Table of Contents |

The main differentiator between publicly traded companies and privately owned companies is that publicly traded companies have their stock listed on an open market, while privately owned companies do not.

Publicly traded companies are under more scrutiny, because they have to provide reporting information at certain intervals. There are also more regulatory requirements for publicly traded companies.

Privately owned companies, on the other hand, are more nimble. They don't have the same regulatory oversight as publicly traded companies.

EXAMPLE

If publicly traded companies want to make a big decision, they must have shareholder approval, which can be a difficult and long process. Privately owned companies, because they are more nimble, can focus more on growth and expanding the business, without being mired in the shareholder approval process.Publicly traded companies can sell more shares, so it is easier for them to gain access to new capital as they need it. This is more difficult for privately owned companies, because they have to go out and try to raise the capital from different investors.

There are several different legal entities involved in accounting.

A sole proprietorship is a type of company that is owned by a single individual, where the individual and the business are legally treated as the same.

In contrast, a limited liability company, or an LLC, is a type of company where owners are not held personally responsible for the organization's liabilities.

A limited liability partnership, or an LLP, is a type of company where only one of the partners is liable for the amount invested in the organization and is not accountable for the behavior of the other partners.

A private corporation, or a PC, is a type of company whose shares are not purchased or traded publicly.

A nonprofit is an organization that reinvests its profit into the goals of the company instead of distributing to owners and shareholders.

Lastly, there is a corporation, or Inc. This is a type of company that exists as a separate unit from owners and shareholders, thereby protecting each individual from liability that exceeds the original investment.

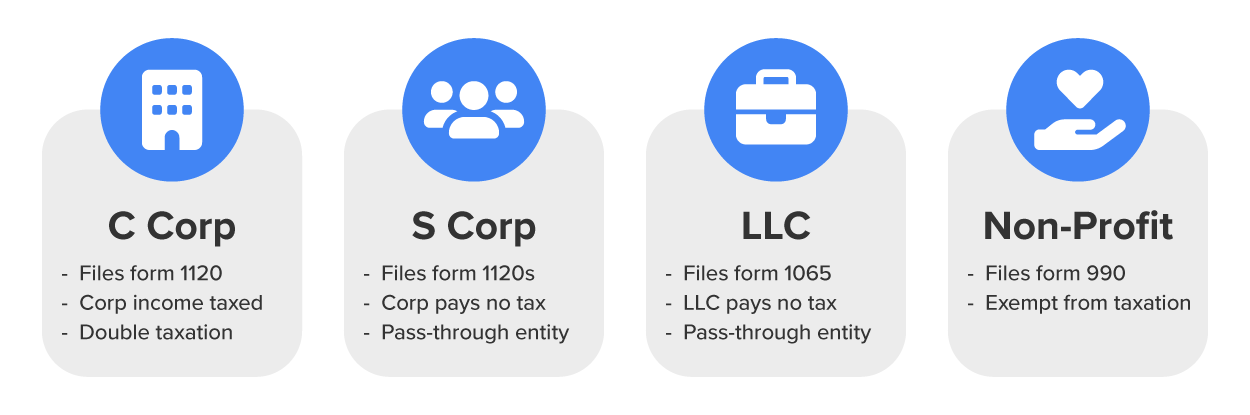

Next, let's discuss the different tax entities involved in accounting, including the different forms that they file.

A C Corp files form 1120; the corporate income tax is paid by the corporation, so the corporation itself pays taxes. However, there is double taxation, meaning any distributions made by that C Corp to owners are also taxed. Therefore, not only does the corporation pay tax, but so do the individual owners.

Next is the S Corp, which also files a form 1120--however, it is the 1120s. Contrasted with a C Corp, an S Corp pays no income tax; it is considered a pass-through entity, so all the activity of the organization passes through to the owners.

The LLC files the form 1065. Like an S Corp, the LLC pays no taxes, and it is also considered a pass-through entity, where all of the business's activity passes through to the owners.

Lastly, nonprofits file form 990. They are exempt from taxation, and include organizations like charities or fundraising organizations. They don't have to pay taxes.

Source: THIS TUTORIAL WAS AUTHORED BY EVAN MCLAUGHLIN FOR SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.