Table of Contents |

A company’s decision about which channel is best for meeting consumer needs involves several considerations.

Target market coverage is defined as having the resources and capabilities to reach and serve consumers in a company’s target market. Companies of all sizes must determine precisely how they will reach consumers with their products and services. Smaller companies tend to focus on smaller, more local markets, while larger companies must meet the consumer demand of larger, even global markets. Companies must analyze the size of their target market and their budget and ensure they have the appropriate coverage.

EXAMPLE

A small local bakery may only target towns in its area; therefore, its target market coverage is small. Kohlberg & Company, the owner of the Sara Lee and Thomas’ brands, on the other hand, reaches global consumers and therefore requires far greater market coverage.Intensive distribution is a strategy that entails distributing a company’s market offering through all intermediaries. With intensive distribution, a consumer can find a company’s product nearly everywhere. Intensive distribution makes sense for products that compete in a competitive market where consumers can easily choose an alternative if a company’s product is not available. Coca-Cola and Kraft, for example, use intensive distribution so that consumers around the world can access their products everywhere and anywhere they would shop for food and beverages.

Selective distribution is a strategy that includes choosing more than one, but fewer than all intermediaries to distribute a company’s market offering. Companies choose selective distribution when they do not need the expansive coverage that intensive distribution provides but still need to reach their target market at specific retail outlets. Large appliance companies, such as Whirlpool and General Electric, use selective distribution by making their products available through their dealer networks and at selective large retailers like Lowe’s and Home Depot.

Exclusive distribution is a strategy that involves allowing a limited number of intermediaries to distribute a company’s market offering. The luxury brand Rolex, for example, allows a limited number of retailers to sell its luxury watches. The exclusivity of these retailers reinforces Rolex’s distinctive position of being a luxurious, hard-to-get brand.

In addition to determining target market coverage, companies must also consider a channel’s ability to fulfill the requirements of buyers. Consumers have specific product and service expectations that must be fulfilled to satisfy their wants and needs.

EXAMPLE

When consumers purchase bottled water, they expect the bottle to be filled to the top, the cap to be sealed before opening, and the water to taste fresh and clean. With these buyer requirements in mind, companies that make bottled water must ensure that they work with channel members who are able to fulfill these buyer requirements because these requirements are critical to the perception of consumer value.Information: Companies who recognize buyers need information to decide between competing products may work with channel members who can provide these services. Consumers with limited knowledge of a product, for example, may be more likely to purchase that product after an in-store demonstration, for example. Grocery retailers like Whole Foods will often host in-store demonstrations of new food products for shoppers to sample. Providing this service makes Whole Foods a desirable channel partner for start-up food brands looking to break into a highly competitive market. In another example, Ace Hardware may be a perfect channel partner for a new brand of tools because of Ace Hardware’s reputation for being “the helpful place.” Working with a channel member who can provide the service of in-store demonstrations creates value for the consumer and thus is a factor in determining channel choice.

Convenience: In some cases, buyers demand convenience and will only purchase products and services close to where they live, work, or shop. Companies must consider whether their target customers value convenience.

EXAMPLE

Buyers shopping for chewing gum value convenience much more than buyers shopping for skis. Companies whose buyers require convenience should choose retail outlets that are convenient and hassle-free.Variety: Companies must also consider how their target market values variety. Imagine walking into a pet supply store and only seeing one type of pet food. Buyers want to choose from a variety of competing products. Petco and PetSmart recognize that consumers appreciate variety in everything from pet food to pet supplies such as toys, leashes, and bedding. For companies who compete in a crowded market where buyers have many options, selecting outlets that offer a variety of similar and competing products makes the most sense.

Pre-Sale or Post-Sale Service: Pre-sale service entails all the activities that help a buyer make a purchase decision, while post-sale service entails all the activities that help a buyer recognize the value of the product.

IN CONTEXT

A pre-sale service can be observed at a car dealership where shoppers are invited to test-drive a vehicle and apply for financing. Post-sale service in this same example would be the offering of vehicle services, such as free oil changes and tire rotations for the life of the vehicle.

For some companies, the service that is provided before and after the sale is critical to customer-perceived value. Customer-perceived value is the overall perception that a consumer has about a company, brand, or product and is measured by what the consumer is willing to pay in return for the features and benefits in the market offering. Companies that sell large appliances and furniture, for example, understand that consumers value haul-away services. For example, for an additional fee, Lowe’s offers customers the option of having their old appliance hauled away and their new appliance installed. These complementary services are important because they add value to the customer’s product experience.

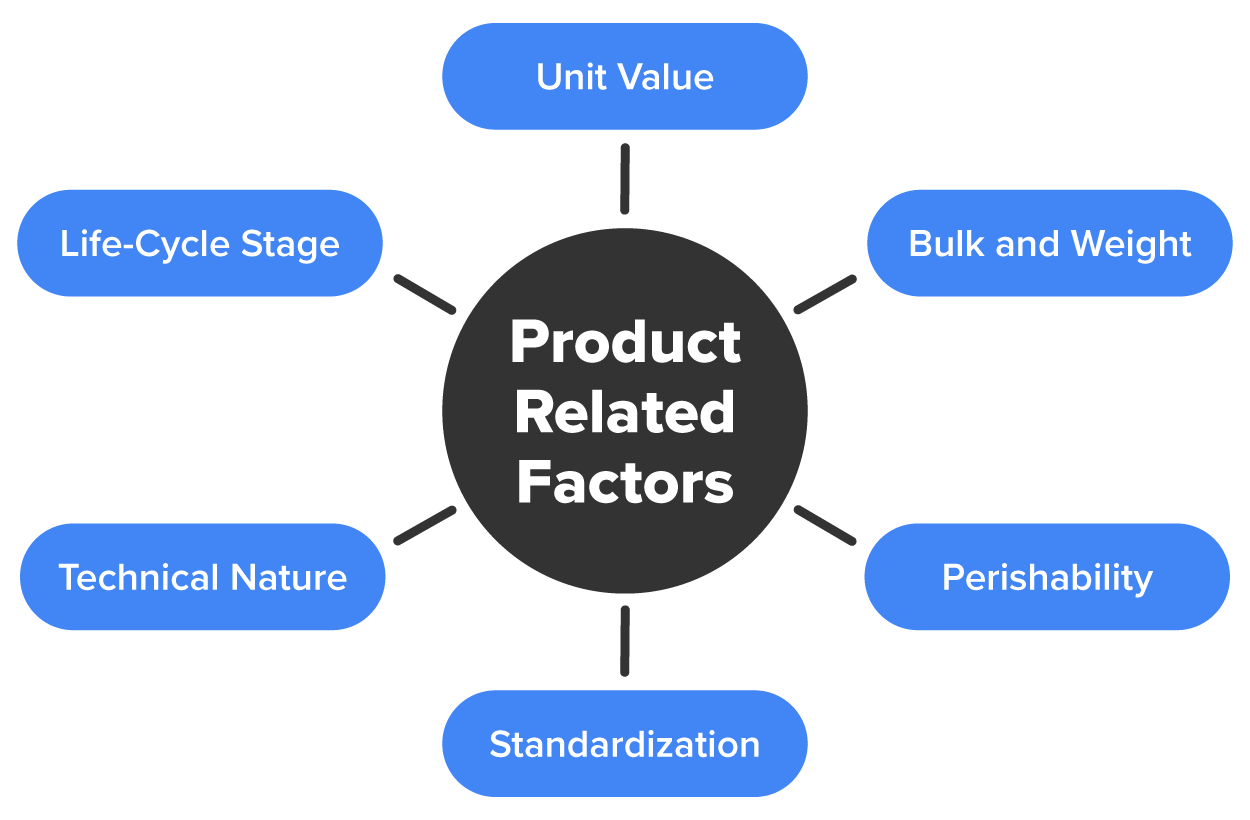

In addition to target market coverage and requirements of the buyer, there are product-related factors that can influence channel decisions. Product-related factors include things like unit value, perishability, and the bulk and weight of a product. These factors can influence the distribution decisions that companies make.

Unit Value: A product’s unit value, or the price that a company charges for one unit or item, can influence channel length decisions. Channel length relates to the number of intermediaries in the marketing channel. For example, products with high unit values, such as cars, boats, and airplanes, will have a much shorter distribution channel than nonperishable products, such as crackers, bandages, and tissues, which have a low unit value. Because of the complexities and costs of moving heavy or awkward products, companies seek a shorter distribution channel to mitigate these factors. There are companies that specialize in moving more expensive and complex products.

Perishability: Perishability relates to the likelihood that a product will spoil, decay, or expire if not used in a timely manner. A product’s perishability also influences channel decisions. For example, orange-juice maker Tropicana’s marketing channel looks much different than Nabisco’s Ritz Crackers’ channel. Because orange juice must be kept cold throughout the distribution process, Tropicana makes channel decisions that allow it to protect the integrity of the product throughout the distribution process.

IN CONTEXT

Working with channel partners who are experts at storing, handling, and moving perishable products is one of the biggest key factors for companies that manufacture perishable products. Alongside unit value, perishability can also influence channel length. Companies marketing perishable goods such as milk, cheese, and meat products require a shorter distribution channel because these products have a limited shelf life.

Bulk and Weight: Much like a product’s unit value, the bulk and weight of a product influence channel length. The bulk and weight of a product is the density and heaviness of one unit of product. Companies that sell larger and heavier items are more likely to use a direct or short distribution channel to avoid issues that arise when too many intermediaries handle a product. For example, because hot tubs or personal spas are bulky and heavy, they are more prone to product damage during distribution. Furthermore, there are typically fewer intermediaries between the manufacturer and customer to mitigate the excessive costs of distributing hot tubs.

Standardization: The standardization of a product also impacts channel decisions. Products that are standardized have no differences in how they are manufactured. Standardized products are uniform and consistent. Agricultural products, such as grain and corn, are standardized. Consumers are unable to tell the difference between these products because of their standardization. Standardized products have a longer channel length than customized products. Customized products are adapted depending on the customer’s needs. They typically require a shorter distribution channel. Companies must consider the impact of standardization before making channel decisions.

Technical Nature of a Product: Products sold in the tech space are typically more complex and often require an onboarding process.

EXAMPLE

The customer-relationship management firm Salesforce offers companies a cloud-based application that allows them to manage millions of contacts or people as they move along the sales cycle from lead to prospect to customer. Products with a technical component often have a short channel length, meaning there is no intermediary between the company and the business consumer. They are distributed directly to business consumers (or B2B) because of the onboarding, implementation, training, support, and maintenance aspects of the product. Companies that use Salesforce have access to a customer relationship management expert who ensures that the program is being used and managed effectively for the customer to get the most out of the product.Product Life Cycle Stage: A product’s life cycle stage may also impact channel decisions. Product life cycle refers to the various stages that a product goes through from its introduction phase to its growth and maturity phase, and in some cases to its decline phase.

IN CONTEXT

During the introduction phase of a product’s life cycle, where profits and consumer knowledge of a product are low, companies may make more conservative channel decisions. As the product enters the growth stage, companies may expand distribution to meet consumer demand. As the product enters the maturity stage and the decline state, a company must ensure that its distribution strategy aligns with its changing consumer demand.

The profitability of a channel can also influence channel decisions. Profitability relates to the amount of money that stands to be gained after a company pays its expenses. A straightforward way to calculate profitability is to subtract these expenses from the revenue generated. Companies must evaluate not just the revenue generated by working with channel partners but also the channel member’s ability to operate profitably. Channels that are not able to manage distribution costs effectively are less attractive for companies seeking to earn a profit. Companies have an obligation to be profitable, and choosing channel partners that help them achieve their overarching goals is more desirable than those that cannot.

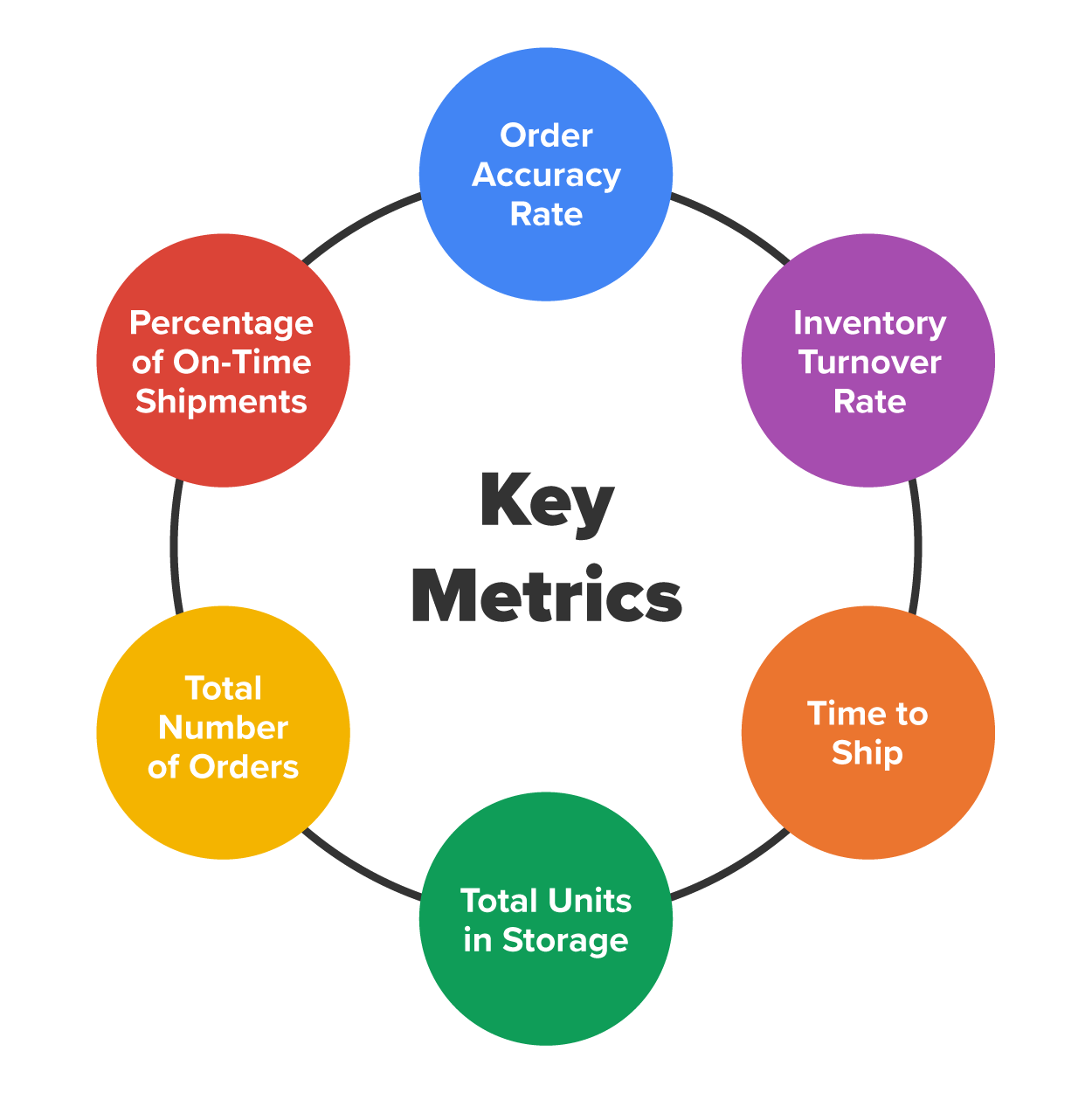

To evaluate channel performance, companies use key metrics including inventory turnover rate, total number of orders, order accuracy rate, time to ship, total units in storage, and percentage of on-time shipments. By monitoring these metrics, companies can assess their performance and adjust as needed.

Inventory turnover rate is a metric that measures how quickly inventory is turned over or sold.

EXAMPLE

Trader Joe’s faced a dilemma with the COVID-19 pandemic as consumers stocked up on nonperishable goods like pasta and rice. As consumer demand increased, Trader Joe’s supply warehouses were virtually empty as they waited for new inventory to come in. When metrics fall outside what a company considers normal or acceptable, it can adjust, such as introducing new products to fill demand as in the case of Trader Joe’s.Order accuracy rate is an important e-commerce metric. It measures the percentage of orders that are processed, fulfilled, and shipped to consumers without any errors. If you’ve purchased a pair of sneakers and the wrong size arrives at your home, this constitutes order inaccuracy. These errors can be costly to companies, who then need to process, fulfill, and send another order.

Time to ship, also known as order cycle time, is the length of time from when a customer places an order to when it reaches them. Amazon has redefined consumer expectations related to shipping. With elevated expectations that purchased items will arrive quickly, online shoppers say that delivery time influences their purchase decision.

Total units in storage is a metric used to evaluate warehouse efficiency. This is a real-time metric that changes as items are sold and leave the warehouse and new inventory moves in. This metric also provides insight into warehousing and inventory costs as well as the number of SKUs, or stock-keeping units, a warehouse is managing at any given time. SKUs are unique numbers assigned to every single product in a warehouse.

The total number of orders is an important metric. The total number of orders is the sum of all orders that a company received in a given time period. It provides insight into consumer demand and helps manufacturers to plan accordingly.

IN CONTEXT

For seasonal products like winter coats and pumpkin-flavored cookies, the total number of orders may fluctuate throughout the year. Evaluating the total number of orders over time helps manufacturers watch for fluctuations and plan accordingly.

Percentage of on-time shipments is a metric used to evaluate how well a channel member meets its promise of delivering goods on time. This metric is especially important to industries that market perishable goods like meat and dairy. Imagine if the Greek yogurt manufacturer Chobani worked with an intermediary that only met its delivery date 50 percent of the time. This would directly impact the shelf life of the product at the retail level and cost everyone in the channel money.

Alongside time to ship, measuring average delivery days looks at the average number of days it takes shipping carriers to deliver purchased goods to consumers. This is important to consumers who value the timely delivery of products purchased online. Manufacturers may choose to work with a company like Amazon because of its core competency of fulfilling and delivering products to consumers quickly.

Source: THIS TUTORIAL HAS BEEN ADAPTED FROM OPEN STAX’S PRINCIPLES OF MARKETING COURSE. ACCESS FOR FREE AT https://openstax.org/details/books/principles-marketing. LICENSE: CREATIVE COMMONS ATTRIBUTION 4.0 INTERNATIONAL.