Table of Contents |

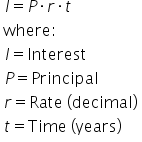

As we discussed in our last lesson, there are two different types of interest: simple interest and compound interest. Simple interest is, well, simple to figure out with a simple formula of:

Simple interest assumes that the interest amount toward a loan or investment is not added back into the principal. Additionally, the time is calculated in years.

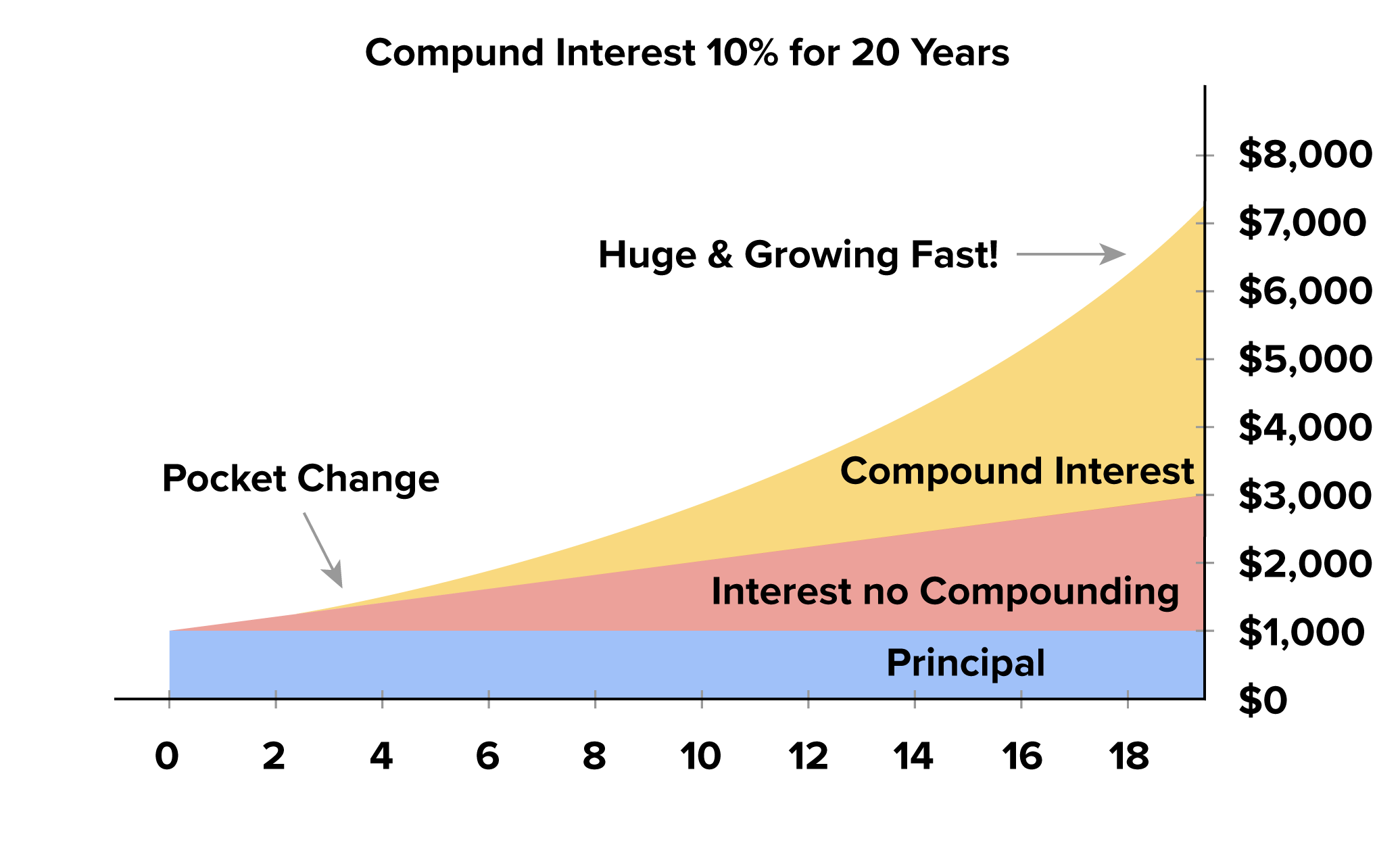

Unlike simple interest, compound interest assumes that the interest earned or incurred is added to the principal amount at set intervals like daily, weekly, monthly, or yearly. Of course, this means that the amount earned in interest becomes much higher.

Let’s look at the power of compound interest over simple interest.

Results Driven: Skill Reflect |

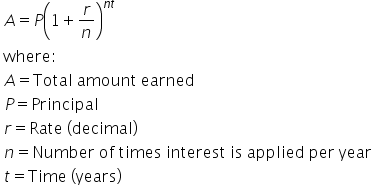

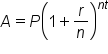

You will use the following equation for compound interest:

In this formula, A is the total amount earned at a give time (t), P is the principal or starting amount, r is the interest rate (as a decimal), t is the time (in years), and n is the number of times interest is applied per year.

Note that the equation for compound interest will result in the total amount earned at the end of time, t. This will be the principal amount and the interest earned added together. The n in the equation represents the number of times interest is applied per year. This would be a whole number such as 1, 2, 4, etc. There are some commonly used words to describe the number of times interest is applied. Looking at the table below we see, for example, if interest is compounded quarterly, this means that interest is applied every 3 months or 4 times of the year. The n in the equation would be 4.

The following table shows commonly used wording to describe the number of time interest is applied within a year:

| Wording | n (# of times interest is applied) |

|---|---|

| Annually | 1 |

| Semiannually | 2 |

| Quarterly | 4 |

| Monthly | 12 |

| Weekly | 52 |

| Daily | 365 |

If you see wording in the above table, you can quickly determine the number of times interest will be applied per year.

EXAMPLE

Martin has a credit card which he has maxed out at $10,000. Unfortunately, he cannot make any payments. Assuming he pays a 15% interest rate, compounded daily, how much will Martin owe in one year?

|

Compound Interest Formula |

|

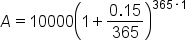

Substitute the known values:  , ,  (15% as a decimal), (15% as a decimal),  (compounded daily), (compounded daily),

|

|

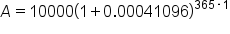

To solve this equation, we must use the order of operations. We will start with what is inside the parentheses. Division within the parenthesis comes first. |

|

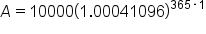

Next, evaluate the addition inside the parentheses. |

|

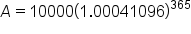

Complete the multiplication in the exponent. |

|

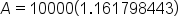

Apply the exponent. |

|

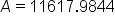

Multiply the remaining values. |

EXAMPLE

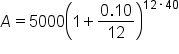

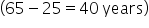

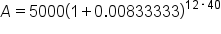

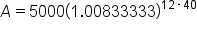

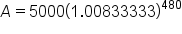

Maryanne is going to invest $5,000 in a retirement account that compounds 10% monthly. If she invests when she’s 25 and retires at the age of 65, how much will she have in the account?

|

Compound Interest Formula |

|

Substitute the known values:  , ,  (10% as a decimal), (10% as a decimal),  (compounded monthly), (compounded monthly),

|

|

To solve this equation, we must use the order of operations. We will start with what is inside the parentheses. Division within the parenthesis comes first. |

|

Next, evaluate the addition inside the parentheses. |

|

Complete the multiplication in the exponent. |

|

Apply the exponent. |

|

Multiply the remaining values. |

Source: THIS TUTORIAL WAS AUTHORED BY SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.