In this lesson, you will learn how budgets are used to calculate your liquidity ratio, determine if your expenses follow the 50/30/20 rule, and calculate your debt service-to-income ratio. These ratios are helpful to assess if your budget is financially healthy.

-

Budgeting can feel like a maze of numbers and rules, but using simple, clear metrics can help you measure and improve your financial health. This lesson explores three essential budget planning metrics: the liquidity ratio, the 50/30/20 rule, and the debt service-to-income ratio. By the end, you’ll not only understand these metrics but also know how to apply them to your finances through relatable scenarios and actionable steps. Each of these metrics is like a piece of a puzzle, helping you see the bigger picture of your financial life.

1. The Liquidity Ratio

Life is unpredictable. One moment, everything is running smoothly, and the next, you’re faced with an unexpected medical bill, a car repair, or even a sudden job loss. These moments can be financially overwhelming, but that’s where liquidity comes into play. Liquidity is essentially how prepared you are to handle life’s financial curveballs without derailing your entire budget.

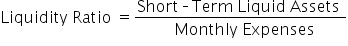

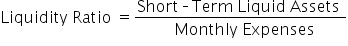

The liquidity ratio measures this preparedness by looking at how quickly you can access cash to cover short-term obligations. In simpler terms, it’s about whether you have enough readily available money to keep your life running if something goes wrong. Think of it as your financial airbag—something you hope you never have to use, but it’s critical if you do.

Building a strong liquidity ratio is foundational. It provides peace of mind and allows you to focus on other aspects of financial planning without constantly worrying about emergencies. Let’s dive deeper into what it means and how you can calculate it.

-

- Liquidity Ratio

-

Short-term liquid assets are basically your financial safety net—money you can access quickly if something unexpected happens. This includes cash, your checking and savings accounts, or anything easy to turn into cash, like a stock you can sell right away. It’s like having a just-in-case fund for life’s surprises!

-

EXAMPLE

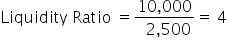

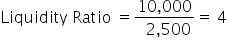

The answer “4” means that you have enough cash or liquid assets to pay your expenses for 4 months.

Financial emergencies are a reality for everyone. Experts recommend maintaining a liquidity ratio of 3 to 6 months. This means that if you lost your income today, you could still cover your essential expenses for at least 3 months without going into debt. It’s like having a safety net that ensures you won’t have to rely on credit cards or loans in a crisis. Without sufficient liquidity, even small, unexpected expenses can feel like major setbacks.

To do this, you can create an emergency fund or set money aside to cover the costs of your rent, utilities, phone bill, and other necessities for up to 6 months in case you become unemployed or unable to work due to a medical issue. An emergency fund allows you to keep paying your bills while you recuperate or find other employment. This way, you and your family or dependents have less disruption in their lives if an accident or job loss occurs. Setting aside money for an emergency is a critical goal that gives you peace of mind and reduces your stress.

-

Have you ever been hit with an unexpected bill and found yourself scrambling to figure out how to pay it? That’s what we’re trying to avoid by building a solid liquidity ratio. An emergency fund acts as a financial buffer, allowing you to stay in control even when the unexpected happens. Knowing you have a few months’ worth of expenses covered can also reduce stress and help you focus on your long-term goals.

Now that you know more about the liquidity ratio, let’s practice how it works.

-

EXAMPLE

-

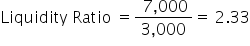

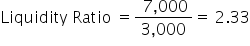

Sarah is a 32-year-old marketing professional who wants to calculate her liquidity ratio. Here’s her financial snapshot:

- Cash in checking: $1,500

- Savings account: $5,500

- Monthly expenses: $3,000

Step 1: Plug Sarah’s numbers into the liquid ratio formula to find her liquid ratio.

Step 2: Evaluate Sarah’s results.

A liquidity ratio of 2.33 months means Sarah is below the recommended range of 3 to 6 months. Building her emergency fund should be a priority.

Sarah realizes she needs to save an additional $2,000 to reach the recommended minimum 3-month ratio. She decides to redirect $200 a month from her discretionary spending into her savings until she hits her goal.

By improving Sarah’s liquidity ratio, she’s not just preparing for emergencies—she’s setting herself up for better financial health overall.

-

Your turn!

Try the liquidity ratio formula. Select the “+” button to see the answer.

-

Let’s bring it closer to home. Start by calculating your own liquidity ratio:

1. Add up all your liquid assets, such as your checking account balance and savings.

2. Divide that total by your average monthly expenses.

If your ratio is below 3, think of ways to boost your emergency fund savings. Could you trim spending, like eating out or subscriptions, and redirect that money into savings? For example, skipping a $30 weekly takeout meal could add $120 a month to your emergency fund.

If your ratio is above 6, think about whether keeping so much cash on hand is really necessary. Consider this: Is all that money sitting idle in a savings account? Could you put some of it to work for you? For instance, instead of earning minimal interest in a savings account, you could explore investing a portion in something simple, like a retirement account or a low-cost index fund. These options allow your money to grow over time, especially if you don’t plan to use it in the near future. We’ll dive into all the options later in this course.

Imagine you’re holding onto a large jar of coins under your bed. It’s great for emergencies, but at some point, it might make more sense to put some of that money into something like a piggy bank that earns interest and grows on its own. This is what investing can do—make your money work harder for you.

Think of your liquidity ratio as a financial parachute. You hope you never need it, but you’ll be glad it’s there if you do.

Now that you’ve learned how to create a financial cushion for emergencies, let’s explore a simple yet powerful framework to manage your monthly income: the 50/30/20 rule. This tool will help you balance your spending, savings, and debt repayment while still leaving room for some fun in your budget.

-

- Liquidity

- The ability to quickly access cash or assets that can easily be turned into cash to cover short-term expenses or emergencies.

- Liquidity Ratio

- A measure of how many months of essential expenses you can cover with your readily available cash or savings.

- Short-Term Liquid Assets

- Money or assets that can be quickly and easily turned into cash to cover immediate expenses, like cash, checking accounts, savings, or stocks.

- Emergency Fund

- A dedicated savings account designed to cover unexpected expenses or financial emergencies.

2. The 50/30/20 Rule

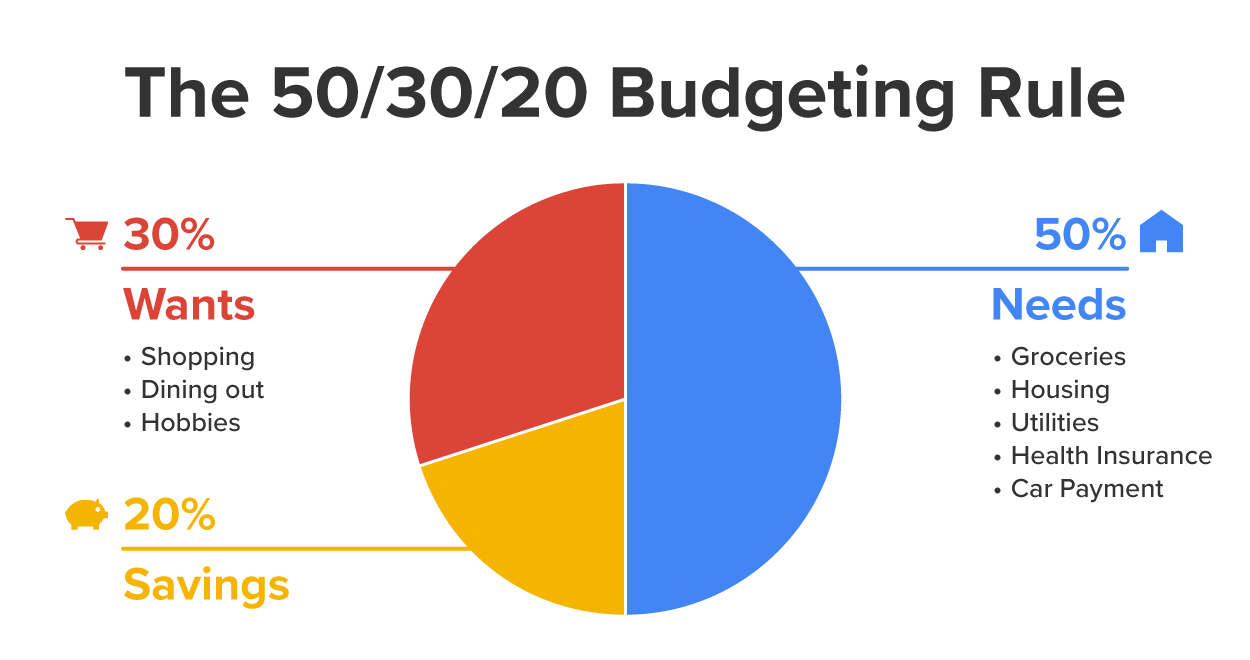

Let’s face it: Budgeting can feel overwhelming, especially if you’re not sure where to start. The 50/30/20 rule is a simple, flexible framework that helps you divide your income in a way that makes sense for your life. Instead of feeling restricted, this rule empowers you to take control of your money while leaving room for the things you enjoy.

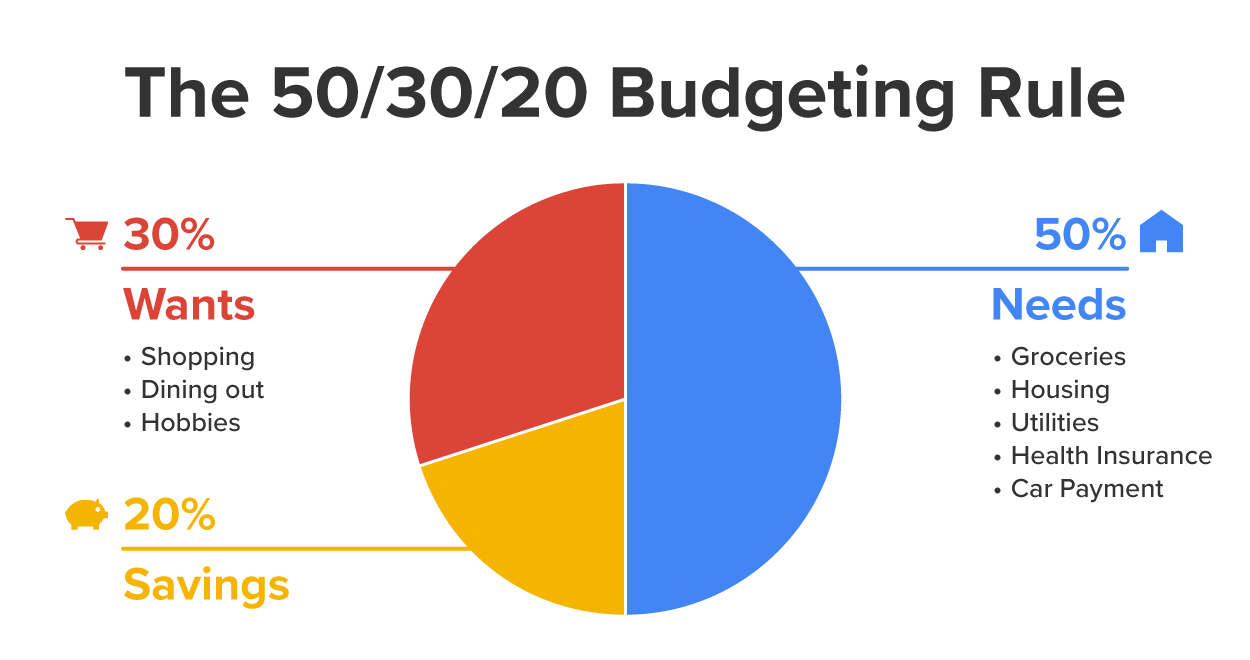

At its core, the 50/30/20 rule ensures you’re balancing the essentials, planning for the future, and enjoying the present. It’s a road map for your monthly income, guiding you to separate your funds across three major categories:

- 50% Needs: These are the essentials—rent or mortgage, utilities, groceries, transportation, and insurance. These expenses keep your life running and are nonnegotiable.

- 30% Wants: This category is for things that enhance your life but aren’t essential, like dining out, hobbies, streaming subscriptions, or vacations. This is your fun money.

- 20% Savings/Debt Repayment: This part goes toward building your emergency fund, investing in retirement accounts, or paying off debt. It’s about securing your future and reducing financial stress.

The beauty of the 50/30/20 rule is its simplicity and flexibility. It helps you understand where your money is going and ensures you’re not neglecting critical areas of your financial health. By dividing your income this way, you can avoid overspending on wants while still enjoying life and working toward long-term goals. However, note that this rule is just a guideline and not meant to be exactly 100% of the time.

Think of it as meal prepping for your finances: It might take a little effort up-front, but it saves you from making impulsive decisions later.

-

EXAMPLE

-

Alex is a 28-year-old software engineer who earns $5,000 a month. He wants to break down his income using the 50/30/20 rule.

Step 1: Calculate each category.

Alex should allocate $2,500 for essentials like rent, groceries, and utilities.

Alex can spend $1,500 on nonessential items like dining out, streaming subscriptions, and hobbies.

- 20% Savings/Debt Repayment:

Alex should set aside $1,000 for building his emergency fund, investing, or paying off debt.

Step 2: Compare Alex’s current spending to the 50/30/20 rule.

Alex reviews his monthly expenses:

- Rent and utilities: $2,000

- Groceries: $400

- Dining out and entertainment: $1,800

- Savings: $800

Alex notices two key issues:

- He’s overspending on wants ($1,800 vs. $1,500).

- He’s under-saving ($800 vs. $1,000).

Step 3: Make adjustments.

- Alex decides to limit his dining out to $300 per month, freeing up $300 to meet his savings goal.

- He also starts meal prepping to reduce his grocery costs, redirecting an additional $100 to his savings.

After adjusting his budget, Alex feels more confident knowing his spending aligns with his financial priorities. He’s enjoying his life now while planning for the future.

-

Your turn!

Try the 50/20/30 budgeting framework, and select the “+” button to see the answer.

Let’s make this personal. Start by calculating your own 50/30/20 budget:

- Write down your after-tax income for the month.

- Break it into three categories:

- 50% Needs: Rent/mortgage, utilities, groceries, insurance, transportation, and other necessities

- 30% Wants: Dining out, hobbies, entertainment, subscriptions, and other nice-to-haves

- 20% Savings/Debt Repayment: Emergency fund, retirement savings, or paying off loans

- If you’re spending more than 50% on needs, it might be time to evaluate where you can make adjustments. Could you save on utilities by being more energy efficient? Is there room to reduce grocery spending by meal planning or buying in bulk? Small changes can add up over time.

- If your wants exceed 30%, take a closer look at your fun money expenses. Could you limit dining out to once a week or skip a streaming subscription you rarely use? For instance, cutting back on a $10 monthly subscription frees up $120 a year for savings or debt repayment.

- If your savings are below 20%, consider automating a portion of your income to go straight into savings or toward extra debt payments. Even starting with 5% and gradually increasing can make a big difference in the long run.

- Imagine your income as a pie chart. Each slice has a purpose: One keeps the lights on, one brings joy to your life, and one secures your future. By balancing the slices, you can enjoy life now while staying on track with your goals. This framework makes budgeting feel achievable, not overwhelming.

The 50/30/20 rule helps you take charge of your money in a way that feels balanced and realistic, covering what you need, enjoying what you want, and building a solid future. It’s like giving your income a purpose that works for your life. Now that you’ve got a handle on how to manage your spending, let’s talk about debt. How much of your income is tied up in payments, and is it holding you back? That’s where the debt service-to-income ratio comes in.

- 50/30/20 Rule

- A budgeting guideline that divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment.

3. The Debt Service-to-Income Ratio

Debt can be a double-edged sword. It can help you achieve big goals, like buying a home or going to college, but too much debt can take over your finances and limit your choices. That’s where the debt service-to-income (DTI) ratio comes in. This ratio helps you understand how much of your income is tied up in debt payments.

In simple terms, the DTI ratio shows whether your debt is manageable or if it’s putting too much strain on your budget. Think of it as a spotlight on your financial obligations—shining a light on how much of your hard-earned money is already spoken for.

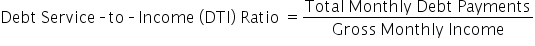

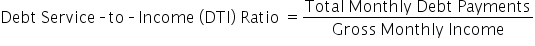

- Debt Service-to-Income (DTI) Ratio

A healthy DTI ratio is essential not only for your financial well-being but also for your ability to borrow money when you need to. Lenders often use this metric to determine whether you qualify for loans like mortgages or car loans. A DTI ratio of 36% or lower is generally considered manageable, while anything above 43% might raise red flags for lenders.

However, it’s not just about borrowing. Tracking your DTI ratio helps you identify if debt is limiting your ability to save, invest, or enjoy life. A lower DTI ratio gives you the flexibility to pursue goals without feeling weighed down by financial obligations.

Imagine being able to look at your budget and know you’re in control, with plenty of room to handle surprises or take advantage of opportunities. That’s the peace of mind a healthy DTI ratio can bring.

EXAMPLE

-

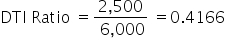

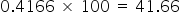

Mia is a teacher who earns $6,000 gross per month and has the following debt payments:

- Mortgage: $1,800

- Car loan: $400

- Student loans: $300

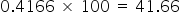

Step 1: Add up Mia’s monthly debt payments: $2,500.

Step 2: Plug the numbers into the DTI ratio formula.

-

To convert to a percentage, multiply by 100.

Step 3: Evaluate Mia’s result.

A DTI ratio of 41.66% indicates Mia’s debt load is on the higher side. While not unmanageable, it could become problematic if unexpected expenses arise.

Mia realizes that reducing her debt is essential for improving her financial flexibility. She decides to focus on paying off her car loan first, as it has the highest monthly payment relative to the balance. By making extra payments, she plans to pay it off within a year. Once that debt is gone, her DTI ratio will drop to 35%, giving her more room to save and invest.

Now, it’s your turn to calculate your DTI ratio. Select the “+” button to see the answer.

- Calculate your own DTI ratio by adding up your monthly debt payments and dividing it by your gross monthly income.

- If your DTI ratio is above 36%, identify one debt to prioritize for repayment. Could you redirect some fun money spending or use a tax refund to make extra payments?

- If your DTI ratio is below 36%, consider how you can maintain this balance while pursuing other financial goals.

A healthy DTI ratio isn’t just a number—it’s a way to ensure your finances are balanced and working for you. Once you’ve tackled debt, you’ll have more freedom to focus on building wealth and achieving your dreams.

- Debt Service-to-Income (DTI) Ratio

- The percentage of your gross monthly income used to pay your monthly debt obligations.

In this lesson, you learned how items from a budget are used to calculate a liquidity ratio, determined if expenses follow the 50/30/20 rule, and calculated a debt service-to-income (DTI) ratio that lenders consider when determining a consumer’s borrowing capacity.