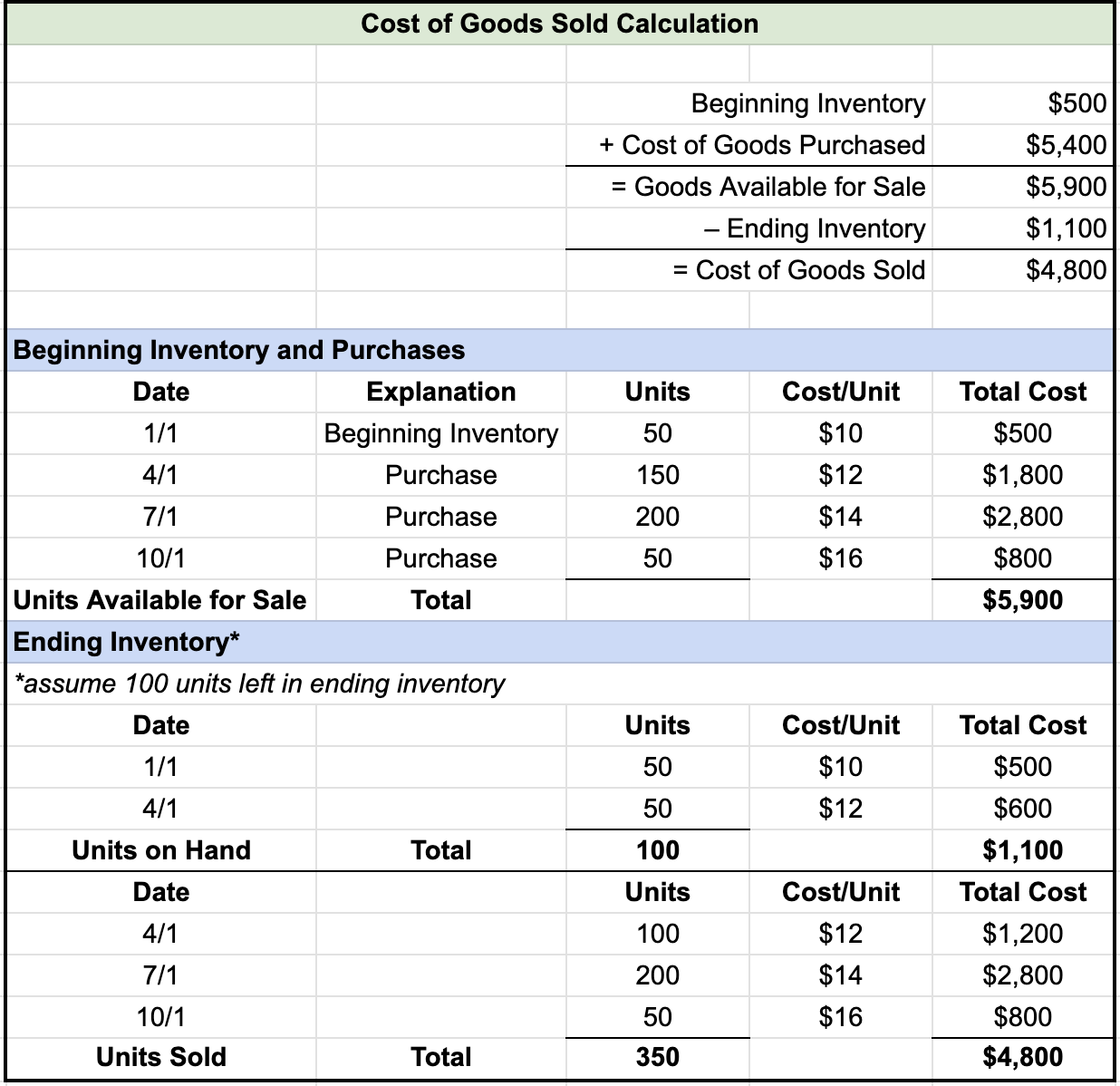

Under LIFO, goods are assumed to be sold newest to oldest, meaning goods that were purchased last or most recently are the first to be sold. The oldest goods, or goods that were purchased first, are assumed to remain in inventory.

The argument for using LIFO centers on matching current costs with current revenues. Newer purchases, which represent current costs, are recorded as cost of goods sold, and that expense is matched with current revenues. The LIFO method of inventory valuation is typically used by businesses that experience inflation in their inventory costs.

EXAMPLE

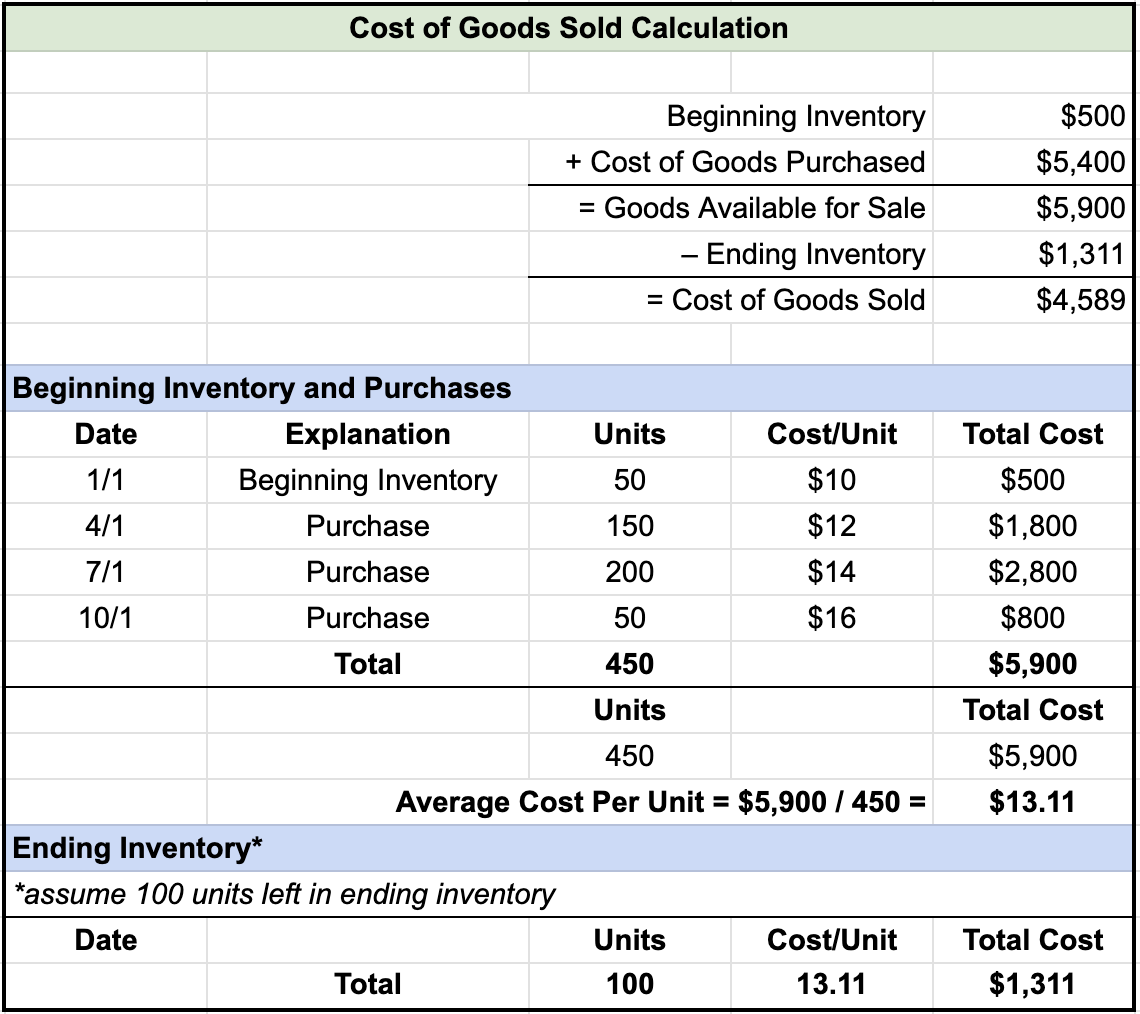

Oil and gas companies, and manufacturers whose costs are tied closely to raw materials are common examples of companies who use the LIFO method. A company that makes aluminum cans will us LIFO to better match costs with revenue as raw material prices fluctuate.The last inventory valuation method to review is the weighted average method, which is based on the average cost per unit. The weighted average method is based on total cost and total units. The total cost of inventory units available for sale is divided by the total units that are available for sale, to provide the average cost per unit.

For the weighted average method, there is no concern for the timing of inventory purchases. It doesn't matter if inventory was purchased at the beginning of the period or at the end of the period--it's all based on the average cost per unit.

The argument for using the weighted average method is that inventory is very complex and it can be difficult to determine which exact units you're selling. Are you selling the units you purchased at the beginning of the period, or are you selling the units purchased at the end of the period? As you can see, it can be difficult to monitor and measure the exact flow of your inventory.

Now let's introduce one more inventory valuation method known as specific identification method. This method is useful if your inventory is exactly known, if you have a low volume business, and if you are able to specifically identify which items are sold and which remain in inventory.

EXAMPLE

For example, suppose you have a car dealership that only has eight cars. Because you can count the eight cars, you don't need to worry about FIFO, LIFO, or the weighted average method.The specific identification method is not very common, because, as mentioned, it's only useful if you have this type of low volume business. This inventory method is usually for big-ticket items such as real estate or luxury yachts.

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.