To discourage taxpayers from withdrawing funds from their retirement accounts before they reach retirement age, the Tax Code imposes an additional 10% early withdrawal penalty tax on the taxable portions of most early distributions from qualified retirement plans, annuities, and IRAs. An early distribution is one made before the taxpayer has reached age 59½.

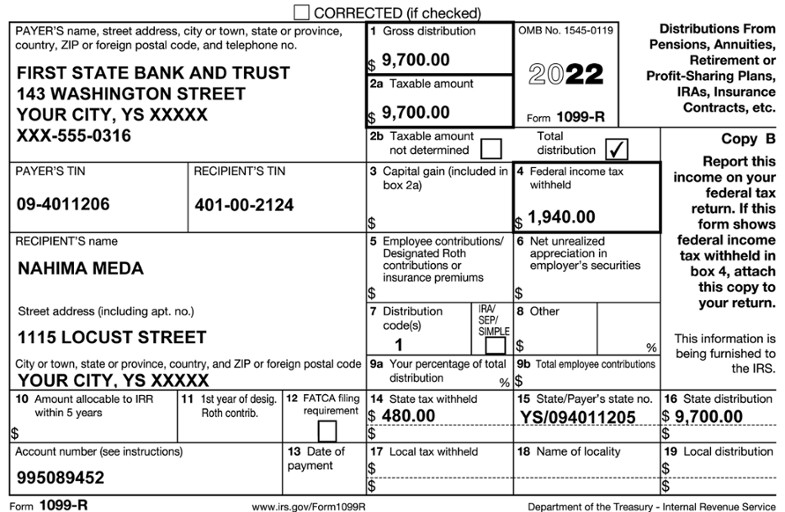

Taxpayers who roll the funds into another qualified account or IRA are not subject to the penalty. There are other exceptions as well, discussed later in this section. However, if no known exception applies, an early distribution is generally denoted by code 1 in box 7 of the taxpayer’s Form 1099-R. The amount withdrawn is also included in the taxpayer’s gross income and reported on Form 1040 or Form 1040-SR.

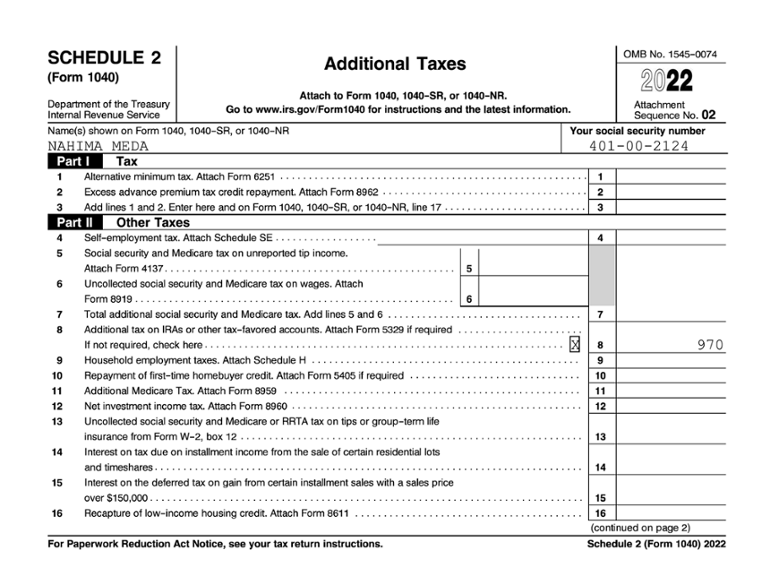

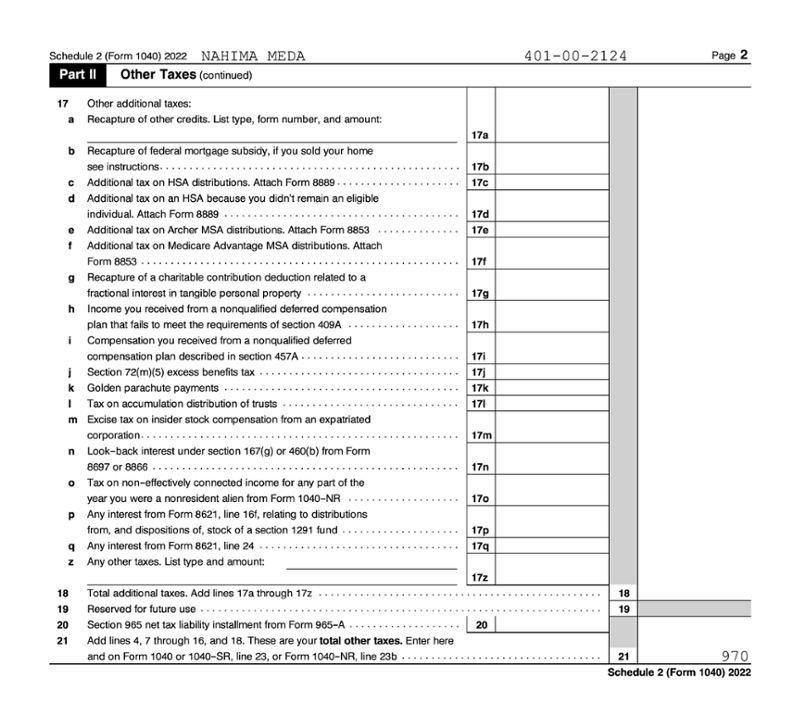

Most taxpayers who only owe the additional 10% tax on early distributions will report the additional tax directly on Schedule 2, Additional Taxes, line 8. However, some taxpayers are required to compute and report the additional tax in Part 1 of Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. Form 5329 is also used to report exceptions to the additional tax. We’ll cover exceptions next.

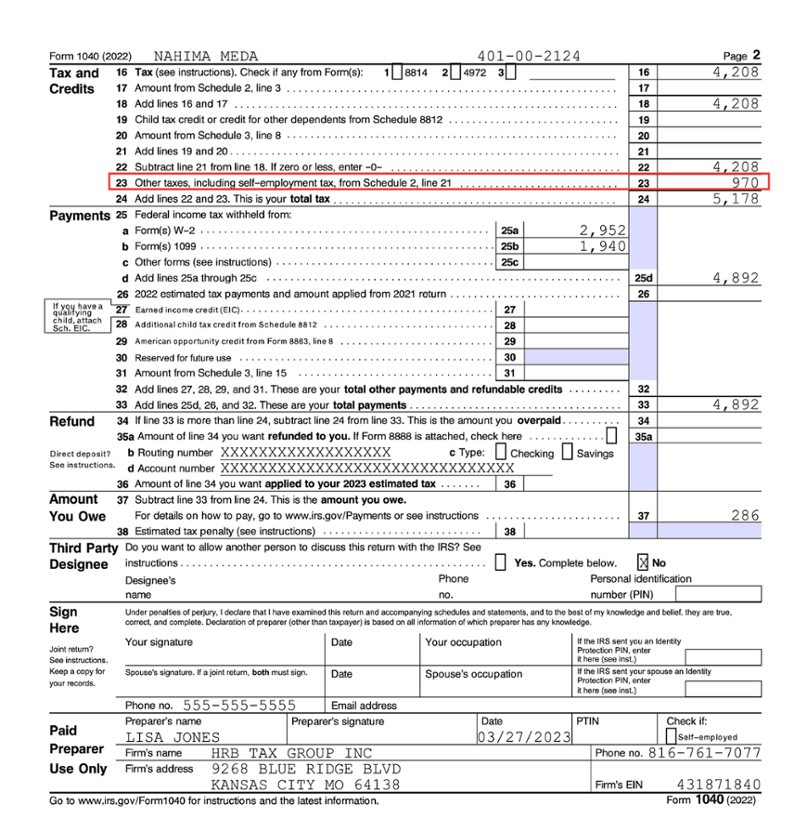

EXAMPLE

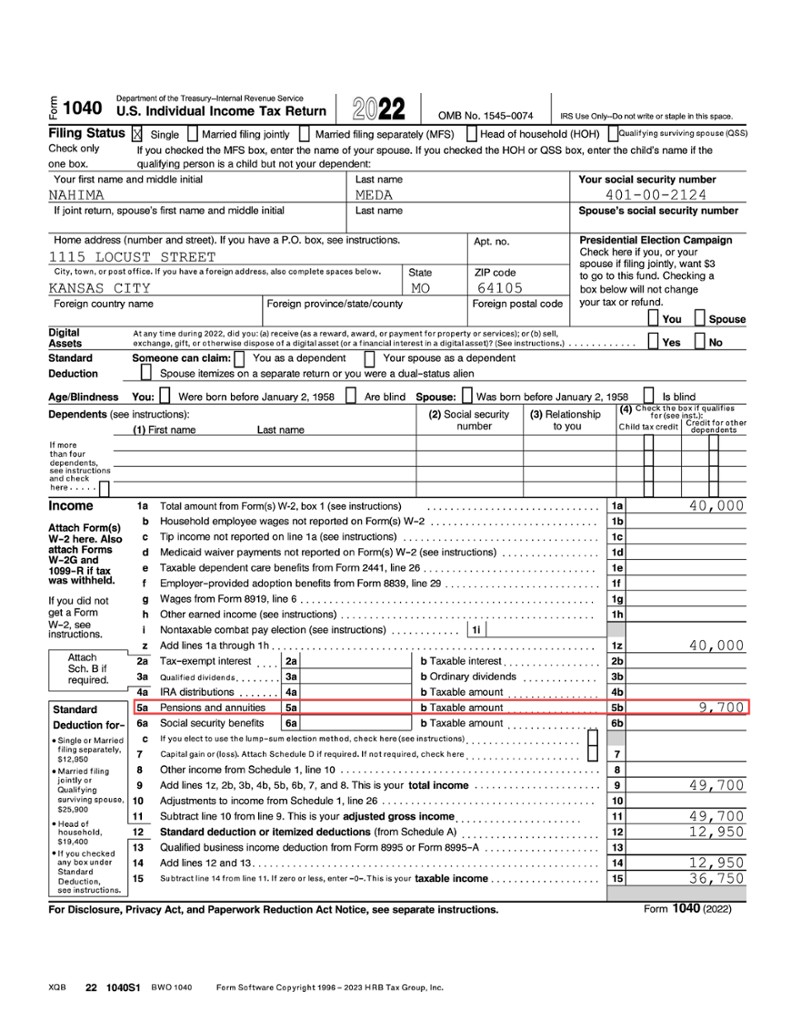

On June 4, 2022, Nahima (33) left her job. She decided to take a total distribution from her §401(k) plan to pay off some bills. Her Form 1099-R shows a fully taxable distribution of $9,700. Since Nahima did not roll any of the funds into another qualified plan or IRA, she must include the $9,700 in her gross income. She is also subject to a 10% early distribution penalty tax since she is under age 59½.

A taxpayer may qualify for an exception to the additional tax on early distributions.

Some exceptions are specific to what types of retirement accounts the exceptions can be used for. In addition to the Form 5329 instructions, for those exceptions available for IRAs, more detailed information is provided in IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs). Many exceptions are covered in IRS Publication 575, Pension and Annuity Income.

The additional tax on early distributions will not apply in the following cases.

Exception 01

The distribution was made to an employee who separated from service during or after the year in which they reached age 55 (age 50 for qualified public safety employees).

Note: This exception does not apply to IRAs.

Age 55: Observe the wording of this exception carefully. The recipient must have separated from the service of their employer before receiving the distribution. They need not have actually reached their 55th birthday prior to the separation, as long as they do so by the end of the year.

Exception 02

The distribution is part of a series of substantially equal periodic payments, made at least annually for the life of the participant (or joint lives of the participant and beneficiary) or the life expectancy of the participant (or the joint life expectancies of the participant and beneficiary).

Note: This exception applies to employer plans, but only if the taxpayer no longer works for that employer.

Exception 03

The distribution was made due to permanent and total disability.

Exception 04

The distribution was due to death.

Exception 05

The distribution was made in a year that (and to the extent that) the taxpayer’s unreimbursed medical expenses exceed 7.5% of adjusted gross income (whether the taxpayer itemizes or not).

Medical expenses: This exception does not require that the money from the distribution itself be used to pay the medical expenses—simply that the taxpayer’s medical expenses for the year exceed 7.5% of AGI, even if the taxpayer doesn’t itemize. This exception may apply to all or part of the distribution.

EXAMPLE

Alan Trimble is 40 years old with an AGI of $40,000, which includes a $5,000 early IRA distribution. During the year, he had unreimbursed medical expenses totaling $4,800. The amount of medical expenses that exceed 7.5% of his AGI is $1,800 [$4,800 medical expenses – ($40,000 AGI × 7.5% = $3,000)].Exception 06

The distribution was made to an alternate payee under a qualified domestic relations order (QDRO). This may be specified under a separation agreement or divorce decree.

Note: This exception does not apply to IRAs.

Exception 07

The distribution was made from an IRA in a year (and to the extent that) an unemployed taxpayer paid health insurance premiums.

Note: This exception only applies to IRAs.

Health insurance premiums paid by unemployed taxpayers: To qualify for this exception, the distribution must be made to a taxpayer who has received unemployment compensation payments for 12 consecutive weeks. This exception does not apply to any distribution made more than 60 days after the taxpayer has returned to work.

Exception 08

The distribution was made from an IRA to pay qualified higher education expenses.

Note: This exception only applies to IRAs.

Qualified higher education expenses, for the purpose of this exception, has the same meaning as for the education credits, plus room and board if the student is enrolled on at least a half-time basis. The expenses must be paid for the taxpayer, the spouse, or the child or grandchild of the taxpayer or spouse. The child or grandchild need not be the taxpayer’s dependent. Roth IRA distributions used for education expenses are not subject to a penalty tax, but they are NOT qualifying distributions.

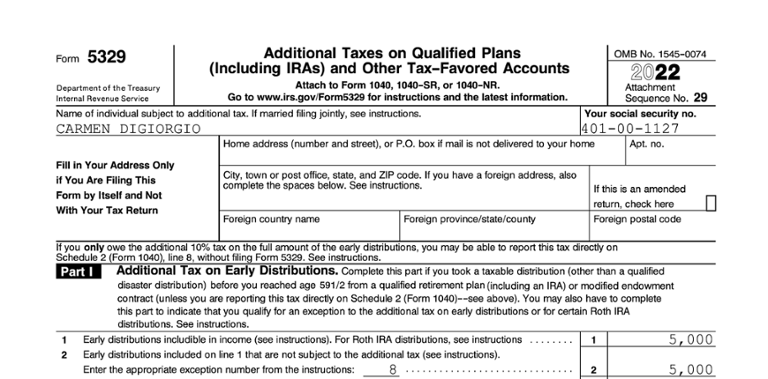

EXAMPLE

In 2022, Carmen DiGiorgio (43) took $5,000 from his traditional IRA to pay his son’s college tuition. The distribution is fully taxable but not subject to the 10% additional tax. Code 8 would be entered on line 2 of his Form 5329. Carmen’s Form 5329 is shown below.

Exception 09

The distribution (up to a lifetime limit of $10,000) was made from an IRA to pay for a first home.

Note: This exception only applies to IRAs.

Qualified first-time homebuying expenses, for the purpose of this exception, are any costs of acquiring, constructing, or rebuilding a principal residence for a first-time homebuyer. The term “first-time homebuyer” is misleading; what it really means is someone who has not owned a home during the two-year period prior to the date of acquisition of the home to which this exception applies (up to $10,000).

The distribution must be used to pay qualified expenses within 120 days after the date of distribution. The expenses must be paid for the taxpayer, their spouse, their child or their grandchild, or parent or grandparent.

Five-year period: A Roth IRA distribution (up to $10,000) used to pay first-time homebuying expenses meets the penalty exception and is not subject to taxation if it was made after the end of the five-year period beginning January 1 of the year for which the first contribution was made. So, if you first contributed to a Roth IRA in 2017, you could take a qualified distribution of up to $10,000 to buy your first home any time after 2021 and pay no tax or penalty.

Exception 10

The distribution was made due to an IRS levy.

Exception 11

The distribution was made to a reservist while serving on active duty for at least 180 days.

Exception 12

Other. For other exceptions, refer to the instructions for Form 5329. Also, use this code if more than one exception applies. For additional exceptions applicable to annuities, see IRS Publication 575 or the instructions for Form 5329.

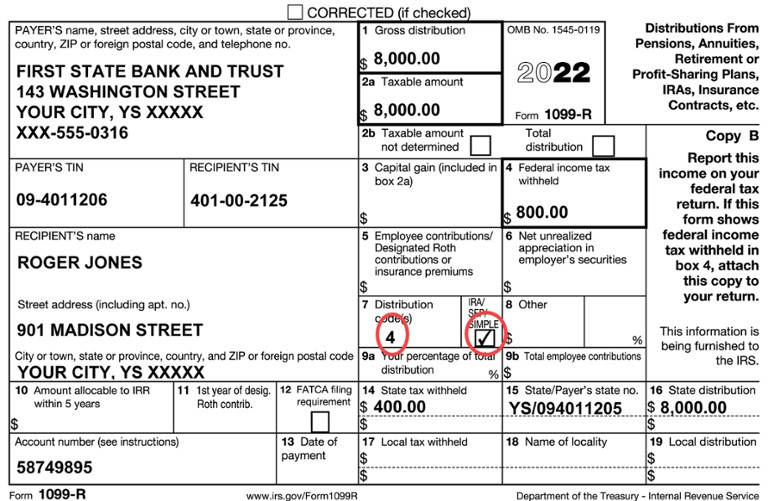

If a taxpayer takes an early distribution, and the payer is aware that an exception applies, then code “2,” “3,” or “4” should be entered in box 7 of the taxpayer’s Form 1099-R.

EXAMPLE

Roger Jones (49) is the beneficiary of his deceased grandmother’s traditional IRA. Roger took an $8,000 distribution from the IRA. Even though he is under age 59½, he qualifies for an exception to the 10% early distribution tax. The payer is aware of this exception, and Roger’s Form 1099-R shows a code “4” in box 7, indicating that the distribution is due to death. Although Roger is not subject to the additional tax, he will include the distribution amount in his gross income.

Payers do not always know when a taxpayer qualifies for an exception. If the taxpayer qualifies for an exception, but distribution code “1” (early distribution, no known exception) is shown in box 7 of the Form 1099-R, the taxpayer should complete Form 5329. The appropriate code identifying the exception is entered on Form 5329, Part 1, line 2.

The second page of Form 5329 contains a taxpayer signature section. The taxpayer (and paid preparer, if any) needs to sign Form 5329 and complete the address on page 1 only if the form is not attached to a tax return but is sent to the IRS by itself. That could happen, for example, if the taxpayer does not meet the gross income filing requirements but had an early distribution subject to the penalty tax.

Form 5329 is not required under the following circumstances:

IN CONTEXT: 2020 COVID-19-Related Distributions

As part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) of 2020, eligible taxpayers could take penalty-free COVID-19-related distributions of up to $100,000 from retirement plans or IRAs during 2020. Eligible individuals include those diagnosed with COVID-19 or individuals whose spouse or dependent is diagnosed with the illness. Eligibility is also extended to those who experience adverse financial consequences as a result of being quarantined, furloughed, or laid off; having to provide childcare because of a school or daycare closure; or having to close or reduce operating hours of business.

Taxpayers who took coronavirus-related distributions from a retirement plan (including IRAs) in 2020 could have elected to include taxable amounts in their income ratably over a three-year period. The three-year period begins with the year in which they received the distribution. Taxpayers who took distributions because they were negatively affected by a qualified disaster are subject to the same rules. For taxpayers who received loans from a qualified plan, or who are recontributing amounts treated as a distribution, special rules apply, and more research may be required. For more details, refer to Coronavirus-related relief for retirement plans and IRAs questions and answers at irs.gov.