What exactly is money, and how has it developed over time? This tutorial will cover how money has developed over time, discussing the history and functions of money. Our discussion breaks down as follows:

1. How Money Has Developed

Back in the day, if you wanted something, you’d trade for it—your goods for theirs. It was simple but not always efficient. Enter the medium of exchange: a game-changing concept that made buying and selling smoother. Today, that medium is money—streamlining transactions and powering economies worldwide.

Traditionally, before people had easy mediums of exchange, they followed a practice called bartering. Bartering, or a barter system, is a direct exchange of goods and services between two people. For a barter transaction to occur, there must be a "double coincidence of wants." This means that the two individuals involved in the trade must each have something that the other desires. Commodity money was the medium of exchange between 3000 BC and 600 BC. It solved one of the barter system’s limitations, the "double coincidence of wants."

-

EXAMPLE

Flour, cowrie shells (because of their beauty & rarity), or salt were used as commodity money.

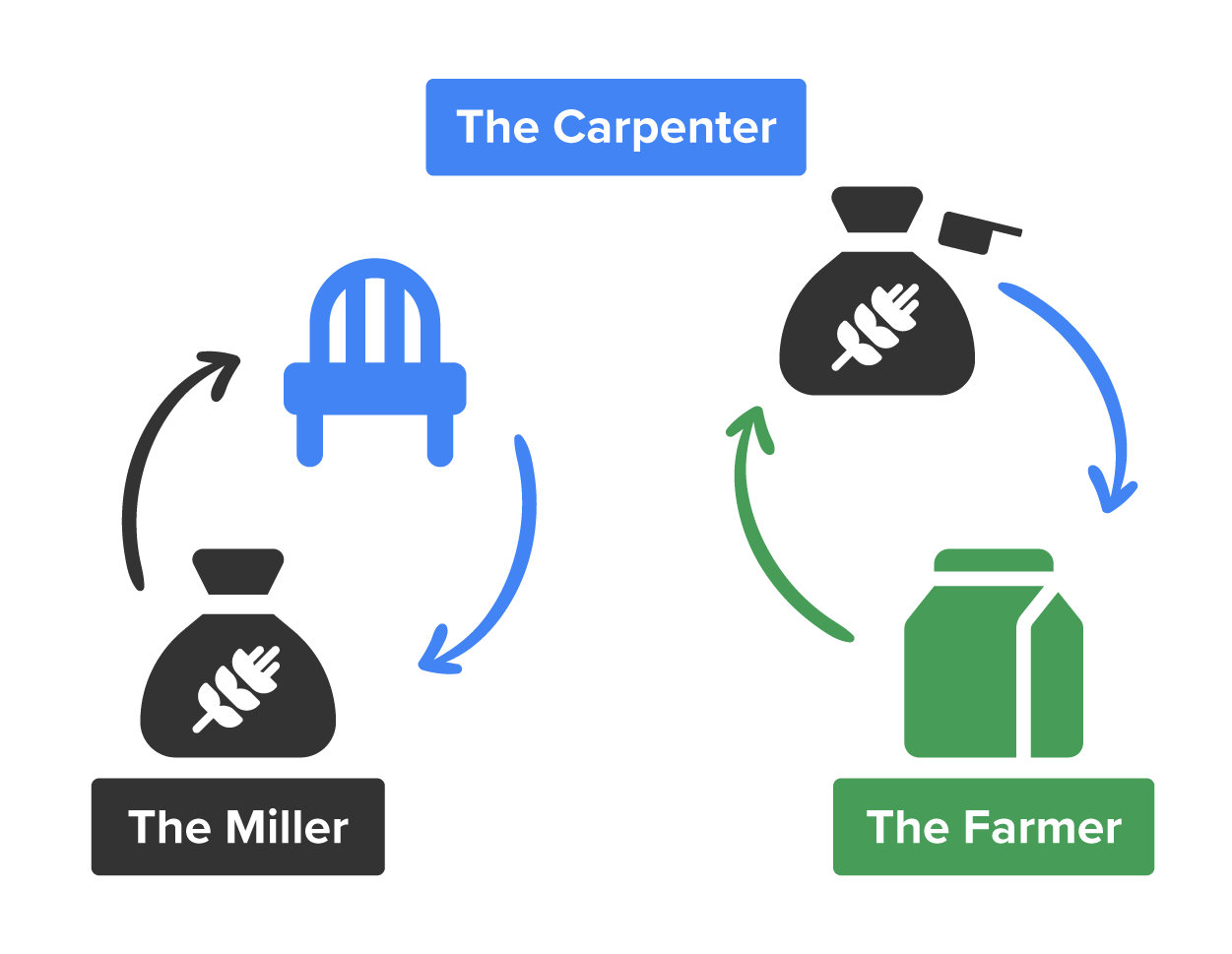

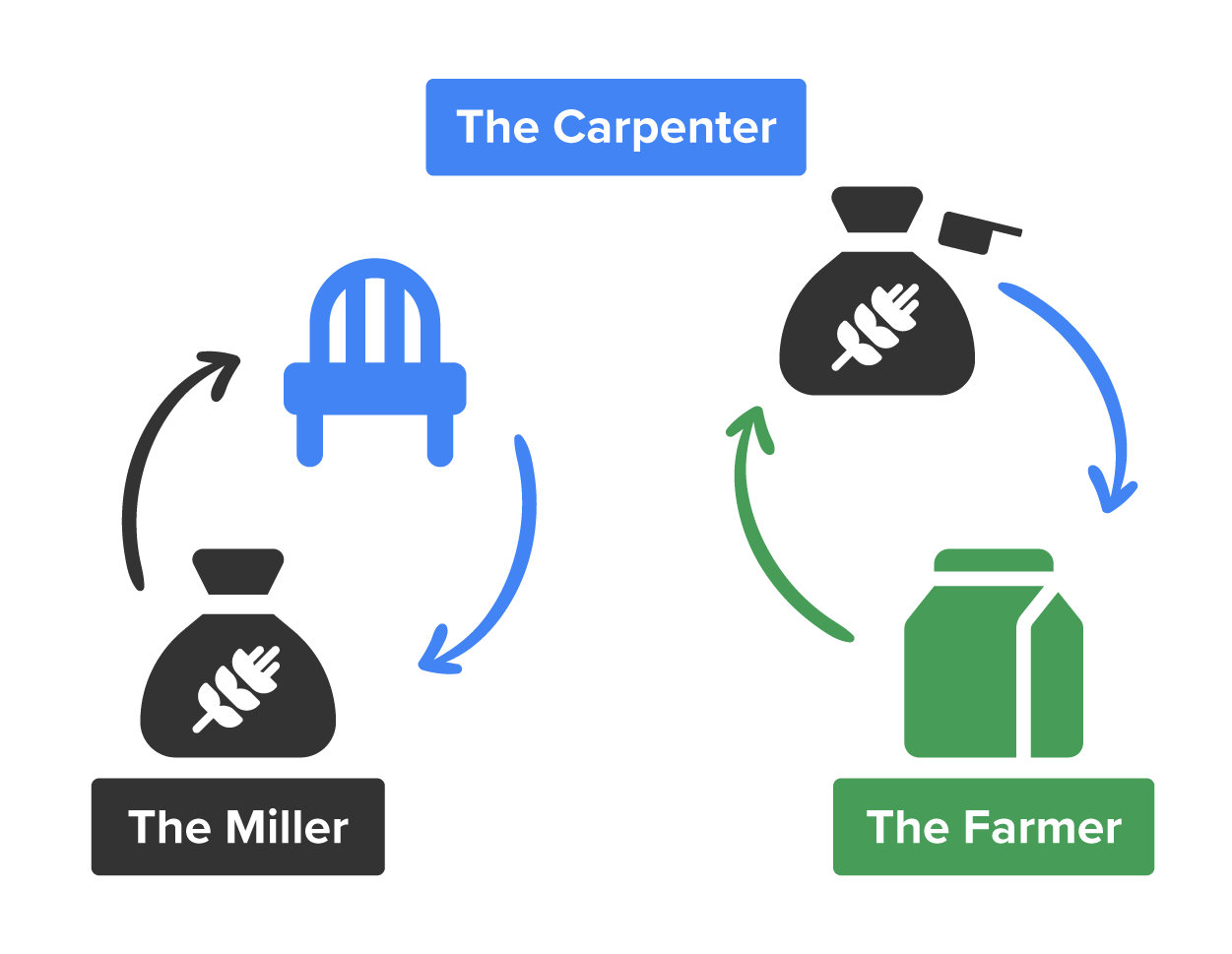

IN CONTEXT: A Chair for Milk?

Suppose a carpenter wants to purchase milk. So, he finds a dairy farmer, and they work out a deal where the carpenter will build the dairy farmer a chair and the dairy farmer gives the carpenter some milk. You can see how this is beneficial for both parties. However, there is a potential problem. Now, the dairy farmer already has a chair, so when the carpenter wants some more milk, what can the carpenter provide to trade?

This dilemma results in individuals accepting things that are considered universal—a universal medium of exchange.

EXAMPLE

Suppose the carpenter, in this case, builds a chair or another item for a miller and, in exchange, he receives a big sack of flour. Then, when he wants something from somebody else—like milk, for instance—he can simply trade cups of flour for that milk, and that serves as the medium of exchange.

The flour becomes that thing by which he can exchange “product for product/commodity money” and get the goods that he wants or needs. The flour is portable and divisible, and it can be stored for a long period of time without spoiling, so it’s also durable.

This is essentially how the whole idea of money, as we know it today, started.

Click through to summarize the evolution of money over time:

Prehistoric or BC

Type: Barter system

Key Features: Direct exchange of goods and services

Example: Grains for meat

3000 BC

Type: Commodity money

Key Features: Items with intrinsic value serve as a medium of exchange.

Example: Salt, flour, and cowrie shells

600 BC

Type: Metal coins

Key Features: Standardized state-backed

Example: Gold, silver, and Roman coins

AD to Early Modern

Type: Paper money

Key Features: Lightweight and centralized issuance

Example: Tang dynasty notes and Bank of England notes

Industrial Age

Type: Bank/credit systems

Key Features: Checks, credit cards, and fractional reserves

Example: Loan system and Mastercard

Late 20th Century

Type: Electronic money

Key Features: ATM, online banking, and mobile transfers

Example: PayPal

21st Century

Type: Cryptocurrency

Key Features: Decentralized and blockchain finance

Example: Bitcoin and Ethereum

21st Century to Present

Type: Central bank digital currencies (CBDCs) & Fintech

Key Features: State-issued digital currency

Example: Digital yuan and eNaira

July 2025 to Present

Type: Stablecoins

Key Features: Digital currency pegged to something of intrinsic value (gold, silver, or fiat money)

Example: USDC by Circle & Tether (USDT)

- Medium of Exchange

- An item that allows a simplified sale or purchase process.

- Bartering

- A direct exchange of goods between two people.

- Commodity Money

- An item with intrinsic value that is used as the accepted universal medium of exchange in a community.

2. Characteristics of Money

For something to be considered money, it must have the following four characteristics:

-

Be portable. It must be easy to carry. It wouldn’t be any good—or much fun—if you had to carry gallons of fresh milk everywhere you go, for instance, as your medium of exchange. Governments eventually began to create their own money with stamped metals and, later on, with printed paper to help with this portability issue.

-

Be divisible. It has to be divisible to serve and function as well as money. If you only wanted a loaf of bread, a $100 gold coin would not be very helpful. Or how many cups of milk equal a loaf of bread? Whatever the currency, you need to be able to divide it. You can’t simply have one big rock or stone that you trade for one thing. In the carpenter example, half a chair doesn’t work!

-

Be durable. It must be able to withstand the wear and tear of many people using it, and it needs to last. Imagine using fresh milk as your source of money. It’s only good for a day or so, so it wouldn’t be very durable and wouldn’t last for very long as a type of money.

-

Be stable. It needs to retain its value. Again, consider the milk example. If you’re losing value every moment that you’re holding it because it’s steadily going bad, it doesn’t stay stable very long.

All of these aspects must be present—even if one is missing, it doesn’t make money very practical! Now that we’ve looked at the characteristics of money, let’s look at how the worth of money is determined.

3. Money’s Worth

For money to serve its purpose, people have to agree on what it’s worth; there must be an agreed-upon value between the two parties. This is determined in part by the supply of money that exists. Money supply refers to the total amount of money available in an economy at a particular time. The more money that is in circulation, generally, the less value it has.

-

Have you ever tried to sell concert tickets when there are many available, but maybe you didn’t get the amount you’d hoped for? Think about the elements of supply and demand you learned in the lesson “Microeconomics: Zeroing In.”

This happens with money supply in countries too. Sometimes, countries will print more money, which means the money that exists is worth less since there is so much available.

-

EXAMPLE

Venezuela is an example of what happens when a country prints too much money without sufficient economic growth to support it—and ultimately making its currency worth less. Starting around 2016, the Venezuelan government began printing large amounts of money to cover budget deficits and fund public programs, especially after oil revenues—the country’s main source of income—dropped significantly.

As a result, inflation began to skyrocket. By 2018, Venezuela’s annual inflation rate had surged past 1,000,000%! Because of this excessive printing, the Venezuelan economy experienced dollarization. This is a situation where a more stable foreign currency replaces the local currency of a nation as the medium of exchange; typically, the United States dollar (USD) is used.

The value of money is determined by several factors, which include supply and demand, which we addressed previously, and the confidence of a government or economy. If consumers think a country’s economy isn’t stable, it is likely its currency will lose value.

- Money Supply

- The total amount of money available in an economy at a particular time.

4. Types of Money Supply

Generally speaking, there are two different types of money supply in the economy that are evaluated to assess a country’s economic health:

-

M1 money supply: This is money that is either physical or immediately accessible through an account, such as a checking account. This can also include cash, checks, or any demand deposit. It is considered to be the money that is the most spendable right now—the funds that you can get your hands on the fastest.

-

M2 money supply: This is all the money that is in M1 plus funds or investments that are easily converted into cash, such as a savings account or money market fund. This includes monies that are convertible into CDs or certificates of deposit, money market accounts, and savings accounts.

Let’s look at how the two types of money supply might occur:

IN CONTEXT: Types of Money Supply

Imagine a small economy with just three people:

- Tasha has $100 in cash.

- Maya has a $500 checking account balance.

- Mohammad has a savings account with $1,000.

-

BIZV13: How Much Money Is Out There?

Why do you think money impacts you? It is important in many ways as it directly affects the cost of living, job opportunities, and the overall health of the economy. When there is too much money in circulation, prices for everyday items like groceries, gas, and rent can rise quickly—also known as inflation, which we talked about in the very first Challenge. That means your paycheck or savings won’t go as far, and your purchasing power decreases.

On the other hand, if the money supply is too tight, businesses may slow down, leading to fewer jobs and lower wages. A stable money supply helps keep inflation in check, supports economic growth, and ensures that people can plan for their futures with more confidence. So, even if you’re not tracking it daily, the money supply quietly shapes how far your dollar stretches, whether you can afford a home, and how stable your financial life feels.

- M1 Money Supply

- The money that is either physical or immediately accessible through an account, such as a checking account.

- M2 Money Supply

- The money in M1 plus funds or investments that are easily converted into cash, such as a savings account or money market fund.

In this lesson, you first learned how money has developed over time from simple bartering to a universal system of exchange using currency. In early economies, people traded goods directly—called bartering—but this method had limitations, especially when one party no longer needed what the other offered. To solve this, people began using items that were widely accepted, like flour, which could be stored, divided, and used as a common medium of exchange. This laid the foundation for money as we know it today.

You also learned that for something to function as money or have the characteristics of money, it must be portable, divisible, durable, and stable. Governments eventually created coins and paper money to meet these criteria. The value of money is determined by both supply and demand and the public’s confidence in the economy. If too much money is printed, it leads to inflation, causing money to lose value and forcing people to abandon their national currency. Economists track two types of money supply: M1 money supply (cash and checking accounts) and M2 money supply (M1 plus savings and other easily accessible funds). The money supply matters to individuals because it affects the cost of living, employment, and economic stability. Too much money can lead to rising prices, while too little can slow the economy. Ultimately, a stable money supply helps people maintain their purchasing power and plan for a secure financial future.

Have you ever tried to sell concert tickets when there are many available, but maybe you didn’t get the amount you’d hoped for? Think about the elements of supply and demand you learned in the lesson “Microeconomics: Zeroing In.”

Have you ever tried to sell concert tickets when there are many available, but maybe you didn’t get the amount you’d hoped for? Think about the elements of supply and demand you learned in the lesson “Microeconomics: Zeroing In.”

Venezuela is an example of what happens when a country prints too much money without sufficient economic growth to support it—and ultimately making its currency worth less. Starting around 2016, the Venezuelan government began printing large amounts of money to cover budget deficits and fund public programs, especially after oil revenues—the country’s main source of income—dropped significantly.

Venezuela is an example of what happens when a country prints too much money without sufficient economic growth to support it—and ultimately making its currency worth less. Starting around 2016, the Venezuelan government began printing large amounts of money to cover budget deficits and fund public programs, especially after oil revenues—the country’s main source of income—dropped significantly.