Table of Contents |

The subject company for our case study is called Legacy Clothing. Legacy Clothing is a sole proprietorship, which is a company that is owned by a single individual, and where that individual and the business are legally treated as the same.

The purpose of Legacy Clothing as a business is to own and operate clothing/merchandise stores. It is similar to a department store chain, selling men's, women's, and children's clothing and other related items. Legacy Clothing has locations throughout Washington, DC, and they have a staff of 50 people employed in their stores.

| Legacy Clothing | |

|---|---|

| Type of company | Sole proprietorship |

| Business purpose | Own and operate clothing/merchandise stores |

| Business location(s) |

Washington, D.C. Staff of 50 people |

Legacy Clothing needs to perform closing procedures to have accurate reporting. They need to close out their temporary or period-based accounts and reset for the next period, which allows them to track activity for individual periods.

Once those temporary, period-based accounts are closed, Legacy Clothing can transfer that net income or loss into cumulative equity. Then, they can reopen those temporary accounts and reset for the following period, to report activity for one specific period.

Now, let's look at identifying and creating closing entries for Legacy Clothing.

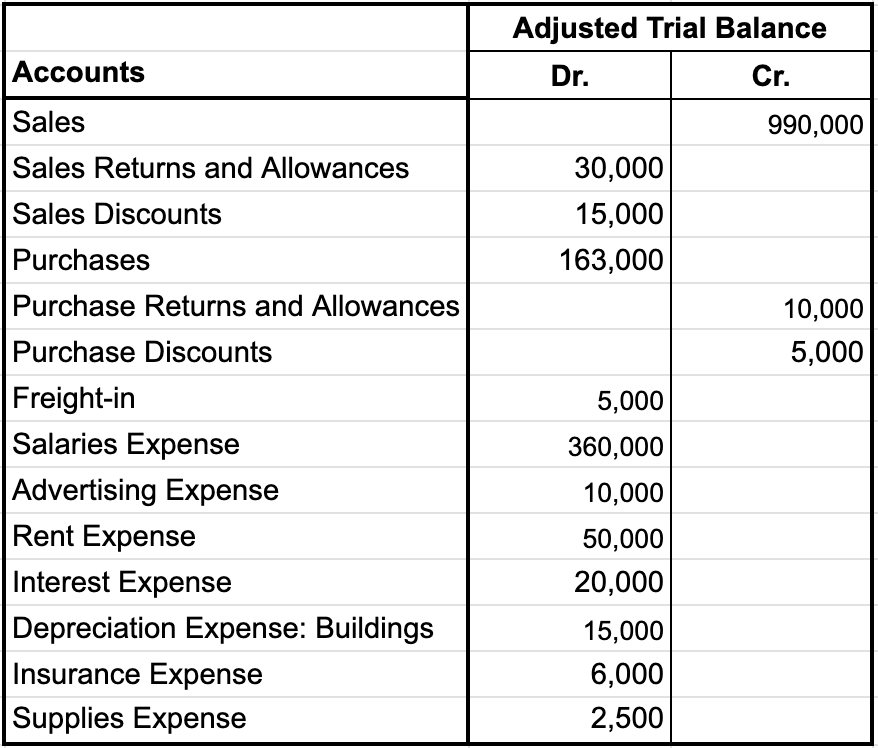

The starting point is going to be the adjusted trial balance, noting that we've already gone through and prepared our financial statements. Now that those are completed, we need to take our adjusted trial balance and prepare the closing entries for Legacy Clothing.

It is important to note that in this example, we are only looking at those closing entries that are unique to a merchandising company. Any company, whether it is merchandising-related or service-related, is going to have to close out temporary accounts such as revenues and operating expenses. However, our focus today is on those temporary accounts that are unique to a merchandising company, outlined in red above.

Let's take a look to see how this will look in the closing entry.

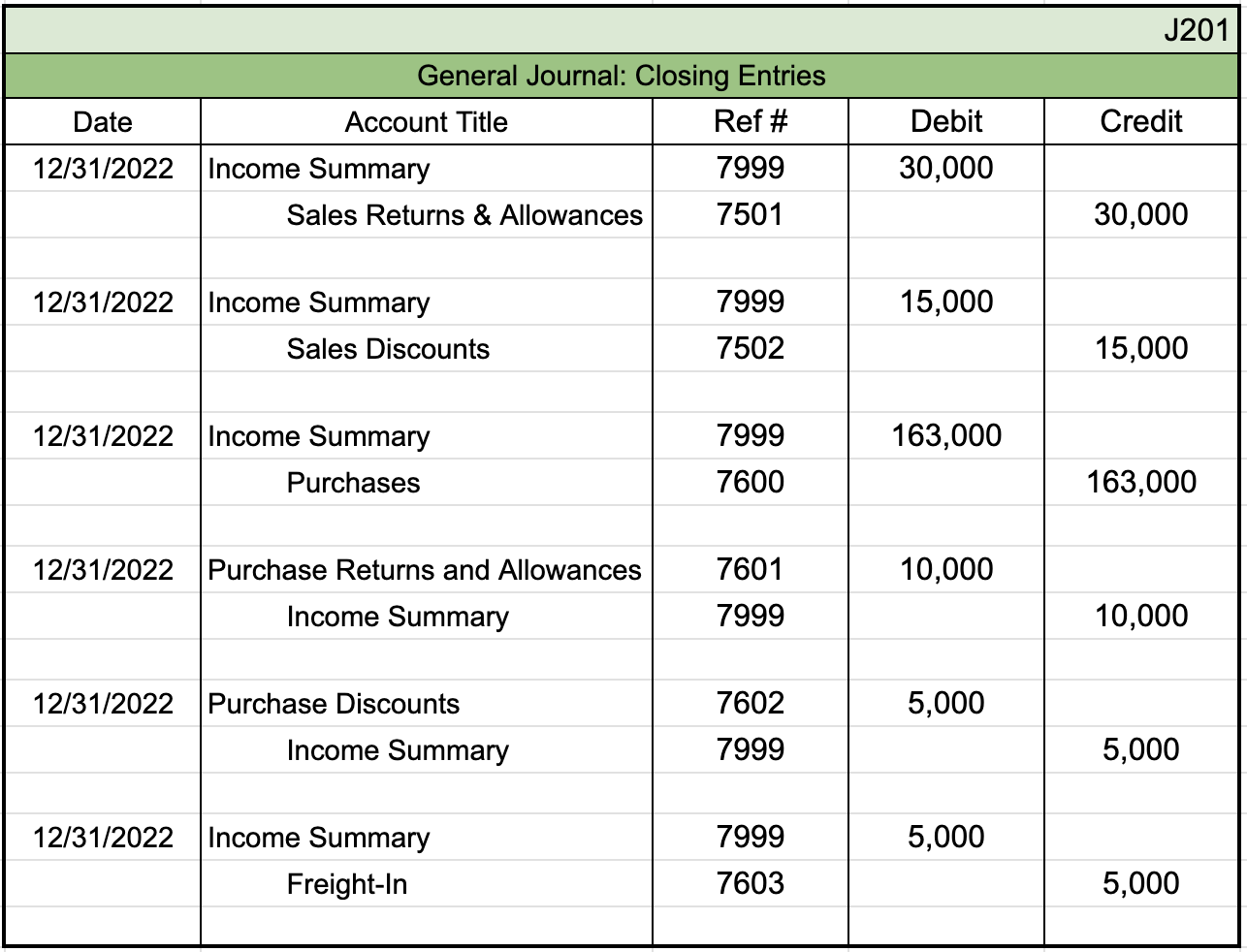

The first accounts that we need to close out are our sales returns and allowances, and our sales discounts. Notice that they are being closed out with credits. This is because they have natural debit balances, because they reduce our sales; they are contra-revenue accounts.

Next, we can close out our purchases account. The purchases account needs to be closed out with a credit. After we've closed purchases, we can close our purchase returns and allowances, as well as our purchase discounts. As you can see, our purchase returns and allowances and purchase discounts are being closed out with debits. This is because they have natural credit balances, as they are a reduction of our purchases.

The last account that we need to close out for Legacy Clothing is the freight-in account, which represents the cost to ship those goods to us. We close out freight-in with a credit because it's an expense, so it will have a natural debit balance.

In conclusion, these are the closing entries that need to be made for a merchandising company, to close out the temporary accounts that are unique to that type of business.

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.