Table of Contents |

Before we begin our discussion of the income statement, it is important to take a step back and define financial statements, which are reports providing financial information about a business at a given time.

An income statement, then, is a financial statement that provides information about the revenue, expenses, and net profit or loss of a business for a given time period. A key phrase in that definition is "a given time period."

Let's break down the net profit or loss idea. The income statement helps to identify the business's profitability, which is a key component of the purpose of the income statement:

Now let's compare the income statement to the balance sheet. Keep in mind that the balance sheet reports balances and the income statement reports activity.

| Type of Financial Statement | Reporting | Accounts Included | Decision Tool |

|---|---|---|---|

| Income Statement | Reports for a period of time; activity based | Temporary accounts; revenues and expenses | Assess past performance and predict future performance |

| Balance Sheet | Reports at a point in time | Permanent accounts; assets, liabilities, and equity | Primarily forward-looking; identify the business's position, as of a certain date, and the implications going forward |

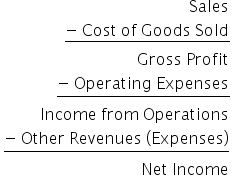

There are two types of income statement formats: single step and multi-step.

The single step income statement is called such because there is only one step. Remember the income statement formula? Revenues minus expenses equals net income. This is what the single step income statement looks like, below. You take your revenues, subtract out your expenses, and arrive at your net income.

The multi-step income statement, on the other hand, has multiple steps.

At the end of the day, the single step and multi-step income statements arrive at the same place, but the multi-step statement has several individual steps that involve calculating gross profit and separating out income from operations, as well as other revenues and expenses.

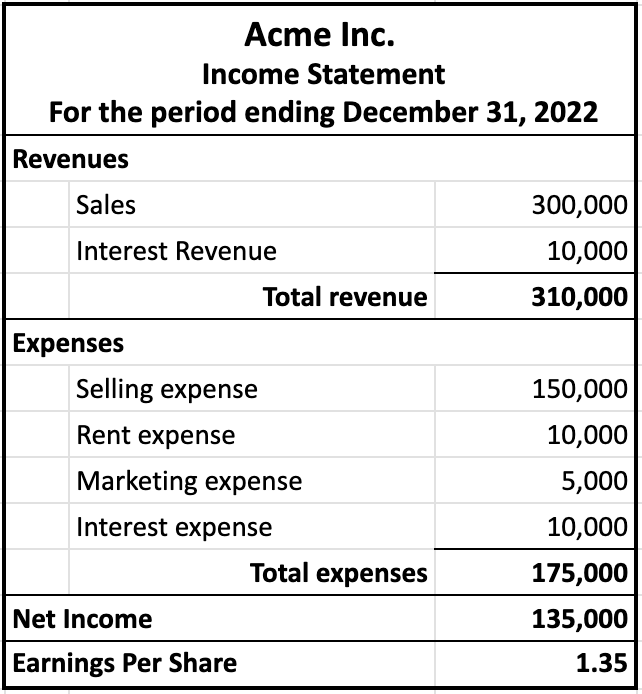

Let's look at an example of a single step income statement and break down its component parts:

| Income Statement Component | Description |

|---|---|

| Header | It is important that the header includes the words, "For period ending...", because this indicates that the income statement is reporting on activity for a given period. |

| Revenues | This section includes sales and any other revenue--in this case, interest revenue. It reflects the total revenue from the single step income statement formula. |

| Expenses | Next is a detail of all expenses. In this case, there are some selling expense, rent expense, marketing expense, and interest expense, summed to equal the total expenses. |

| Net Income | The total revenue of $310,000 minus total expenses of $175,000 equals a net income of $135,000. |

| Earnings per Share | This is the other piece of information contained on this single step income statement, calculated by taking the net income and dividing it by the number of shares that are owned and issued by the company. If this was a publicly traded company and they had shares on an exchange, you would list the earnings per share. In this case, we assumed there were 100,000 shares, so the earnings per share are $1.35 per share. |

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.