Table of Contents |

You started this course learning about personal budgets because managing your own money is like your personal economy—you decide how to spend, save, and make the most of what you have. Once you understand that, it’s easier to see how the bigger economy works in similar ways, just with a lot more people involved! Now that you’ve got a handle on your own finances, we can explore how things like prices, jobs, and even your paycheck are influenced by the larger economy around you. It’s all connected, and knowing both sides helps you make smarter choices with your money.

The economy is essentially a system where resources are produced, distributed, and consumed. It involves supply and demand, or how much of something is available versus how much people want to buy.

Think of the economy as a big marketplace where what’s available and what people want, supply and demand, keep things in balance. When lots of people want something but there isn’t much of it, prices go up—think about expensive holiday flights when seats are limited but everyone wants to travel. But when there’s a lot of something and not much interest, prices drop, like the big sales on holiday decorations after the season ends.

This balance of supply and demand keeps the economy moving. By understanding it, we can make smarter choices, like knowing when to buy, waiting for a sale, or saving up.

EXAMPLE

Every holiday season, there is a popular toy that kids are very excited about receiving. They beg their parents to buy this item for them, but it is sold out everywhere. The demand for this toy is high, and supply starts to run scarce. This causes the stores to increase the toy’s price, hoping that it will discourage some buyers. As the toy manufacturer makes more to sell, the price starts to reduce as more supply is available. This is an example of the cycle of supply and demand.There are three main types of economies—market, command, and mixed—because different societies have different ways of deciding who makes things, who buys them, and who sets the prices. The main difference between these types comes down to government involvement: In some economies, people and businesses make most decisions, while in others, the government takes control. Let’s take a closer look at each of them.

1. Market Economy

In a market economy, consumer choices and market forces decide what’s produced, how it’s made, and who buys it. You can think of it as a hands-off economy—individuals and businesses make their own decisions based on what they believe will be profitable, and these choices collectively shape the economy. In a market economy, the government doesn’t interfere because it trusts that people and businesses making their own choices will lead to the best outcomes. As people buy what they want, companies compete to provide it, which helps keep prices fair and encourages new ideas. This “hands-off” approach lets supply and demand shape the economy naturally.

EXAMPLE

Think about Apple designing the latest iPhone. Apple, as a company, studies consumer preferences and their competitors, then decides on product features and pricing. The company is by the belief that people will want to buy the new model. There’s no government official telling Apple what to make or what price to charge—Apple decides based on what it thinks will sell well. By the looks of things, Apple has made some good decisions, as many of us own at least one Apple product.2. Command Economy

In a command economy, the government has a big say in what gets produced, how it’s made, and who benefits. The government controls most, if not all, of the major industries and resources and decides on behalf of the people what’s needed. Think of it as a tightly controlled economy where the government is the decision-maker.

EXAMPLE

In a command economy, instead of Apple choosing what products to create, the government might decide that only basic smartphones are necessary, setting the design, production goals, and pricing. If there’s a shortage of a certain material, the government might reallocate resources to produce goods it considers more essential, like food or medical supplies.3. Mixed Economy

A mixed economy is a blend of both market and command economies. In a mixed economy, think of it as a balance between freedom and support. It’s like when you’re given the freedom to make choices but have some rules to keep things safe and fair. This balance allows individuals and businesses to make choices while the government steps in when it’s necessary to correct issues, protect consumers, or provide public services.

EXAMPLE

In the United States, companies like Apple make their own decisions and compete with other businesses, which is how a market economy works. But the government also plays a role by setting rules and offering support. For example, the Environmental Protection Agency (EPA) creates rules to limit pollution, protecting the air and water for everyone. The government also provides social programs like Medicare, Medicaid, and public schools so that people can access health care and education, even if they can’t pay for private options. This mix of free business choices and government support is what makes the United States a “mixed economy.”Each type of economy has its own advantages and disadvantages, which affect people’s lives in different ways.

Each type of economy—market, command, and mixed—decides who gets what and who makes the big choices. This affects prices, job options, and what’s available to buy. To see how well an economy is doing, let’s look at economic indicators, which act like checkups on an economy’s health and future direction.

Just like doctors check vital signs to understand your health, economists use economic indicators like gross domestic product (GDP), unemployment rate, inflation, and consumer confidence to measure the economy’s health. These “economic vital signs” help businesses, governments, financial experts, and you make decisions. For instance, if unemployment is high, the government might introduce job support programs, or if consumer confidence is strong, businesses may prepare for higher sales. Tracking these indicators gives a snapshot of how the economy is doing and helps predict what might come next. Let’s take a deeper dive into each of these economic indicators.

GDP represents the total dollar value of everything produced within a country’s borders over a certain period. It’s like the economy’s report card. A growing GDP generally means a healthy economy, where people are buying, businesses are investing, and jobs are being created.

EXAMPLE

During the COVID-19 pandemic, many economies saw their GDP shrink as businesses closed and consumer spending dropped. However, in recovery periods, GDP growth resumed, signaling that people were starting to spend and businesses were reopening.The unemployment rate shows the percentage of people who want to work but can’t find jobs. This is important because it tells us how many jobs are available and how strong the economy is. When the unemployment rate is low, most people can find jobs, which usually means businesses are doing well and need workers. A lower unemployment rate also suggests the economy is healthy and not under stress. However, the unemployment rate is always changing.

EXAMPLE

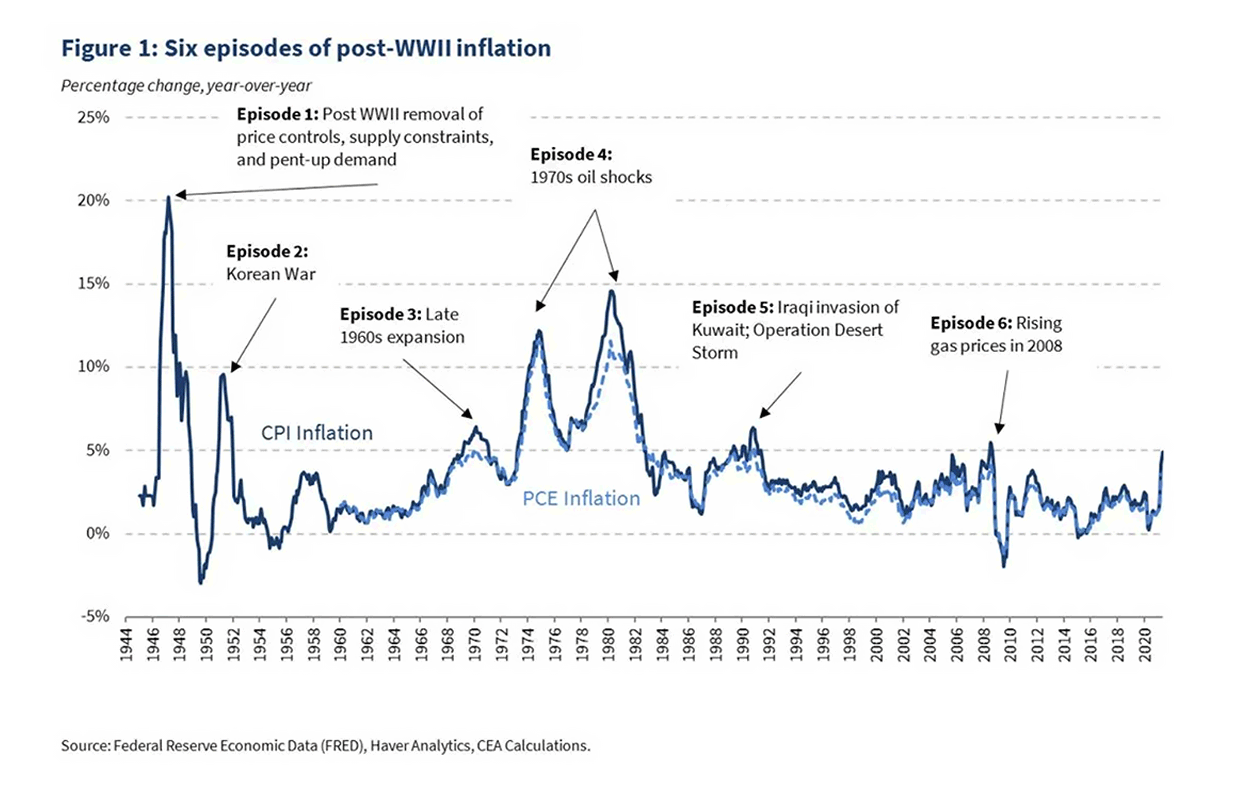

Many restaurants all over the country struggled to hire staff during the COVID-19 pandemic. High unemployment rates meant fewer people were working, impacting both income and spending in the economy.Inflation measures how much prices for goods and services increase over time. Imagine your grocery bill today versus 5 years ago—chances are it’s higher, thanks to inflation. A small, steady level of inflation (around 2% annually) is considered healthy, but too much inflation means people’s money loses value, or, simply put, your dollar does not stretch as far as it used to.

The Consumer Price Index (CPI) tracks how prices are changing for everyday things people buy regularly—like food, clothing, rent, and health care. Think of this as a “basket” filled with these common items that represent a typical person’s spending. When economists measure the cost of this basket over time, they can see if prices are going up. If the total cost of the basket rises, it means inflation is happening—everything in that basket is getting more expensive, so your money doesn’t go as far as it used to.

EXAMPLE

For instance, in recent years, supply chain disruptions and high demand for goods caused inflation to spike, leading to rising grocery and gas prices.Interest rates represent the cost of borrowing money. They’re set by central banks, like the Federal Reserve in the United States, and influence everything from mortgage payments to credit card interest. When the economy needs a boost, central banks lower rates to encourage borrowing and spending. When it’s overheating, they raise rates to control inflation.

EXAMPLE

With rising inflation after the COVID-19 pandemic, central banks raised interest rates, making it more expensive to borrow. This was aimed at slowing down spending, which in turn could help bring prices down.Think of stock market indexes as a scoreboard for the economy. Just like in sports, where a scoreboard shows which team is winning, stock market indexes—like the S&P 500 or the Dow Jones—give us a snapshot of how well big companies are doing. When these scores (or indexes) go up, it’s like the economy’s team is winning; investors feel confident, companies are doing well, and people tend to feel optimistic.

The Consumer Confidence Index measures how optimistic or pessimistic consumers are about the economy.

The Consumer Confidence Index is like a “mood ring” for the economy. When confidence is high, people are more likely to spend—planning vacations, shopping, and making big purchases. This spending boosts the economy. But if people feel uncertain, maybe due to rising prices or job concerns, they’ll spend less and save more. Lower confidence can slow the economy as people hold back on big purchases.

So, the Consumer Confidence Index tells us the overall vibe of the economy. High confidence means more spending; low confidence usually means more saving. It’s a quick way to see how people feel about the future.

Understanding the economy doesn’t have to be daunting. With a grasp of these key indicators, you can make sense of economic news and what it means for you. Remember, each indicator is like a piece of the puzzle, and, together, they help paint a picture of where the economy is headed. By staying informed, you’re not only keeping up with the economy—you’re empowering yourself to make financial decisions that support your financial goals.

Here are a few examples that use these indicators to help you make financial decisions:

IN CONTEXT

Economic indicators don’t operate in isolation; they interact in powerful ways. Imagine the GDP grows (showing a strong economy), but unemployment remains high—this could indicate growth that benefits only certain sectors. Similarly, high inflation could push interest rates up, making it harder for people to borrow and spend.

A recent example is the post-COVID recovery period. Stimulus checks boosted spending (affecting GDP and consumer confidence), while disrupted supply chains contributed to inflation. In response, central banks raised interest rates to curb inflation, showing how interconnected the indicators are.

Source: THIS TUTORIAL WAS AUTHORED BY SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.