All individual tax returns start and end with a version of Form 1040. It is the foundation of a federal tax return.

Form 1040 has been redesigned many times the last few years. This includes redesigns of Schedules 1 through 3. These schedules are needed for more complex tax situations. The newest Form 1040, and its associated Schedules 1 through 3, are completely comprehensive. They are the catch-all forms that report all types of:

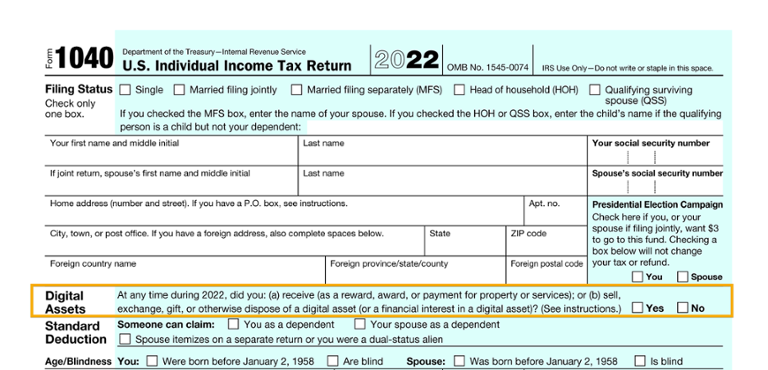

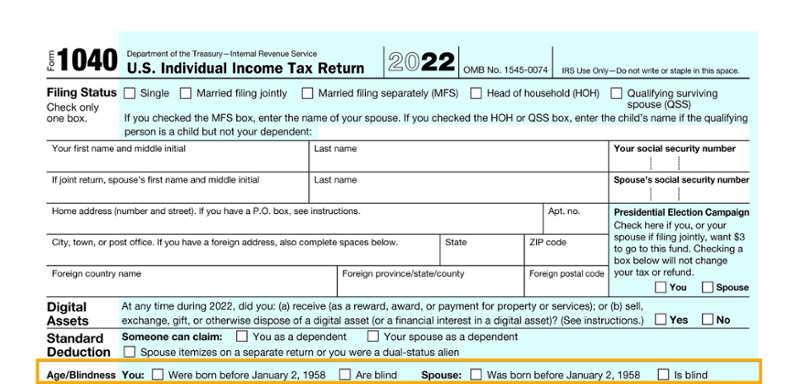

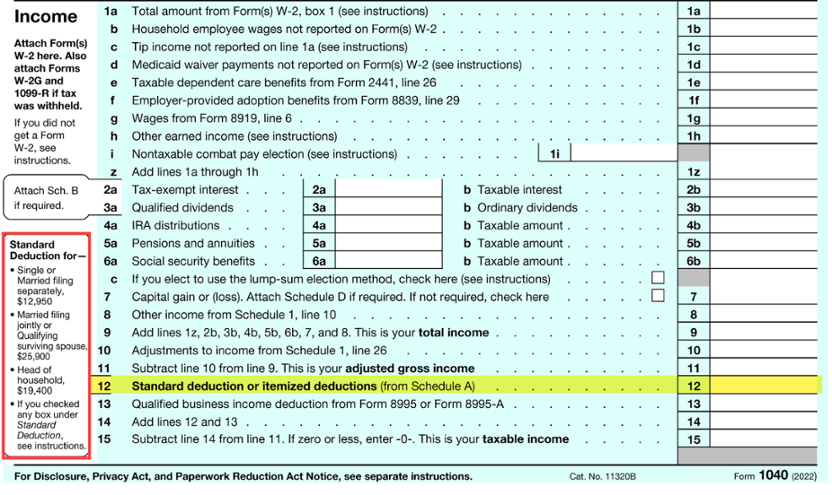

Form 1040 has two pages. We will start with page 1, as illustrated below.

The header of Form 1040 starts with the five filing statuses.

Next is the primary taxpayer's first name, middle initial, last name, and social security number and their spouse's, if married.

This is followed by the taxpayer's address, city, state, and ZIP code section. A checkbox follows for the taxpayer and/or their spouse to designate $3 to the Presidential Election Campaign Fund if they would like to do so.

IN CONTEXT: Presidential Election Campaign Fund

This fund helps pay for presidential election campaigns. The fund reduces candidates' dependence on large contributions from individuals and groups and places candidates on an equal financial footing in the general election. Currently, the fund also contributes to pediatric medical research. Taxpayers who want $3 to go to this fund will check the box. On a joint return, a spouse can also have $3 go to the fund. Checking the box will not change a taxpayer's tax due or refund as it is essentially authorizing a transfer of $3 from the General Fund of the United States Treasury to the Presidential Election Campaign Fund.

The next question states, "At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?"

A digital asset is an electronic form of money. In 2014, the IRS defined "virtual currency" as the following:

However, since that time, the IRS has switched to using the "digital asset" terminology, though they both basically mean the same thing.

From the user's perspective, a digital asset is not very different from traditional money. It can be accessed electronically and spent in an increasing variety of ways. The state of Ohio has even accepted Bitcoin for business tax payments.

If the taxpayer had any type of transaction involving a digital asset, this box must be marked Yes.

In the U.S., the Tax Code treats a digital asset as property. You will learn more about this later.

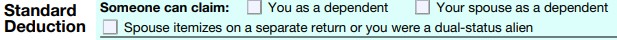

The next line is titled Standard Deduction, and there is a checkbox for taxpayers who are dependents, spouses who may be claimed as a dependent, and spouses who are filing separately and are itemizing or were dual-status aliens.

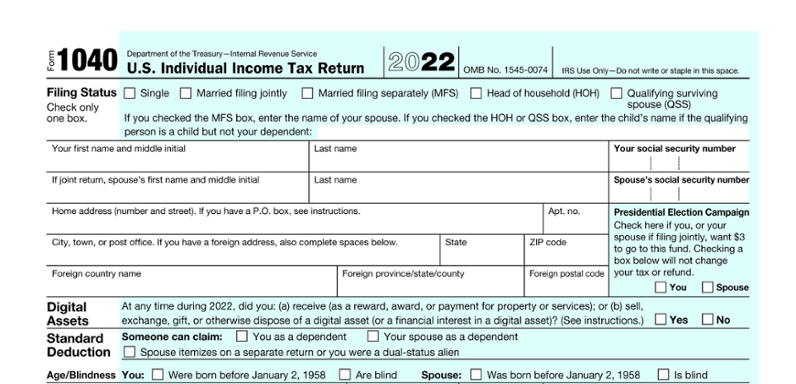

The section that follows, titled Age/Blindness, is for primary taxpayers and spouses who were born before January 2, 1958 or are blind.

Most taxpayers have social security numbers, but the IRS can issue an individual taxpayer identification number (ITIN) to taxpayers who are ineligible to get social security numbers. Generally, this applies to nonresident aliens, but can also apply to resident aliens who do not have permission to work in the U.S. Certain tax benefits cannot be claimed by taxpayers without social security numbers. An ITIN can be obtained by applying to the IRS with Form W-7, Application for IRS Individual Taxpayer Identification Number. Applying for an ITIN and its tax implications are beyond the scope of this course.

When a tax return is submitted to the IRS with a name or social security number (SSN) that does not match the information on file with the Social Security Administration (SSA), the return is rejected. This means the IRS has not accepted it, and it is considered to not be filed. This often happens, for example, when a married or divorced person fails to report a name change to the SSA. It is important that the taxpayer verifies all personal information before filing a tax return. Besides preventing difficulties in processing the tax return, the correct name and SSN help ensure that the taxpayer receives all future social security benefits to which they are entitled.

To complete the heading of a return being prepared by hand, clearly print the following (preferably in capital letters):

Married taxpayers filing jointly may list their names in either order in the heading of the return on their first joint return. The name listed first will be the primary taxpayer. Any mention of the taxpayer later in the return refers to the primary taxpayer. They must be careful, however, to list the social security numbers in the same order as their names. The order must be consistent from year to year in order to avoid confusion and delays in processing their returns.

Usually, the first social security number listed in the heading should also be used in the heading on any other form or document attached to the return. Certain forms, however, require that the social security number of the taxpayer who earned the income be used in the headings of those forms. Such forms are identified when they are discussed during the course.

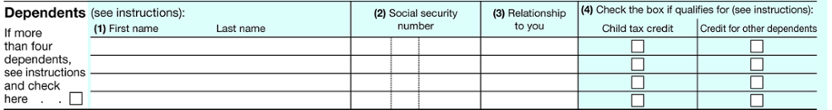

Taxpayers are required to name any dependents on their tax return. The Dependents section has space for up to four dependents, their social security numbers, their relationship to the taxpayer, and their qualification for the Child Tax Credit (CTC) and Other Dependent Credit (ODC). There is also a box to check if the taxpayer has more than four dependents.

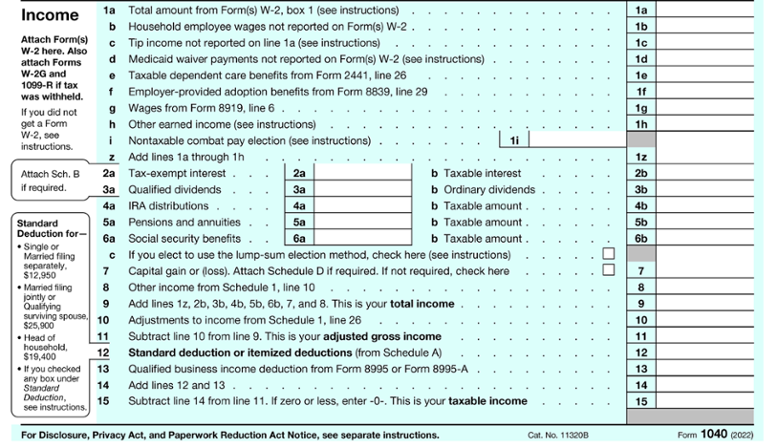

The first step in the tax computation process is to add up all items of income (many of which you will learn about later). The types of income reported on Form 1040, page 1, include the following:

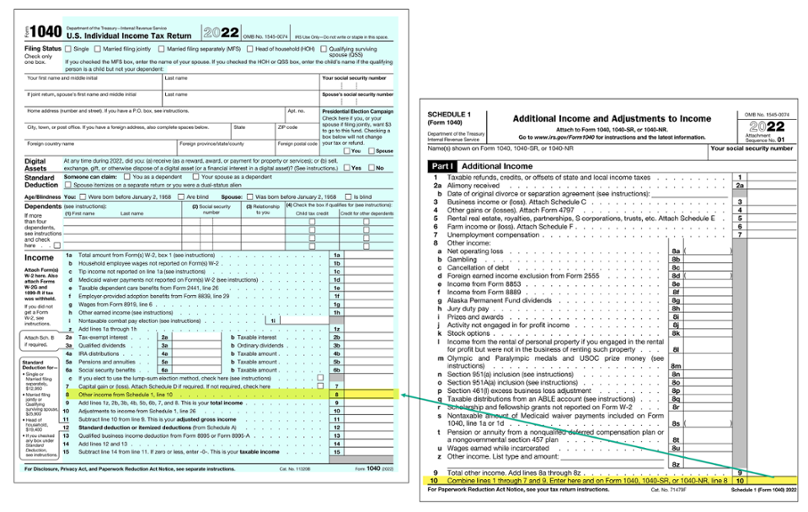

Form 1040, page 1, shows that the taxpayer's total income, line 9, is calculated by adding up subtotaled lines 1z, 2b, 3b, 4b, 5, 6, 7, and 8, which includes additional income items from Schedule 1, Part I reported on Form 1040, line 8.

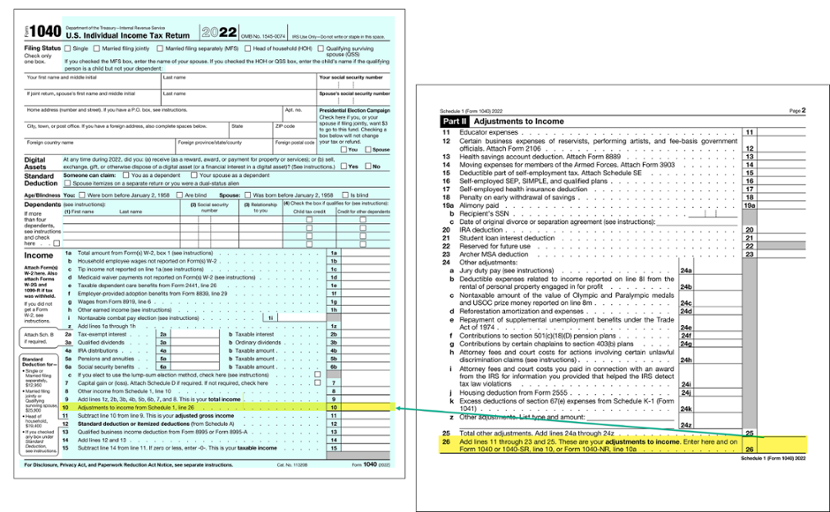

The next step after income is to add up the taxpayer's income adjustments. Income adjustments are a set of specific deductions potentially available to all taxpayers and are reported on Schedule 1 of Form 1040, Part II. Total adjustments are shown on line 26 of Schedule 1.

The taxpayer's adjusted gross income (AGI) is then computed by subtracting the adjustments from total income.

The standard deduction is a dollar amount, determined by filing status, that taxpayers subtract from their income before tax is determined. Taxpayers may choose to itemize deductions using Schedule A, which you will learn more about later, or they may use the standard deduction. The amounts for each filing status are listed in the left margin on Form 1040, page 1.

The 2022 standard deduction amounts are:

There may be additional amounts added to the standard deduction. These will be covered in the chapter “Filing Requirements.”

The taxpayer's taxable income is reported on Form 1040, page 1, line 15. Taxable income is computed by taking the taxpayer's AGI, less their allowable standard deduction per filing status or total itemized deductions, less the qualified business income (QBI) deduction (if applicable). The taxpayer's tax is calculated using their amount of taxable income.