Table of Contents |

To begin our discussion of annual percentage yield (APY), let’s consider two scenarios:

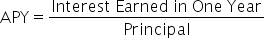

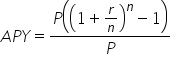

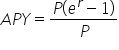

Conceptually, the APY is the amount of money earned each year for every dollar invested. A more convenient way to express APY is as a percent.

. To convert this to a percent, multiply by 100.

. To convert this to a percent, multiply by 100.Note that this formula means that we compute the APY by first dividing the interest by the principal, then multiplying by 100 to convert to a percent, round to the desired number of decimal places, then affix the percent symbol.

EXAMPLE

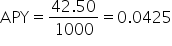

Find the APY for an investment of $1,000 that earns $42.50 in interest per year. .

.

By comparing the APY’s in the example and in the “TRY IT,” we see that the first investment is earning a higher annual interest rate. Even though the amount of interest is lower, it was based on a smaller principal.

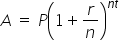

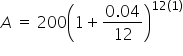

Suppose $200 is invested into an account at an annual interest rate of 4%, compounded monthly. Let’s find the amount in the account after 1 year.

|

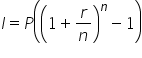

The compound interest formula. |

|

Substitute P = 200, r = 0.04, and n = 12. |

|

Use a calculator to approximate. |

So, after 1 year, there is $208.15 in the account.

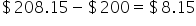

Knowing that $200 was invested, anything additional is interest earned. In this case, the interest earned is  .

.

What does this mean? If we know the amount in the account and the principal, we can also find the interest earned by calculating their difference.

, where A is the amount in the account after a given length of time, and P is the principal (amount invested).

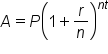

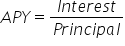

, where A is the amount in the account after a given length of time, and P is the principal (amount invested).Consider a principal of P dollars invested for one year, invested at an annual interest rate r (in decimal form), where interest is compounded n times per year.

Let’s use this information to see if we can find a formula for APY.

|

The amount in the account is found by using the compound interest formula. |

|

In this case,  ; substitute and simplify. ; substitute and simplify.

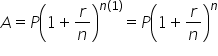

|

|

Interest is the difference between the value after one year and the principal. |

|

Remove the common factor of P. |

|

|

|

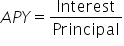

Cancel out the common factor of P. This is the decimal form of the APY. |

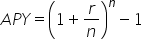

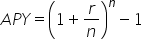

, where r = the annual interest rate (in decimal form) and n = the number of compounding periods in one year. To convert this to a percent, multiply by 100.

, where r = the annual interest rate (in decimal form) and n = the number of compounding periods in one year. To convert this to a percent, multiply by 100.The formula suggests that the principal is not needed to compute the APY! All that is needed is the annual interest rate and the number of annual compounding periods there are.

EXAMPLE

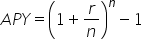

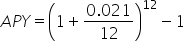

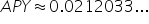

Determine the APY for an investment in which the annual interest rate is 2.1% and is compounded monthly. Express the final answer as a percent rounded to the nearest hundredth.

|

The APY formula. |

|

Substitute  and and  . .

|

|

Use a calculator to approximate. |

|

Multiply by 100 and round to the nearest hundredth. |

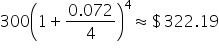

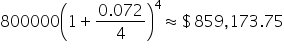

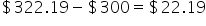

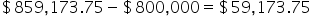

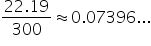

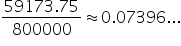

| P = $300 | P = $800,000 | |

|---|---|---|

| Amount after 1 year: |

|

|

| Interest earned: |

|

|

|

|

|

| Convert to % and round: | 7.40% | 7.40% |

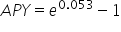

Similar to how we derived the formula for APY for an investment that compounds n times per year, we can derive a formula for the APY of an investment that compounds interest continuously.

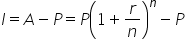

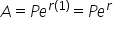

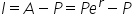

Recall that the formula for continuously compounded interest is  , where A is the amount after t years, P is the principal, and r is the annual interest rate.

, where A is the amount after t years, P is the principal, and r is the annual interest rate.

Let’s use this information to see if we can find a formula for APY.

|

The amount in the account is found by using the continuously compounded interest formula. |

|

In this case,  ; substitute and simplify. ; substitute and simplify.

|

|

Interest is the difference between the value after 1 year and the principal. |

|

Remove the common factor of P. |

|

|

|

Cancel out the common factor of P. This is the decimal form of the APY. |

To get the APY, take the result and multiply by 100.

, where r = the annual interest rate (in decimal form). To convert this to a percent, multiply by 100.

, where r = the annual interest rate (in decimal form). To convert this to a percent, multiply by 100.EXAMPLE

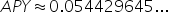

An investment has an annual interest rate of 5.3%, compounded continuously. Find the corresponding APY. Write your answer as a percent rounded to the nearest hundredth.

|

The APY formula for continuous compounding. |

|

Substitute  . .

|

|

Use a calculator to approximate. |

|

Multiply by 100% and round to the nearest hundredth. |

The APY tells us about the rate at which interest is earned each year. Therefore, the higher the APY, the higher the rate of interest. APY is a tool that can be used to compare investments (with the same principal) when it isn’t clear which one yields more interest.

EXAMPLE

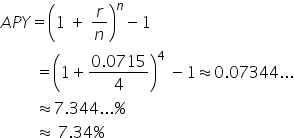

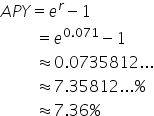

You have a choice between two investments for the next year:| Investment A | Investment B |

|---|---|

|

7.15%, compounded quarterly r = 0.0715, n = 4 |

7.1%, compounded continuously |

|

|

Source: THIS TUTORIAL WAS AUTHORED BY SOPHIA LEARNING. PLEASE SEE OUR TERMS OF USE.