Table of Contents |

An adjusting entry is an entry that is made at the end of an accounting period to report any unrecognized income or expenses for that period.

The purpose of an adjusting entry is to correct values, which speaks to the concept of matching principles--revenue recognition and expense recognition. We need to match those revenues and expenses with the correct period. An adjusting entry is also used to correct errors and omissions. If any errors or mistakes were made during the journalizing and posting process, they can be corrected through an adjusting entry.

As mentioned in the definition, adjusting entries are entered at the end of the period, not the beginning. They are not recorded as part of the daily activity.

Now, where are these adjusting entries entered? They are entered in the general journal, which then gets posted to the general ledger. Adjusting entries are also put in the trial balance worksheet, which we work through at the end of the period.

Now we're going to look at examples of different types of adjusting entries and how they would be created in the general journal.

Note, for all of these examples today, we're going to be reporting at 12/31/23, the end of the year, and thus making our adjustments at the end of the year.

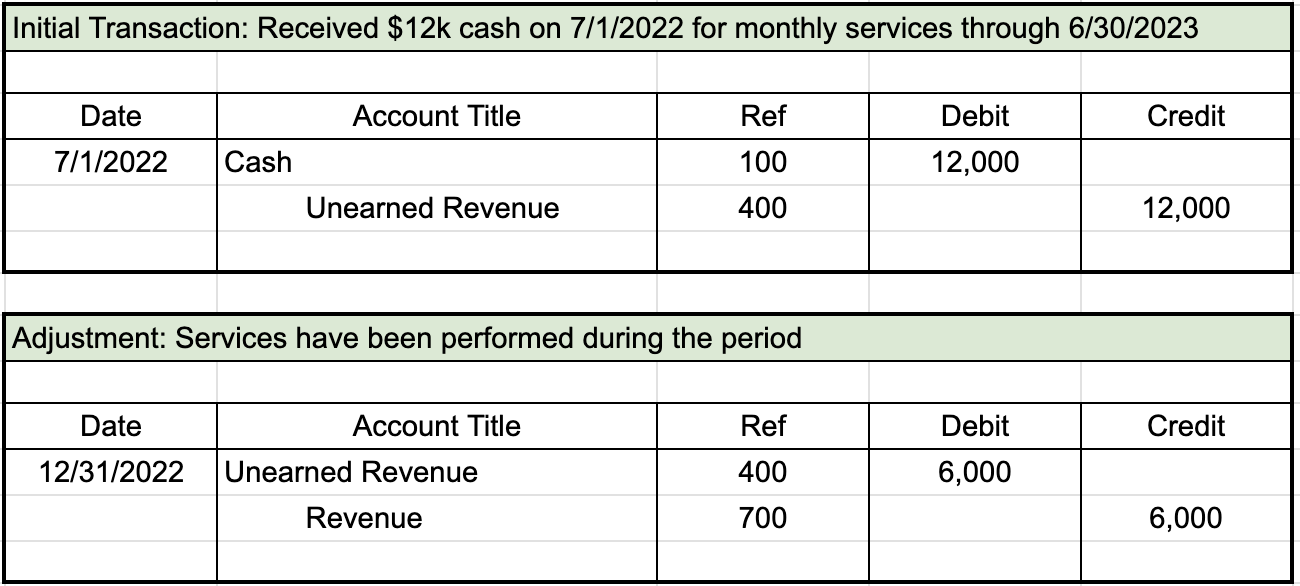

In the initial transaction, we received $12,000 of cash on July 1, 2022, for monthly services through June 30, 2023, so on that date, we recorded the cash and the unearned revenue. Note, it's unearned revenue because we haven't performed the services yet.

The adjustment is that services had been performed during the period, so at the end of the year, we have to reduce our unearned revenue and recognize the amount of revenue that we earned during the period.

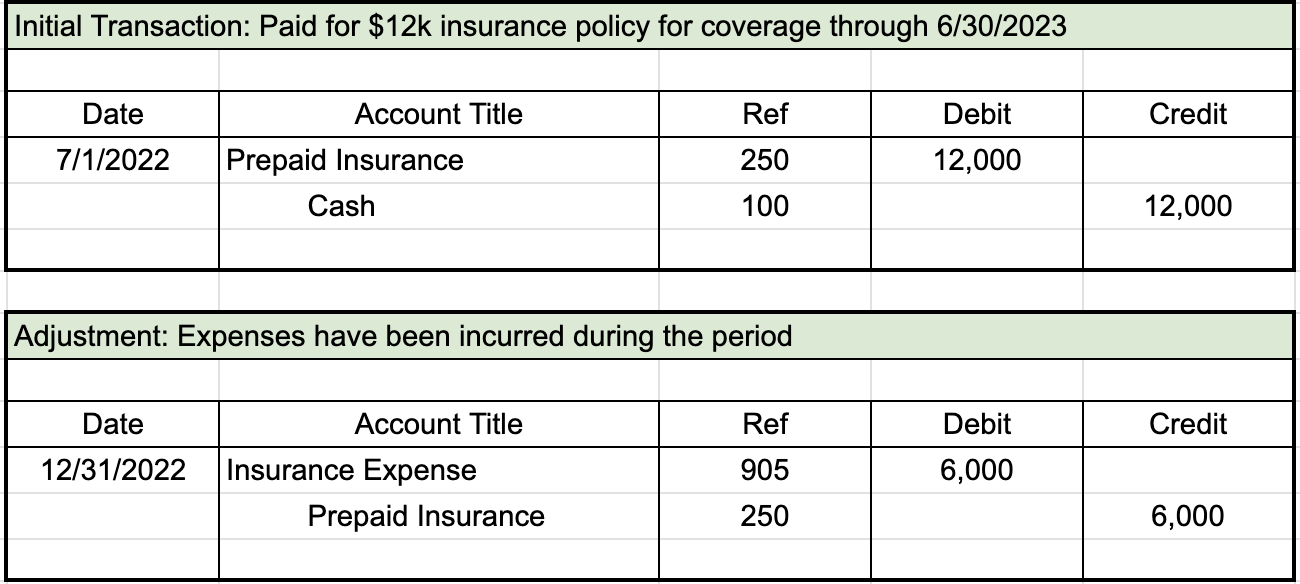

Initially, we paid $12,000 for an insurance policy that includes coverage through June 30, 2023. You can see that we purchased that on July 1, 2022. We recorded our prepaid insurance, and cash being paid for it.

Our adjustment, now that expenses have been incurred during the period, is to record the insurance expense and reduce our prepaid insurance for the six months that we have covered.

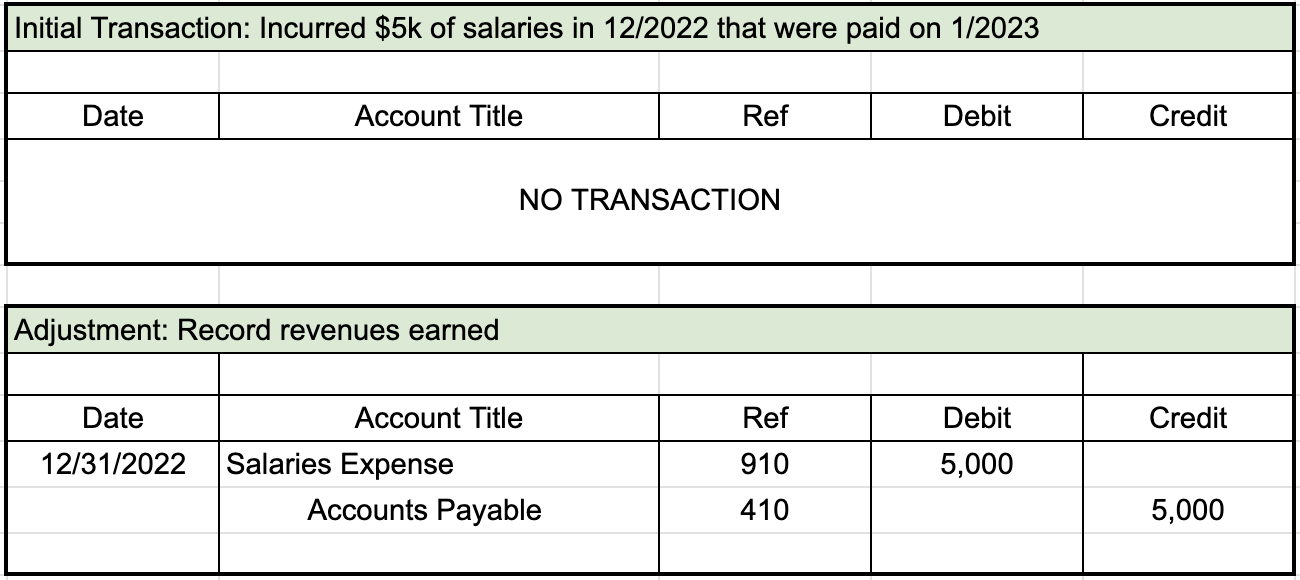

Initially, we incurred $5,000 of salaries in December of 2022 that were paid in January 2023. So, initially we didn't record anything.

The adjustment is to record the expenses that we incurred, so at the end of the year, we have to record our salary's expense, and then record our accounts payable, or that money that is owed for those salaries.

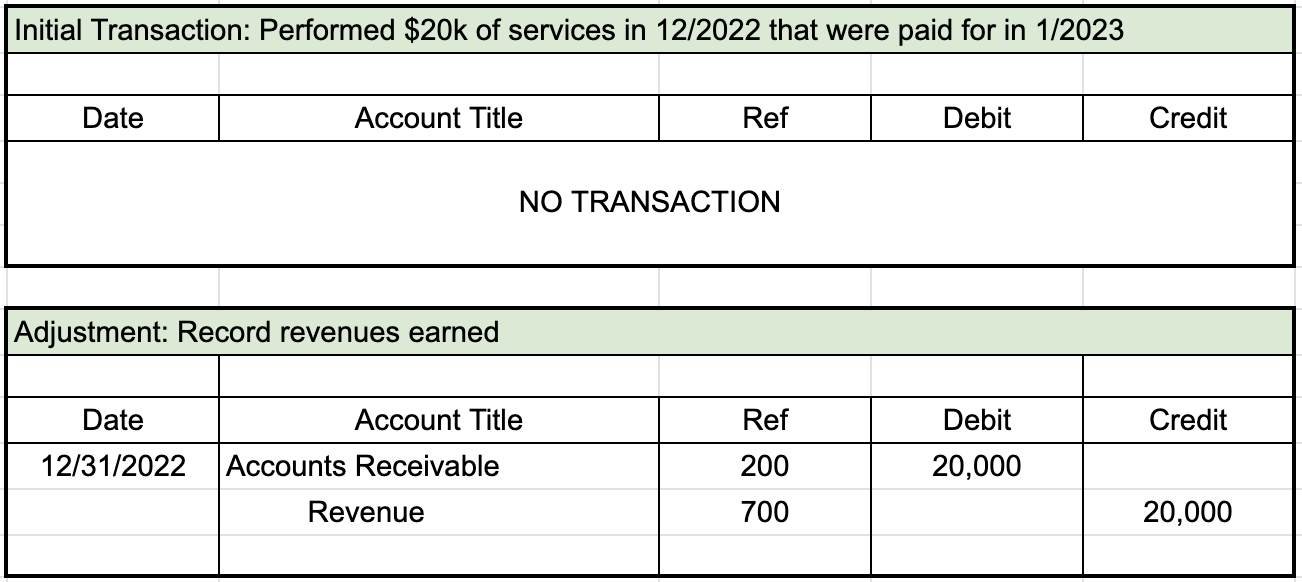

We perform $20,000 of services in December 2022 that were paid for in January 2023. Now, we haven't recorded anything.

The adjustment we have to make is to record the revenues that we earned, "earned" being the keyword. In compliance with the matching principle, at 12/31/12, we have to record accounts receivable--the money that we're going to receive from our customer--and recognize that revenue of $20,000 that we earned in December.

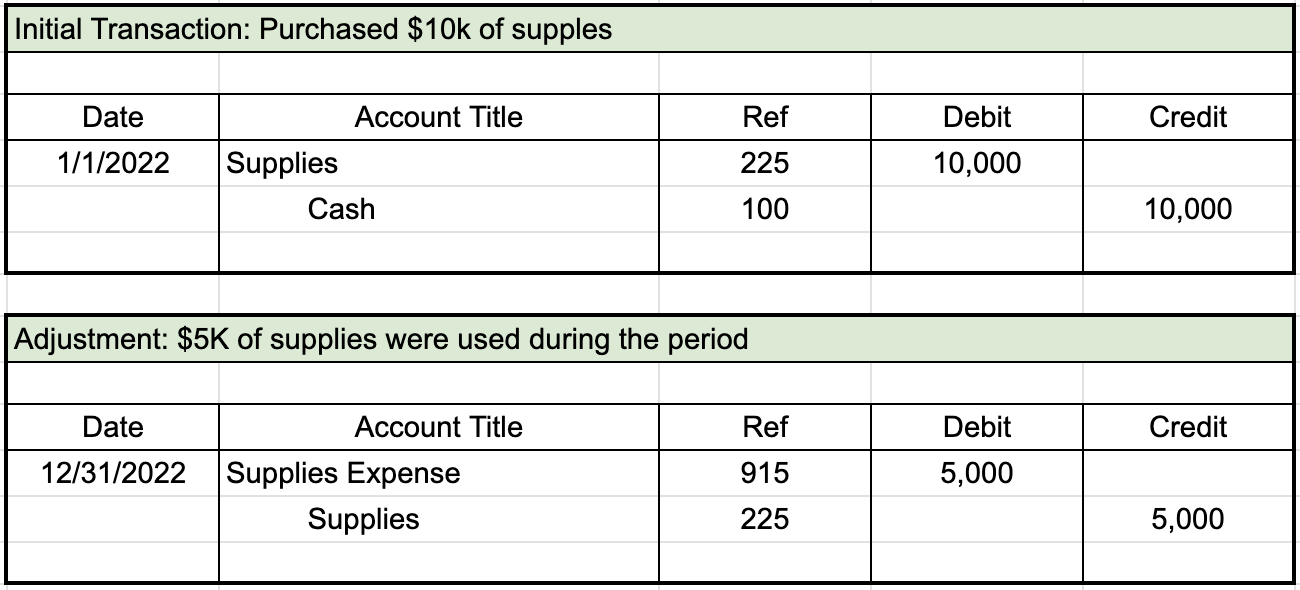

Initially, we purchased $10,000 of supplies, so on January 1st, 2022, we recorded an asset of supplies in the amount of $10,000.

What is the adjustment? Well, $5,000 of those supplies were used during the period to help generate revenue for the business. Therefore, a twofold adjustment is needed. We have to record the expense of supplies that were used, and we also have to reduce that supplies asset to reflect the appropriate balance of the supplies account.

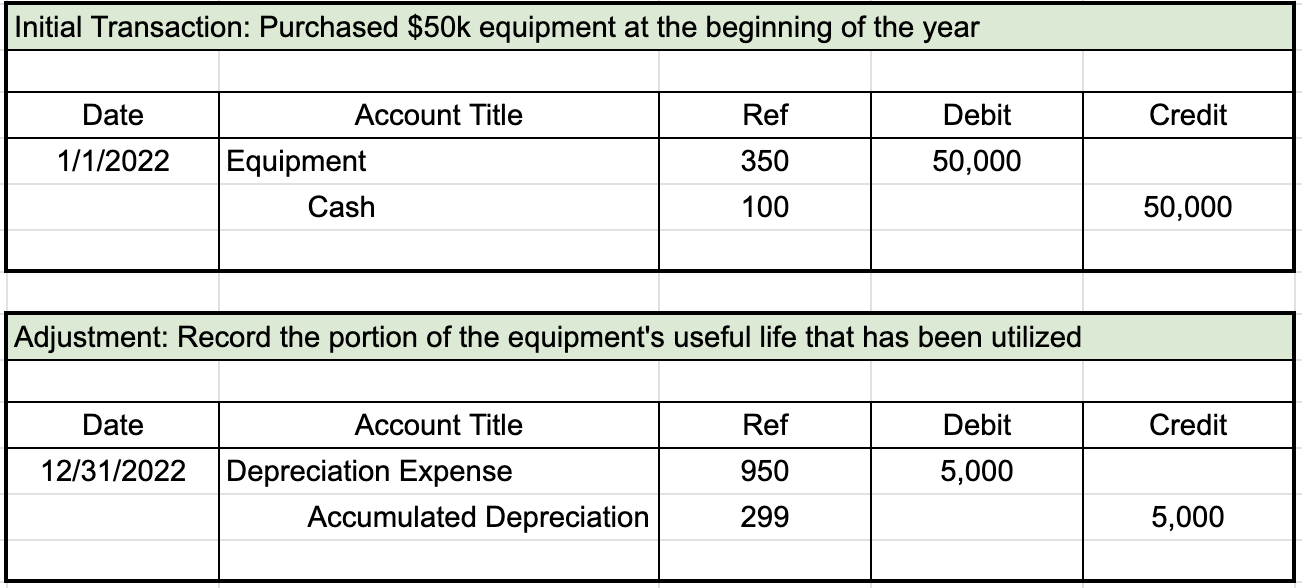

Initially, we purchased $50,000 of equipment at the beginning of the year on January 1, 2022, for cash.

Adjustment-wise, we need to record the portion of the equipment's useful life that has been utilized, so at the end of the year, we have to record depreciation expense. We also recorded accumulated depreciation, which is where we track the total depreciation for that piece of equipment.

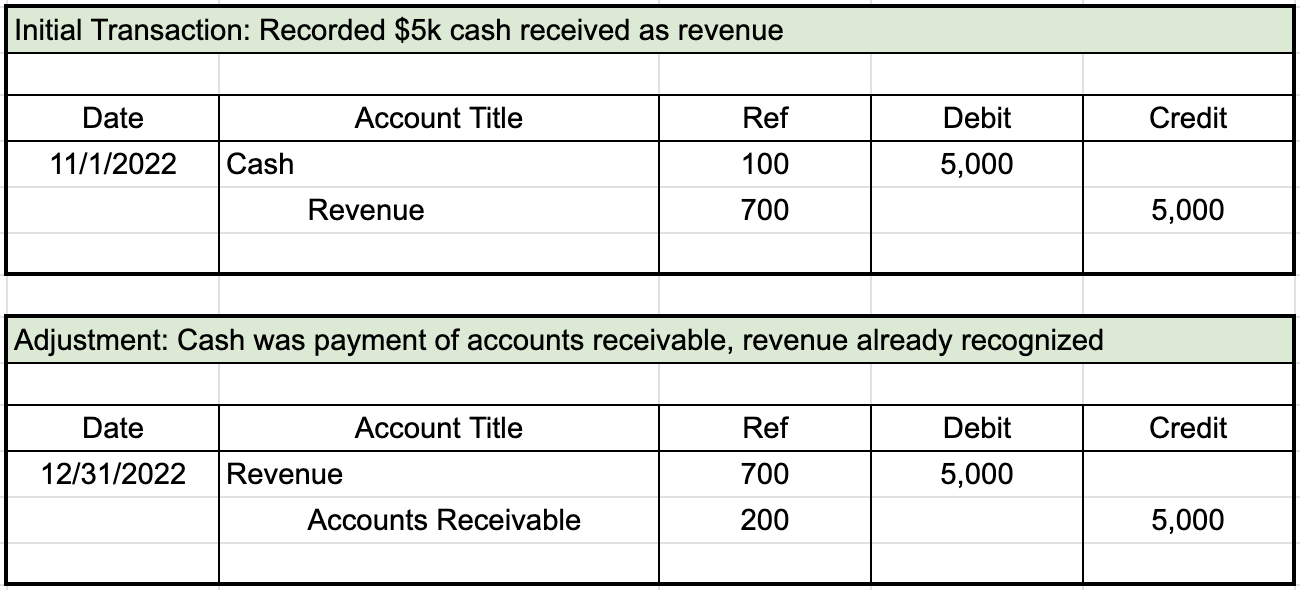

Initially, on November 1, 2023, we recorded $5,000 of cash received as revenue.

Now, it turns out that the cash payment was for accounts receivable. However, we had already recognized that revenue. To correct this, at the end of the year, we have to reverse that revenue recognition out, meaning we need to debit our revenue. Then, we would credit our accounts receivable because it was a payment for accounts receivable. We have to reduce our revenue, as well as reduce our accounts receivable to correct for that error.

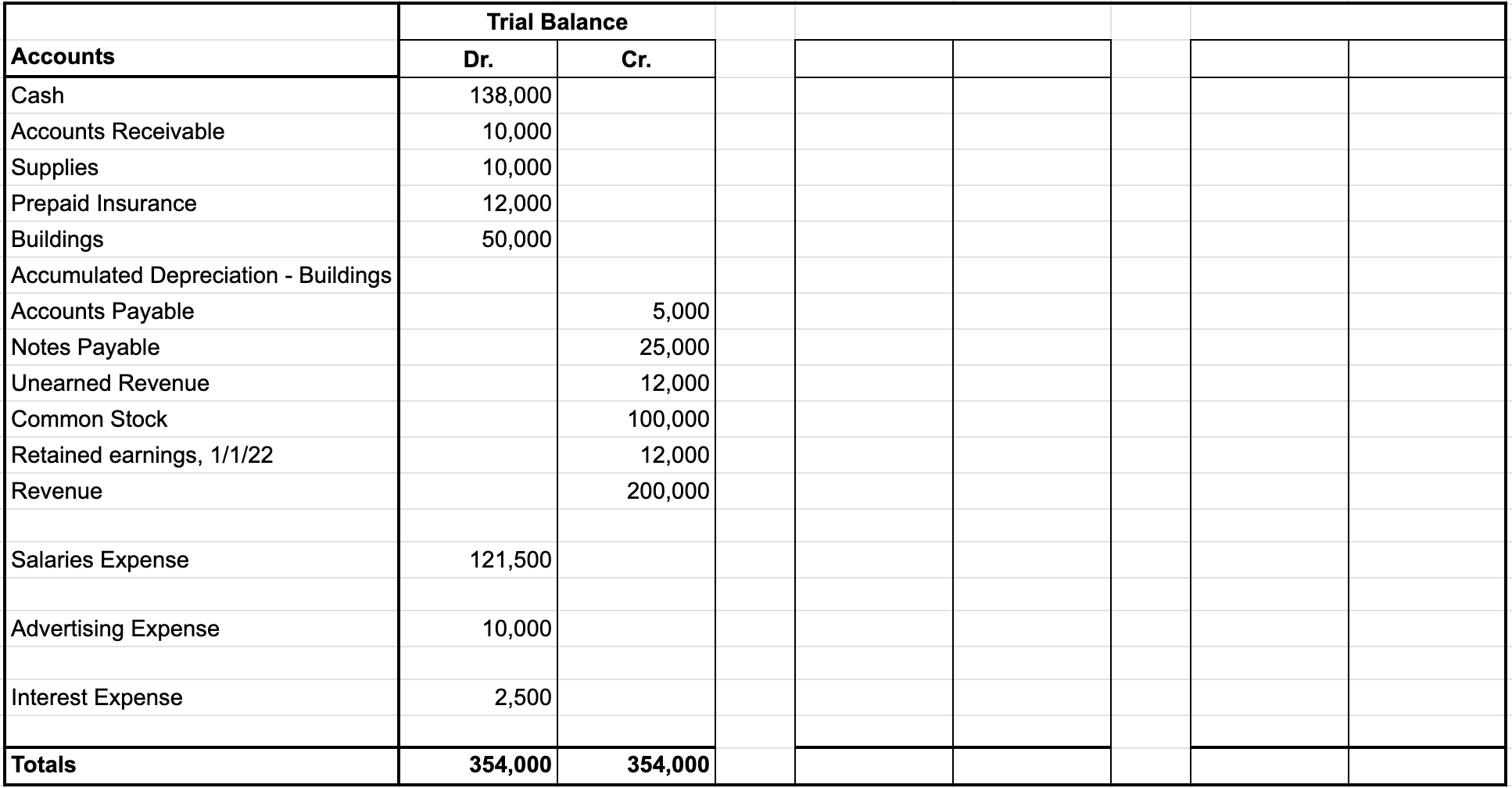

Lastly, let's look at the trial balance worksheet and how these adjusting entries fit into that.

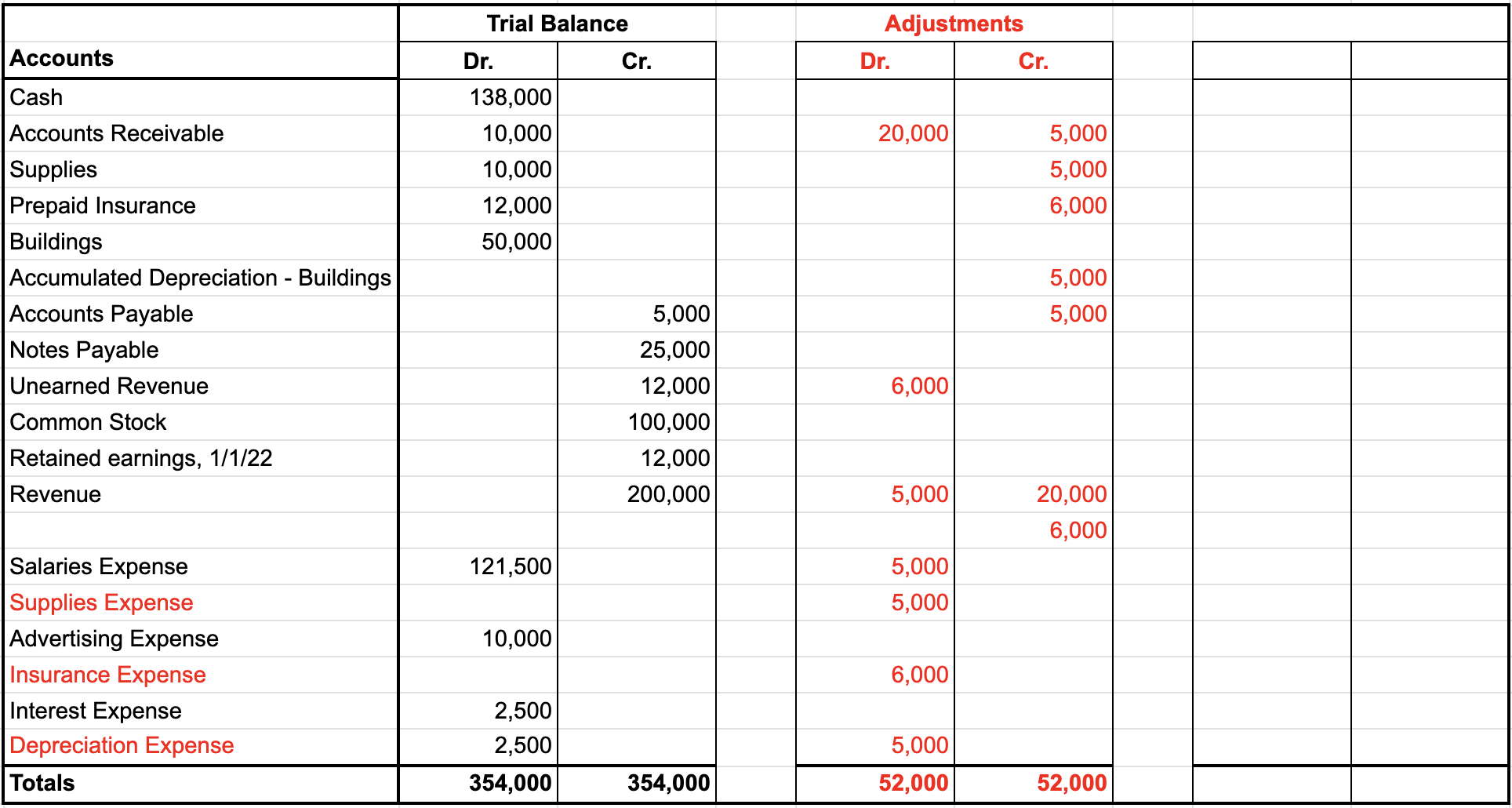

Here is the trial balance worksheet, starting with our trial balance. We have a list of all the ledger accounts and a detail of all the debit or credit balances in those accounts.

We've identified all of our adjustments, so now we're going to enter these adjustments into the trial balance worksheet. As shown in the worksheet below, you can see all of the adjustments reflected in the adjustments columns.

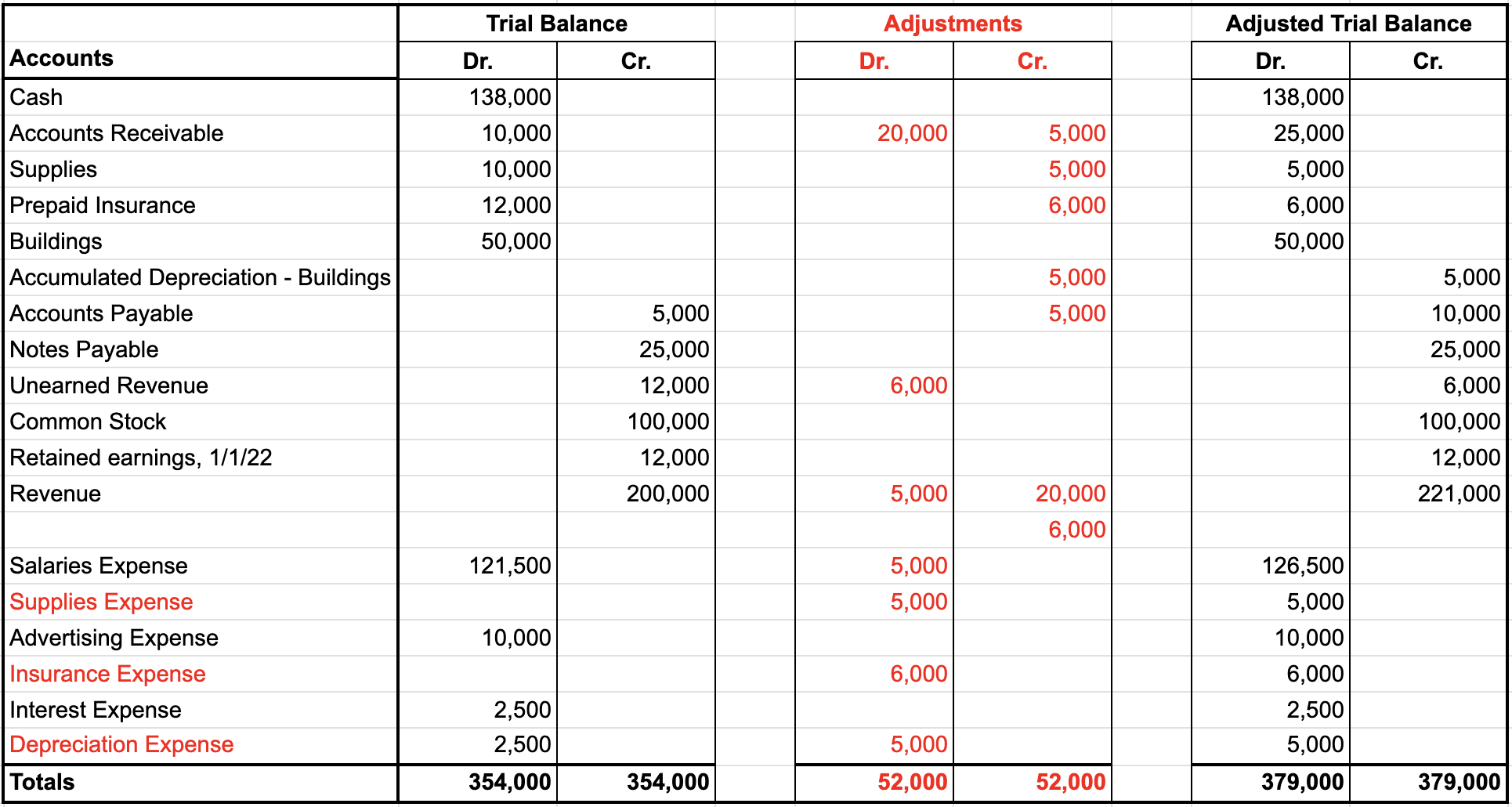

Now we can prepare our adjusted trial balance, which is simply taking the trial balances within those individual accounts and adjusting them per the adjustments that we made in the middle column. As you can see, we now have balances in our supplies expense, insurance expense, and depreciation expense. Once all of our adjustments have been entered, we can then use the adjusted trial balance to create our financial statements.

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.