In this lesson, you will learn about auto insurance and how to choose the right plan for your budget. Specifically, this lesson will cover the following:

1. What Is Auto Insurance?

You just got your dream car. It’s sleek, it’s shiny, and every time you slide into the driver’s seat, you feel like you’re on top of the world. That first drive down the highway—windows down and music blasting—is pure freedom. But then—bam—reality kicks in.

Before you can fully enjoy your new set of wheels, there’s something you absolutely need: auto insurance.

If you’ve ever felt overwhelmed by terms like liability coverage, comprehensive insurance, or deductibles, you’re not alone. Insurance can feel like a confusing mess of jargon and legal requirements, but don’t worry—we’ve got you covered.

At its core, auto insurance is a contract between you and an insurance company. You agree to pay a monthly or annual premium, and in return, the insurance company promises to cover certain financial losses if you’re in an accident or your car is damaged.

Without insurance, you could be stuck paying out of pocket for repairs, medical bills, and even legal costs—and let’s be real, that could wipe out your savings in a heartbeat.

Let’s put this into perspective:

- A minor fender bender could cost you over $1,000 just to fix your bumper.

- A major accident with medical bills? That could easily skyrocket to $100,000 or more.

- If you total your car and don’t have the right coverage, you could be left paying off a loan on a car you can’t even drive.

-

EXAMPLE

Lisa finishes a long day at work and drives home, thinking about what to cook for dinner. She looks down for a split second, and when she looks up—bam!—she rear-ends the car in front of her at a stoplight.

The other driver’s bumper is damaged, and they complain about neck pain. Without insurance, Lisa would have to pay out of pocket for the following:

- The other driver’s car repairs ($3,000+)

- Their medical bills (who knows how high that could go?)

- Any legal costs if they decide to sue her (yikes!)

But Lisa does have auto insurance. Instead of draining her savings, her liability coverage kicks in and pays for the other driver’s damages and medical bills (up to her policy limits). She may have to pay a deductible, but that’s way better than facing financial ruin.

This is why insurance isn’t just a good idea—it’s a must-have.

-

Yes, in most states, having some form of auto insurance is required by law. Even in states where it’s not mandatory, driving without insurance is a massive financial risk. If you cause an accident and don’t have coverage, you could end up in serious debt—or even face legal consequences.

Some states allow drivers to post a cash bond instead of carrying insurance, but let’s be real: Most people don’t have tens of thousands of dollars sitting around just in case of an accident.

Auto insurance isn’t a one-size-fits-all deal. There are different types of coverage, and knowing what they do can help you choose a policy that actually protects you. In the next section, we’ll dive into the main types of auto insurance coverage and what each one means for you.

1a. Key Aspects of Auto Insurance

Auto insurance comes with a lot of complicated terms but understanding them is essential to making sure that you have the right coverage. If you’ve ever wondered what liability, comprehensive, or deductibles actually mean, this guide will break it all down in simple terms so you can confidently choose the best policy for your needs.

1. Liability Insurance (Required in Most States)

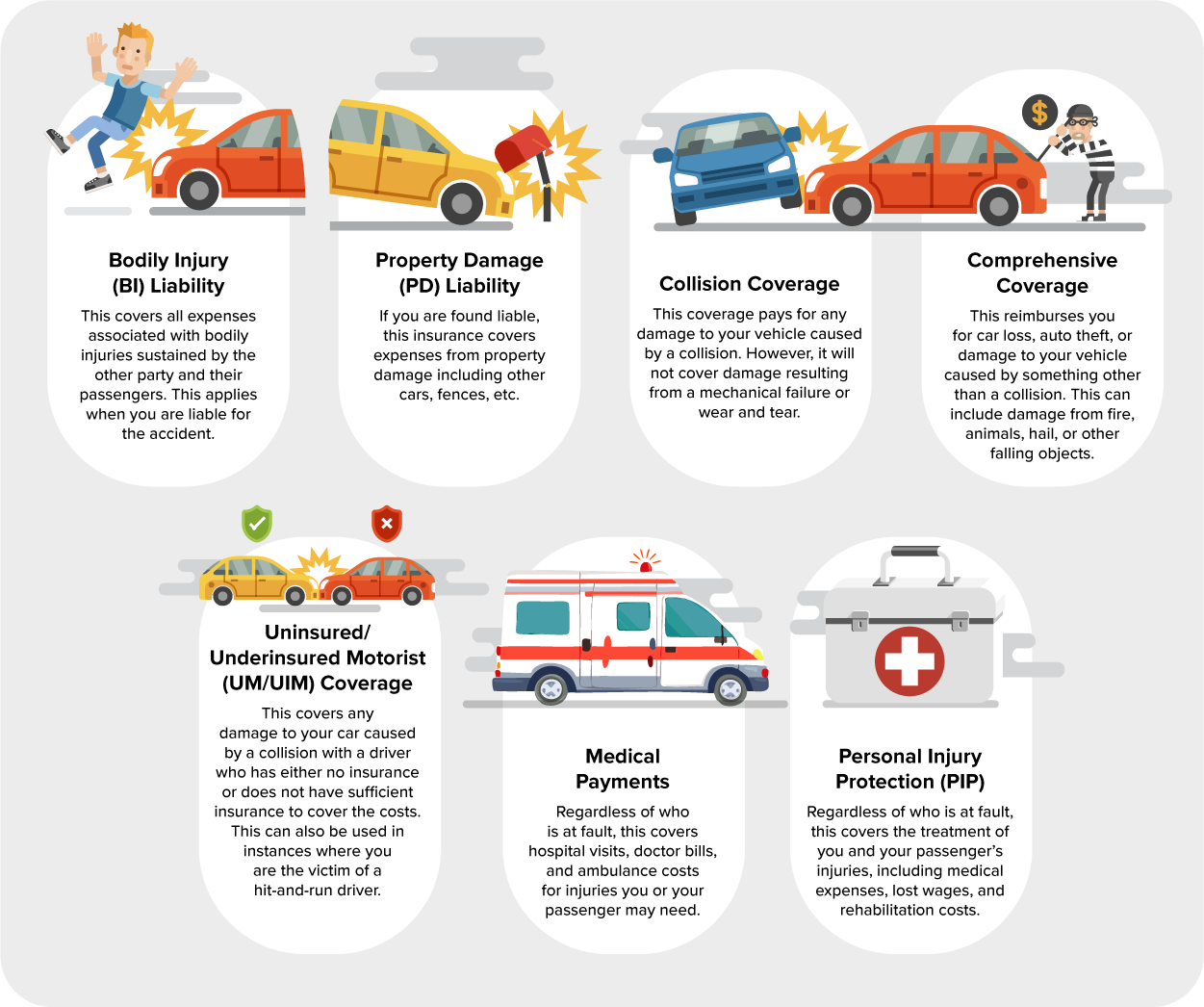

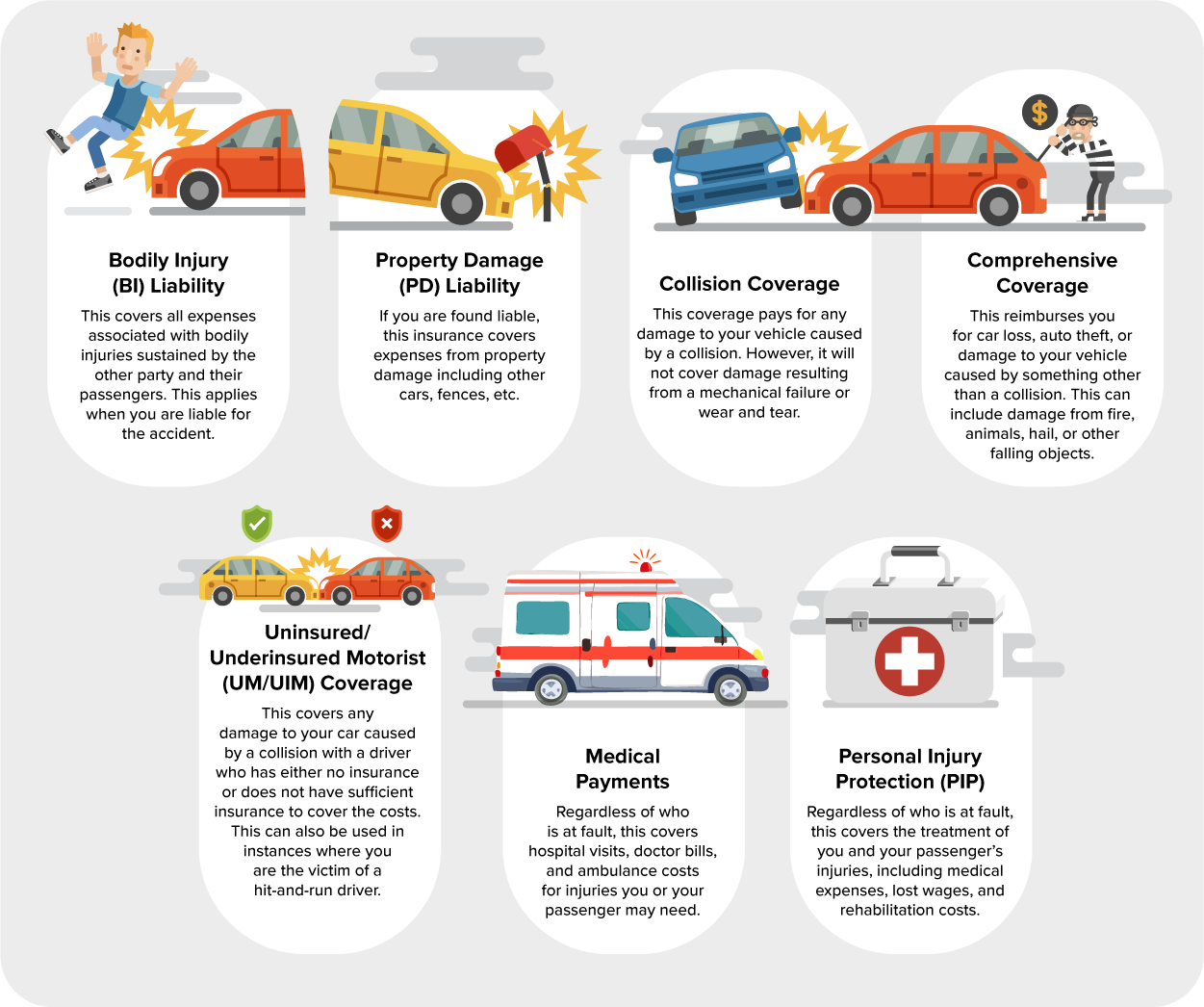

- Liability insurance covers expenses for other people if you are at fault in an accident. It has two main parts:

-

Bodily injury (BI) liability: Covers medical expenses, lost wages, and legal costs for the other party if they are injured in an accident you caused

-

Property damage (PD) liability: Pays for damage to other people’s property, such as their vehicle, a fence, or a building

-

EXAMPLE

Jake runs a red light and crashes into another car. The other driver suffers a broken arm and requires $5,000 worth of car repairs. Jake’s liability insurance would cover these expenses up to his policy’s limit.

- Liability insurance does not cover damage to your own car—it only covers the other party’s expenses.

2. Collision Coverage (For Your Own Car)

-

Collision coverage helps pay for repairs or replacements for your car after an accident, regardless of who was at fault.

-

EXAMPLE

Mia is driving on an icy road and skids into a tree, causing $7,000 in damage. Without collision coverage, she would have to pay for repairs herself. With it, her insurance pays after she meets her deductible.

- Collision coverage is not required by law, but if you lease or finance your car, your lender will likely require it.

3. Comprehensive Coverage (For Noncollision Damage)

-

Comprehensive insurance covers damage to your car that is not caused by a collision. This includes incidents like theft, vandalism, fires, natural disasters, and animal-related damage.

-

EXAMPLE

Alex parks his car overnight and wakes up to find it broken into and the stereo stolen. His comprehensive coverage pays for the repairs and the replacement of the stereo.

- Comprehensive coverage is optional unless required by a lender. Lenders usually require collision and comprehensive coverage to protect their investment in your car until you pay off the loan. If your car is damaged, stolen, or totaled, this insurance ensures that they get their money back.

4. Uninsured/Underinsured Motorist (UM/UIM) Coverage

- This coverage protects you if an uninsured or underinsured driver causes an accident. Medical bills and repairs would be covered by uninsured/underinsured motorist (UM/IUM) coverage.

-

EXAMPLE

Sarah is hit by a driver who runs a stop sign, but the driver has no insurance. Because Sarah has UM coverage, her insurance pays for her medical bills and car repairs.

- Some states require UM/UIM coverage, while others make it optional.

5. Medical Payments (MedPay) and Personal Injury Protection (PIP)

- Both medical payments (MedPay) and personal injury protection (PIP) help cover medical expenses for you and your passengers after an accident, regardless of who was at fault.

- MedPay covers hospital visits, doctor bills, and ambulance costs.

- PIP covers medical expenses, lost wages, and rehabilitation costs.

-

EXAMPLE

David and his friend are in a minor accident, and both suffer whiplash. MedPay covers their hospital visits and physical therapy sessions.

- Some states require PIP, while others do not. If PIP is not available, MedPay can be a good alternative.

6. Deductibles and Premiums

- Your auto insurance costs are made up of two key components:

- Premium: The amount you pay for insurance, which can be billed monthly, semiannually, or annually

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in

-

EXAMPLE

Jessie has a $500 deductible on her collision coverage. After hitting a pole, her repair bill comes to $2,000. She pays the first $500, and her insurance covers the remaining $1,500.

- A higher deductible usually lowers your premium, but it also means that you will pay more out of pocket if you file a claim.

-

Grab your insurance card and take a look at your coverage details. Check for terms like liability, collision, comprehensive, UM, and deductibles—these will tell you what protection you currently have. If something is missing or unclear, make a note to review your policy or ask your insurance provider for clarification.

Auto insurance is more than just a legal requirement—it provides financial protection that can prevent a minor accident from becoming a major financial burden. Understanding these key terms helps you choose the right coverage without overpaying or leaving yourself unprotected. Reviewing your policy and making adjustments as needed can ensure that you have the best coverage at the best price. Now, let’s look at how to choose the right auto insurance plan for you.

-

- Bodily Injury (BI) Liability

- Pays for medical expenses, lost wages, and legal fees if you cause injuries to others in an accident.

- Property Damage (PD) Liability

- Covers repair or replacement costs if you damage someone else’s property, like their car or home.

- Collision Coverage

- Pays for damage to your own car after an accident, regardless of fault.

- Comprehensive Insurance

- Covers damage to your car from noncollision events like theft, fires, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage

- Protects you if you’re in an accident caused by a driver with no insurance or not enough coverage.

- Medical Payments (MedPay)

- Helps pay for medical bills for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP)

- Covers medical expenses, lost wages, and other costs for you and your passengers after an accident, regardless of fault (required in some states).

2. How to Choose the Right Plan

Choosing the right auto insurance plan is about more than just finding the cheapest rate. The right coverage should protect you financially, fit your budget, and meet any legal or lender requirements. Here’s a step-by-step guide to help you choose the best policy for your needs.

-

Step 1. Assess Your Driving Habits and Risks

Before selecting a policy, consider the following:

- How often you drive and the distances you travel

- Where you park (garage, driveway, or street)

- Whether you drive in areas with high accident or theft rates

- Your accident history and driving record

- Whether you lease or finance your car (which may require extra coverage)

If you drive frequently or live in a high-traffic area, having comprehensive and collision coverage might be a smart investment. If you drive an older car with a lower value, liability coverage may be enough.

Step 2. Know Your State’s Minimum Insurance Requirements

Most states require drivers to carry liability insurance to cover damage or injuries caused to others in an accident. Some states also require UM/UIM coverage or PIP.

Check your state’s minimum requirements, but remember that minimum coverage may not be enough to fully protect you in an accident.

Step 3. Compare Costs Beyond the Premium

Many drivers focus only on the monthly premium, but other costs impact how much you’ll pay when you file a claim:

- Deductible: The amount you pay out of pocket before your insurance kicks in. Higher deductibles mean lower premiums but more costs if you need repairs.

- Coverage limits: Higher limits provide better protection but increase your premium.

- Out-of-pocket costs: Look at co-pays, coverage exclusions, and additional fees in the policy.

Choosing a higher deductible can lower your premium, but be sure you can afford it if you have to make a claim.

Step 4. Check Discounts and Ways to Save

Insurance companies offer a variety of discounts that can significantly lower your premium. Look for the following:

- Safe driver discounts for accident-free records

- Bundling discounts when combining auto and home insurance

- Good student discounts for young drivers with high grades

- Low-mileage discounts if you don’t drive often

- Usage-based insurance discounts for safe driving habits tracked through an app

- Higher deductible options to reduce monthly costs

Step 5. Review the Insurer’s Reputation and Customer Service

Not all insurance companies are created equal. Check the following:

- Customer reviews and complaints to see how they handle claims

- Financial strength ratings from agencies like AM Best to ensure that they can pay claims

- Ease of claims process—some companies offer fast online claims, while others require more paperwork

Step 6. Consider Add-Ons and Extra Coverage

Some insurance policies offer additional protection, including the following:

-

Roadside assistance for towing, flat tires, or lockouts

-

Rental car reimbursement if your car is in the shop after an accident

-

Gap insurance to cover the difference between what you owe on a car loan and its actual value if totaled

If you drive often or rely on your car for work, these add-ons might be worth considering.

Step 7. Get Multiple Quotes and Compare Policies

Prices vary widely between insurers, even for the same coverage. Get at least three quotes and compare the following:

- Policy limits and deductibles

- What’s included and excluded

- Customer service reputation

Online comparison tools and independent insurance agents can help you find the best deal.

Choosing the right auto insurance plan requires balancing cost, coverage, and protection. While minimum coverage may seem cheaper up front, the right policy should protect you from major financial losses in case of an accident. Take the time to compare your options, understand the coverage, and choose a policy that gives you peace of mind on the road.

-

- Roadside Assistance

- Covers emergency services like towing, battery jump-starts, flat tire changes, and lockouts if your car breaks down.

- Rental Car Reimbursement

- Pays for a rental car while your vehicle is being repaired after a covered accident.

- Gap Insurance

- Covers the difference between what you owe on your car loan or lease and its actual value if your car is totaled or stolen.

In this lesson, you learned all about auto insurance, including the key aspects of auto insurance. Then, you discovered how to choose the right plan for your budget.